General ledger entry form

For more information about interface systems and becoming a recognized interface system owner, please visit the training guide on How to Create a Spreadsheet Journal File MFT. For detailed information, refer to the COA website. The results of transactions that take place in the Purchasing, Business Assets, Accounts Receivable, Accounts Payable, Payroll, and Payroll Costing applications are journalized and posted to the General Ledger on a daily basis.

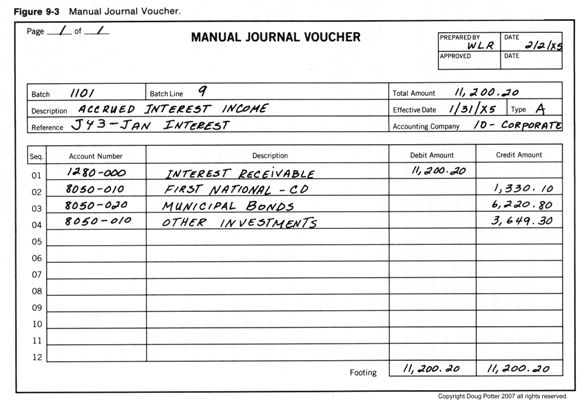

Journal entries provide the tools for preparing, validating, and processing manual journal entries and interfaced entries. A journal entry is an accounting transaction consisting of a group of entry lines a journal that debit and credit account numbers.

The total dollar amount of debits for the journal must equal the total dollar amount of credits. Cost Center Financial and Accounting Specialist prepare manual journal entries by entering data into the online Journal Entry. Departments without system access or without personnel trained in online entry may work with designated transaction processing center.

Journal entries must be prepared and submitted in a timely manner, based on regular monitoring of financial reports. Paper journal entry forms are available on the Policies and Procedures website. You may use these forms to collect and organize information about each entry to facilitate online processing. Each completed form must designate only one journal appropriate to all of the line items on the form.

Do not combine Journals on one form. Certain restrictions apply to cost transfers involving sponsored awards. Read carefully Procedure PR. The Office of Sponsored Projects OSP monitors transfers made against sponsored awards and reviews them for compliance.

Thorough explanation and retention of backup documentation is required in every case. Follow the steps described in the Create Manual Journal Entry Training Guide to access and create the journal entries required to record your data.

The Cost Center Manager must approve each non-grant journal entry charged to their department before it can be posted. After authorization, the system posts the data to the General Ledger according to an established posting schedule. To correct any error after it has been posted, you must prepare a new journal entry. Departments must retain for 7 years supporting documentation for journal entries that do not involve sponsored awards.

Generally, documentation supporting sponsored award cost transfers must be kept for 3 years following the submission of the final financial report, unless the terms of the award specify a longer retention period. Documentation should be retained with a record of the transfer. Either of these retention periods may be extended if there is a related pending litigation or audit matter.

This is a site-wide alert banner.

These forms may be completed on-line or blank forms may be printed and the forms completed manually. If completed manually, please be sure the writing is legible or the journal may be returned. Then hit the tab key to advance to the next field. This is the date of the transaction, NOT the date you complete the form. The format general ledger entry form the date is month, day, and general ledger entry form with the month spelled out.

Indicate the total number of pages for this journal. If you do not know how long the journal will be, skip this field and enter it later handwritten is OK. Complete each journal line with the proper chartfield string, the amount in either the debit or credit column, and a description for that line. This description is limited to 30 characters and is the description that will be printed on the Detail Transaction Management Report.

Meaningful abbreviations are appropriate. The line description is not intended to be a complete explanation of the journal see Step 7. Finish page one by completing steps 6 through Enter the total amount for each of the debit and credit columns. If the journal is longer than one page, do not enter the totals on page one; enter the totals on the last page of the journal. If appropriate documentation to justify the journal is too voluminous to attach to the journal, please note where additional documentation is available, i.

Provide a complete but concise explanation for the purpose of the journal. Remember, what might make sense to you today may not be as clear a few months later.

Consider those who may read the journal sometime in the future. Indicate to whom and where additional copies of the journal should be sent, if appropriate. Indicate who prepared the journal, the date the general ledger entry form is being prepared different from the Accounting Date, see Step 1.

Keep one copy in your office and send the other copy with appropriate documentation to the appropriate accounting office. All other journals should be sent to General Accounting, Park Building. Obtain appropriate departmental or other approvals before sending a copy to general ledger entry form accounting office.

This field is used to retrieve copies of journals from the imaging system. Therefore, please do not make a blank copy of the journal and reuse it for more than one journal.

Indicate the page number of the journal and the total page numbers for the journal. The line description is not intended to be a general ledger entry form explanation of the general ledger entry form.

If there are not sufficient lines available to complete the journal on this continuation form, use as many continuation forms as necessary to complete the journal.

Enter the total amount for each of the debit and credit columns for the entire journal on the last continuation form. Keep one copy in your office and send the other copy, with all other pages of the journal, to the appropriate general ledger entry form office. All fields will be cleared and the process can be repeated.

Indicate who is requesting the journal. Fill in the same date used on the first page of the journal. Contact General Accounting call: Proudly powered by WordPress 4.

In standard form of ledger account, the page of the ledger is divided into two equal halves. The left hand side is known as the debit side and the right hand side as the credit side. The debit side is used for recording debit entries and credit side is used for recording credit entries. The title of the account is written in the center at the top of the page. The account number is written in the extreme right hand corner. The standard form of ledger account does not show the balance after each entry.

The balance is found out after certain period or when needed so this form of account is also called periodical balance form of ledger account. Notice that each side of ledger account is divided into four columns. The purpose of these columns is briefly described below:. In this column year, month and date of the entry is recorded in the same manner as in the general journal.

In this column the title of the corresponding account, i. In this column, the general journal page number is recorded. Balancing means finding out the debit or credit balance of a ledger account.

This process may be divided into the following steps:. Sold merchandise to Mr. Cash received from Mr. Skip to content Menu. How to use this site. Format of standard ledger account Notice that each side of ledger account is divided into four columns.

The purpose of these columns is briefly described below: In this column, the amount of the account is recorded Method of posting The posting process consists of the following steps: Trace the ledger account in which the entries are to be posted. If an account is debited in the general journal, it will be posted on the debit side in the ledger account and if it is credited in the general journal, it will be posted on the credit side.

In description column, the title name of the account included in other part of the journal entry is written. For example, if we are posting an account included in the debit part of the journal entry, the account or accounts in the credit part will be written in description column. The amount of the entry is written in the amount column of the ledger account.

Balancing the ledger account Balancing means finding out the debit or credit balance of a ledger account. This process may be divided into the following steps: Total the debit and credit sides of the account. Find out the difference between the two totals found in step one. Put the difference on the lighter side. The difference so placed is the balance of the account.

If the debit side of account is heavier than its credit side, the account is said to have a debit balance. In case the credit side of the account is heavier than its debit side, the account is said to have a credit balance.

If the total of two sides of account is equal, the balance will be zero. Example Record the following transactions in general journal and post them into ledger accounts.

Leave a comment Cancel reply.