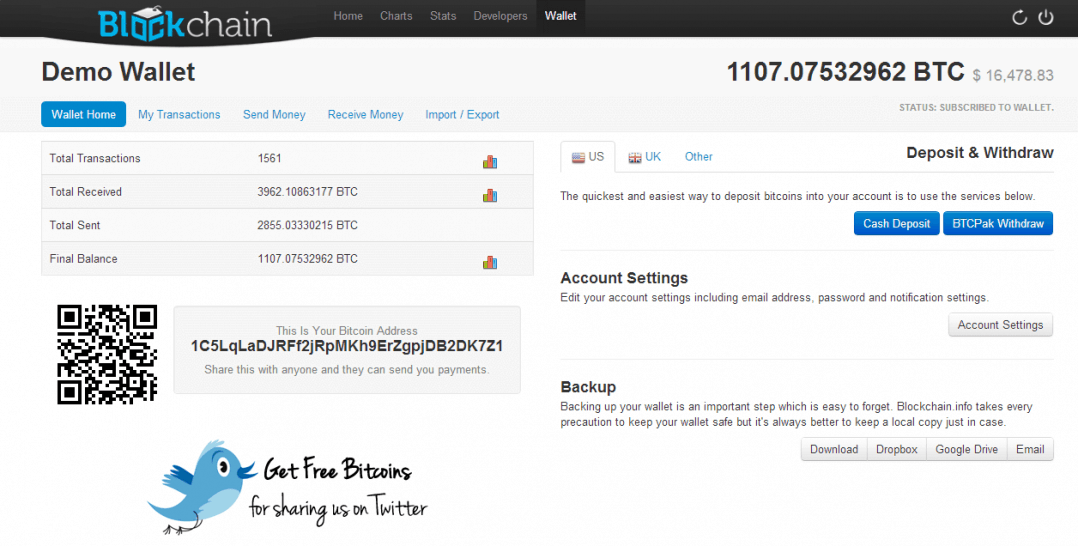

Blockchain logout google drive

In a new possible Ethereum fork, will all the ERC20 fork too? If so, will they have internal wars on what fork they want to be on?

In blockchain terms, you could conceive of merge mining as extended uncle resolution. Uncle miner still is incentivized, they get some proportion of the block reward.

Likewise, people who contribute to the "losing token" are still incentivized. When you think of merging chains, you're still incentivizing a smaller chain's absorption into the larger chain. We call this a softmerge cc desantis https: How can a blockchain gracefully terminate? Can it just pass on its assets somehow to a succeeding blockchain? Western UnionChina, and Napoleon are a few prominent examples. Now we have Facebook.

Manage New Post Logout Login. Like all good blog posts, this one starts with a tweet. In this case, I can point to Nicola for spurring this one. You can think of this in the same spirit as that post. Portability has been a great side-effect of abstractions for computation, higher-level languages and will have the same effect for the decentralized world as well.

In the centralized world, we have Dropbox, Google Drive, and Evernote. These all let us take our information wherever we want it. Whereas before, the existing model was a thumb drive or involved clunky data transfers. The internet helped pave the way for user side abstraction.

Preceding that were IaaS plays, namely AWS, and preceding that you had to rent out hardware and co-locate a hardware. Right now, a lot of effort is spent building on a base layer Turing ish -complete stack-based machine like Ethereum. While Ethereum remains a market leader right now, things might change. A 0day exploit might appear, someone very influential might die within their organization, or a switch to PoS might actually prove to have a bad security model.

In theory, a dapp should be able to move its contract state to another base layer protocol. Another way to look at it is again through the lens of history and greater abstraction previously mentioned.

Kin moving to Stellar rather than building on Ethereum, at least initially. I do have a gut feeling that the switching costs may be less than people think, especially since new base layer protocols are taking the tack of enabling the EVM already, like RSKSmart.

Also, the Ethereum state trie is already publicly available, and that lets people do airdrops and such, like EtherMint. And of course, Ethereum abstracted away the messy world of bootstrapping your own blockchain, secured by miners.

Hopefully, they'll allow protocols now built only on Ethereum to work on other base world computers with ease. In the formally-verified future, dapps and protocols will compile down to multiple VMs. Users and developers might not have to worry about a break down in the consensus mechanism of any one base layer protocol.

Maybe these token prices will be pegged to each other, Or value will be accrued in proportion to the amount of state that they actually keep. In this way, the different base layer protocols may just be different shards on which protocols interact.

