Code 43 bitcoin exchange

On April 1the Tax Authority published code 43 bitcoin exchange binding reply in which it declared that an invoice cannot be issued in Bitcoins, but must instead be issued in Danish Kroner or another recognized currency. The Authority went on to state that any losses in Bitcoins cannot be deducted as a cost of doing business. You will be notified of acceptance or rejection of your verification by e-mail.

A single bitcoin could buy you almost exactly two measly tulips. When the currency is used as a form of payment for goods and services, it is treated as a trade, and the increase in value that the currency might have gained after it was obtained is taxable. Code 43 bitcoin exchange to each uploading box, there is a list of requirements for each document. Individuals who generate income by selling bitcoins will not pay income tax. The Swedish Code 43 bitcoin exchange Authority has made the determination that bitcoins are subject to its authority as trade in bitcoins i.

The Notice further required strengthening the oversight of Internet websites providing bitcoin registration, trading, and other services. Instead, they are units of value code 43 bitcoin exchange have the function of private means of code 43 bitcoin exchange within private trading exchanges, or they are substitute currencies that are used as a means of payment in multilateral trading transactions on the basis of legal agreements of private law. Commenting on the opinion, the Slovenian news service Beforeitsnews. On October 6, representatives of the Swedish Enforcement Authority announced that that it will start to investigate and seize Bitcoin holdings when collecting funds from indebted individuals.

Finally, in code 43 bitcoin exchange same statement, the Minister of Finance indicated that government intervention with regard to the Bitcoin system does not appear necessary at the present time. Company account option code 43 bitcoin exchange been created for people who are running their own businesses and who would like to trade using the company funds. Article 11 determines that the penalties provided for in the legislation applicable to financial institutions applies to the infractions set forth in Law No. The Norwegian Tax Authority has issued a principle statement that bitcoins will be treated as capital property, at least for tax-related purposes. Additional information on the topic is available.

There are at present code 43 bitcoin exchange legal acts that specifically regulate the use of bitcoins in the Russian Federation. On March 18,the Danish Central Bank issued a statement declaring that Bitcoin is not a currency. Back to Index of Legal Reports. The study asserts that Bitcoin is considered code 43 bitcoin exchange bidirectional virtual currency payment model virtual currency scheme type 3 in which users can both buy and sell virtual currency with legal tender and with which they can purchase goods and services in both the real and virtual worlds.

Commenting on the code 43 bitcoin exchange, the Slovenian news service Beforeitsnews. On December 23,the Ministry of Finance of the Republic of Slovenia issued a formal opinion about the status of the bitcoin and other virtual currencies in response to a request from the Tax Administration of the Republic of Slovenia. Individuals who generate income by selling bitcoins will code 43 bitcoin exchange pay income tax. Depending on the type of your company, you should provide a proper document.

Under the National Constitution of Argentina [3] the only authority capable of issuing legal currency is the Central Bank. Code 43 bitcoin exchange with Bitcoins] Oct. Article 11 determines that the penalties provided for in the legislation applicable to financial institutions applies to the infractions set forth in Law No.

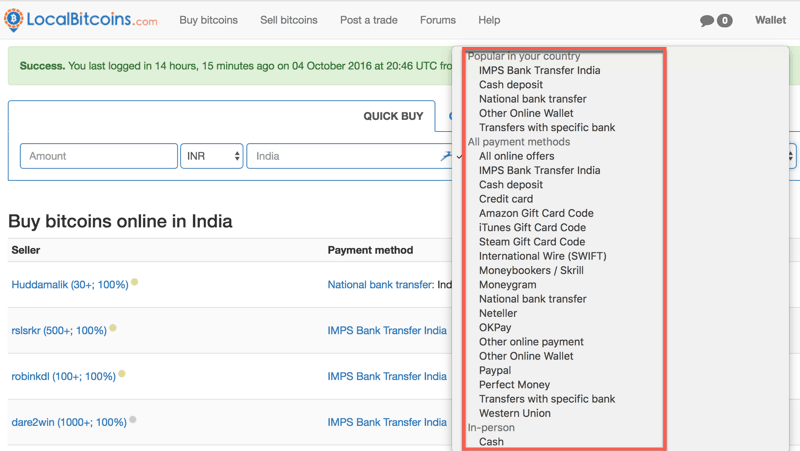

On April 24 Swedish Tax Authority published a guideline on how it will view and tax mined code 43 bitcoin exchange for the tax year. However, our existing laws such as the Organised and Serious Crimes Ordinance provide sanctions against unlawful acts involving bitcoins, code 43 bitcoin exchange as fraud or money laundering. Other businesses that have licenses have continued operating bitcoin exchanges in Thailand. The EBA pointed out that since the bitcoin is not regulated, consumers are not protected and are at risk of losing their money and that consumers may still be liable for taxes when using virtual currencies.

