22 banks blockchain stocks

With its global reach, SWIFT gpi is regarded by banks as the natural place to collaborate and innovate cross-border payments. Brussels, 6 July — SWIFT announces today that 22 additional global banks have joined its blockchain proof of concept PoCdesigned to validate whether the technology can help banks reconcile their international nostro accounts 22 banks blockchain stocks real time.

The banks that have recently joined the PoC 22 banks blockchain stocks Working independently of the founding banks, the 22 institutions will act as a validation group to further test the application and evaluate how the technology scales and performs. We 22 banks blockchain stocks welcome the new banks and look forward to their insights.

Launched in Januarythe PoC aims to help banks overcome significant challenges in monitoring and managing their international nostro accounts, which are crucial to the facilitation of cross-border payments.

Currently, banks cannot monitor their account positions in real time due to lack of intraday reporting coverage. As such, the PoC recognises the need for banks to receive real-time liquidity data in order to manage funds throughout the business day. The PoC application will use a private permissioned blockchain in a closed user group environment, with specific user profiles and strong data controls. User privileges and data access will also be strictly governed.

Moving forward, the PoC blockchain application will undergo testing over the summer months, with the results scheduled to be published in September and presented at Sibos in Toronto in October.

The PoC is being undertaken as part of SWIFT gpi, a new service that is revolutionising the cross-border payments industry by combining real-time payments tracking with the speed and certainty of same-day settlement for international payments.

Since it became 22 banks blockchain stocks in January20 global transaction banks have begun actively using or implementing the SWIFT gpi service, with another 50 in the implementation pipeline. DLT holds the potential to improve nostro account reconciliation and liquidity management. Distributed Ledger Technology provides the opportunity for banks to reconcile international nostro accounts in real time and manage funds throughout the business day. We appreciate 22 banks blockchain stocks opportunity to be part of Proof of Concept PoC initiative and sincerely wish to witness the accomplishments DLT could achieve.

Commerzbank is delighted to participate in this proof of concept to build standards and enhance the portfolio of SWIFT gpi. We welcome any developments associated with achieving real time Nostro and Liquidity Management, and the increased operational efficiencies and improved risk management that accompany them.

Intesa Sanpaolo is very active in innovative technologies and is willing to help build this new route to the future of cross border payments. We believe SWIFT, covering the largest network of banks and standardized messaging protocols, is strategically positioned to revolutionize the way banks manage their processes, and paves a path towards creating a true digital community, amongst the many other initiatives to follow. Nostro reconciliation is identified by the gpi vision group as a priority use for DLT exploration.

SWIFT gpi is a collective response to some of these threats. Being part of SWIFT global payments innovation gpiand working with our industry counterparts, is giving correspondent banks a platform to examine and refine current processes, and to collaborate and explore different, more efficient ways of doing things. Ultimately, our clients will benefit most from this initiative.

SWIFT gpi is one of the more exciting initiatives in correspondent banking in recent years. 22 banks blockchain stocks Chartered has been involved in the gpi initiative 22 banks blockchain stocks a pilot bank and a founding member in its vision group.

The work on the DLT PoC will allow us to continue improving on the cross-border payments experience for our clients by making 22 banks blockchain stocks internal processes around the critical step of NOSTRO reconciliation, highly efficient.

It is significant that gpi banks are going to address it in the foreseeable future. Real time visibility of nostro reconciliation is another leap forward in efficiency for correspondent banking, as we endeavour to improve the customer experience in cross-border payments.

We provide our community with a platform for messaging and standards for communicating, and we offer products and services to facilitate access and integration, identification, analysis and regulatory compliance.

Our messaging platform, products and services connect more than 11, banking and 22 banks blockchain stocks organisations, market 22 banks blockchain stocks and corporate customers in more than countries and territories.

While SWIFT does not hold funds or manage accounts on behalf of customers, we enable our global community of users to communicate securely, exchanging standardised financial messages in a reliable way, thereby supporting global and local financial flows, as well as trade and commerce all around 22 banks blockchain stocks world.

As their trusted provider, we relentlessly pursue operational excellence; we support our community in addressing cyber threats; and we continually seek ways to lower costs, reduce risks and eliminate operational inefficiencies.

SWIFT also 22 banks blockchain stocks the financial community together — at global, regional and local levels — to shape market practice, define standards and debate issues of mutual interest or concern. For more information, visit www. To learn more, visit www. Proof of Concept launched to determine if distributed ledger technology could help banks reconcile their nostro databases in real time. Corporate treasurers can now find out where a payment is at any given time.

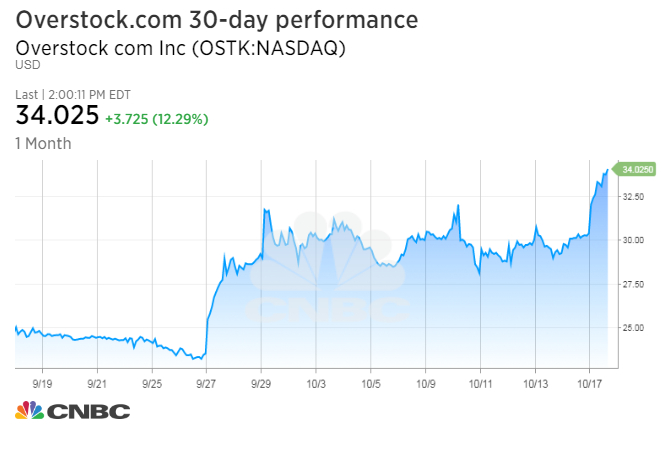

Public companies often see their stock prices soar dramatically when they announce new blockchain-focused initiatives.

But when 22 banks blockchain stocks hype dies down, how successful are they at sustaining investor interest? Below, we round up 9 public companies that saw notable stock price jumps after their blockchain announcements — and take a look at whether or not these companies were able to sustain the hype after the initial bump.

Specifically, the company said it would launch a digital coin trading platform via its subsidiary tZeroand would raise money for it via an ICO. Medici Ventures has backed a number of other blockchain-focused startups, including SettlemintFactomRipioand earlier this month, both Bitt and Bitsy.

To date, Overstock has largely followed through on its announced initiative. On February 22, Overstock extended the ICO period an additional month, and as of now the sale is still ongoing.

However, the uptick was short lived. On November 4, Bioptix Inc. Together, the companies would develop a platform allowing cryptocurrency holders to make purchases at millions of retail locations worldwide using cryptocurrency. However, the spike was short-lived: The stock has since continued to hover around that point.

The firm was allegedly partnering with Chinese giants like Alibaba Group, ZTE, and Huawei to offer a framework specifically focused on the chemical industry. However, the jump was short-lived. Easy come, easy go. Every meal enjoyed at any Chanticleer Holdings brand will accrue currency for the consumer that can be used for future meals or traded with other consumers.

The company plans to roll out the blockchain loyalty rewards program in mid with its technology vendor Mobivity. Despite the diversity of these initiatives, all attracted an initial flurry of investor interest 22 banks blockchain stocks drove stock prices up, even briefly — suggesting that when it comes to blockchain technology, investors are not so 22 banks blockchain stocks about how the technology is being applied.

They are more interested in jumping quickly on the trend. And, 22 banks blockchain stocks much as investors eventually softened their enthusiasm for these blockchain pivots and stock prices leveled out a bit, many are still trading above their pre-announcement price.

Nong has a wealth of operational and professional management experience. What pisses me off is that poloniex doesn't address what is going on. Cipher LP has invested 0.