Already, some tokens are looking at building on both Ethereum and NEO. If this vision of dapps on multiple chains does play out, competition between base layer protocols based solely on the dapps that they host may not be a long-term competitive advantage.

Again, that hypothesis is premised on the belief that switching costs of state are low, and it does look like that is happening. There are so many rungs on the ladder of abstraction yet to be formalized and built. It's not immediately clear how scaling, where the points of friction and therefore economic value will be long term.

You might say that the tokens that have the largest network effect will win out, i. Yet, the network effect argument is self-referential. It is intrinsically so, the more people use it, the better Ethereum gets. But the more people that leave an ecosystem, the more unstable it gets. With flows between addresses on chain and economic value exchanged cross-chain all available in real time on decentralized exchanges and on blockchains. Please talk to me if you think I'm right or wrong: Written by Niraj and Dillon.

There is an argument to be made that "Core" or the Foundations bearing the base token name centralize development resources. Forking seems to have to have become a way for talented devs to work on protocols.

Just look at LTC and satoshilite. Additionally, we see that experimentation has been a net positive for society in other areas. Allowing for experimentation and merging isn't limited to blockchains. Just to name a few:. How to Do Merges There are two methods for potentially doing a merge for tokens and probably more that we haven't thought of. The first method is pegging a token A to token B. Meaning that token A remains and token B is never used again.

Both of these scenarios involve a lot of coordination. Imaging trying to do a protocol merge without some kind of explicit voting mechanism other than hash power signaling induces a headache right away. The future of decentralized governance will definitely play a large part in how these things happen. Also, as we see in centralized mergers and acquisitions, the larger company often has to purchase the shares of the smaller company at a price premium.

We'll have to establish a better pricing mechanism beyond hash power and other matters. Ari Paul and Chris Buniske have been doing a lot of great work in fundamental valuations for this. It's more-or-less arbitrary — Chris Burniske cburniske June 17, Fundamental Valuations Additionally, atomic cross chain swaps are not the only potential way to transfer a token from one chain to another, using a protocol such as Polkadot or Cosmos we might allow for this sort of thing as well.

These wouldn't just have to be currency tokens, you could potentially also merge utility tokens as well. For example, looking at Sia and Filecoin.

If Filecoin were to establish a dominant market cap and share position, it might behoove them to purchase the Sia network. An additional step would need to be taken. Individuals would need to, before they can acquire any of token A, transfer their files over to the new blockchain.

Once this is performed, they can claim their Filecoin token. Facebook is just the largest and easiest target. The aim as a public company is to create long-term shareholder and user value. Therefore, any tailoring of the newsfeed algorithm will be made towards those ends. Facebook has always been a walled garden, killing off any products Facebook Platform, access to media, etc that captured too much value from the all important newsfeed.

Much like Facebook, the internet in China is also a walled garden. With the Chinese internet, we know the aims of censorships are to achieve political goals. These have been proposed solutions that I don't feel like are permanent fixes:. The core problem with Facebook, Twitter, Linkedin, is that they need to aggregate their data and users. They know their graph is what makes them special. Yes, IMAP and access to emails is one example where multiple parties have access to data, and where companies can still make money.

However, the blockchain and app coins might provide a better solution to ending censorship by algorithm and still incentivizing people to create open products.

Just as we have in email, we can use multiple clients to look at our email, and as well as incentivize creators of these protocols. The token should rise in value just as Bitcoin has risen in value as more transactions, more data is added to the ledger. When we tie the business model of the token directly to data, we don't have the same problem of not allowing Facebook to share their data.

Just as we can view our email with multiple clients, we'd be able to view our friendship graph, the stories and links they post with multiple front ends. We can have ones that allow users to see fake news, ones that allow users to be exposed to more long-form content, or even ones that promote argument. Cryptocurrency based social networks can end the de facto censorship that Facebook holds over what news a user sees. And some people have already built prototypes of these social networks: Facebook represents a centralized model of social networks.

While a great utility, it also runs counter to the spirit of the open web. Perhaps blockchain social networks can return us to the open-source past of the web, while still allowing creators to satisfy their self interest.

57 2 Blocked Unblock Follow Following Zeus Follow Chatbots Life Best place to learn about Chatbots. This is how you make sure no one will be able to steal your coins, but obviously, keeping the keys a secret is always a good idea too.

When I could act more efficiently and also do better analysis, I could for sure reach higher profits.

Which cryptocurrency is worth buying and investing in. It will level out around 4k Anonymous View Same Google iqdb SauceNAO bitcoin tax. If I were trading in the afternoon, I would sell around the top of the wedge and bought a little lower.