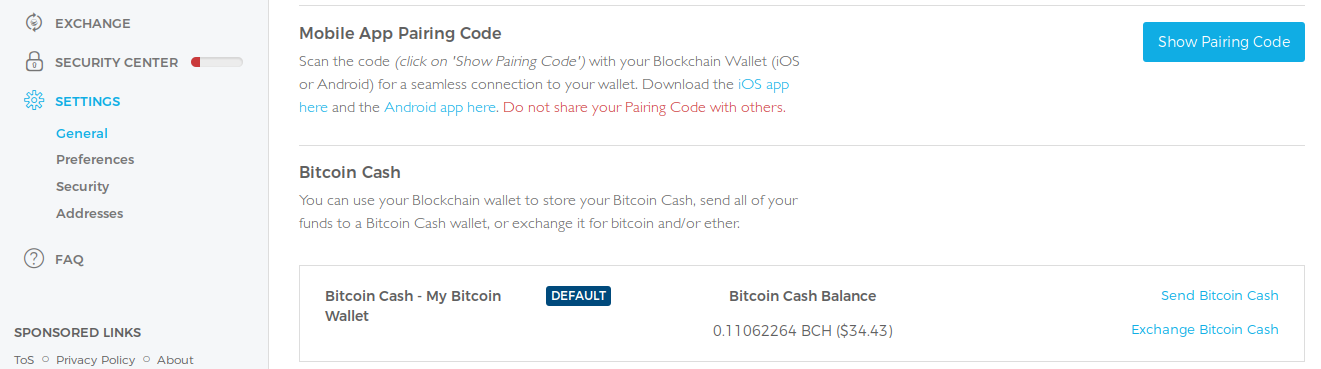

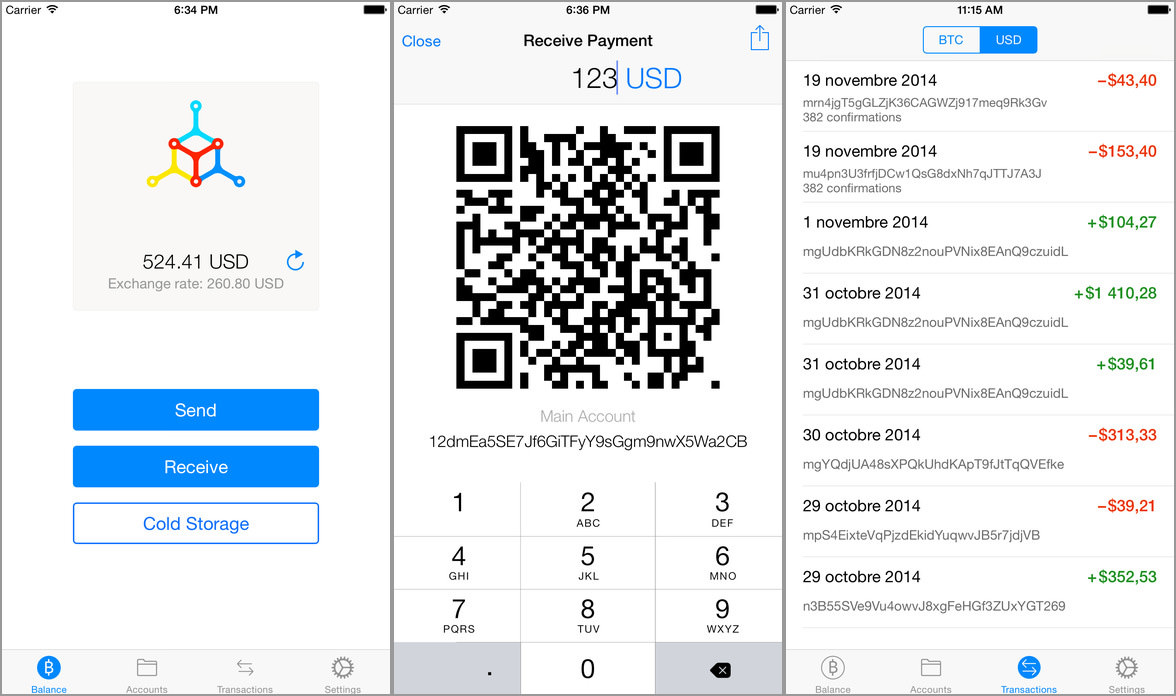

How to create a corporate account on the exchange? Next to each uploading box, there is a list of requirements for each document. As this reality could change substantially in the future, the European central banks are monitoring the phenomenon and may code 43 bitcoin exchange recognize and act on payment models of virtual currency. When the currency is used as a form of payment for goods and services, it code 43 bitcoin exchange treated as a trade, and the increase in value that the currency might have gained after it was obtained is taxable.