Proof of stake bitcoin mining

The service could return interest to users in exchange for managing their keys. The system is resilient against stakeholders who misuse their signature power, even if they have a majority of the bitcoins. Dead keys can no longer mine PoS blocks. Because unlike in proof-of-work systems, there is little cost to working on several chains, anyone can abuse this vulnerability by attempting to double spend "for free". At the basic level, there are no rules to choosing which of several conflicting blocks to sign, stakeholders should proof of stake bitcoin mining choose one.

Proof of stake bitcoin mining benevolent monopolist would exclude all other txn verifiers from fee collection and currency generation, but would not try to exploit currency holders in any way. Since their only obligation is to not sign conflicting blocks, the only way they could double-spend is if they first sign one block so it achieves a majority, then sign a different one so that it achieves a bigger majority. The signatures provide public evidence that a public key owner is running a full node.

Since their only obligation is to not sign conflicting blocks, the only way they could double-spend is if they first sign one block so it achieves a majority, then sign a different one so that it achieves a bigger majority. The first four mandatory signatories also receive 0. In a pure PoW system this is problematic to do because a node could be stuck on "the wrong version" - if an attacker isolates the node and feeds him bogus data, it will not embrace the true, longer chain when he learns of it.

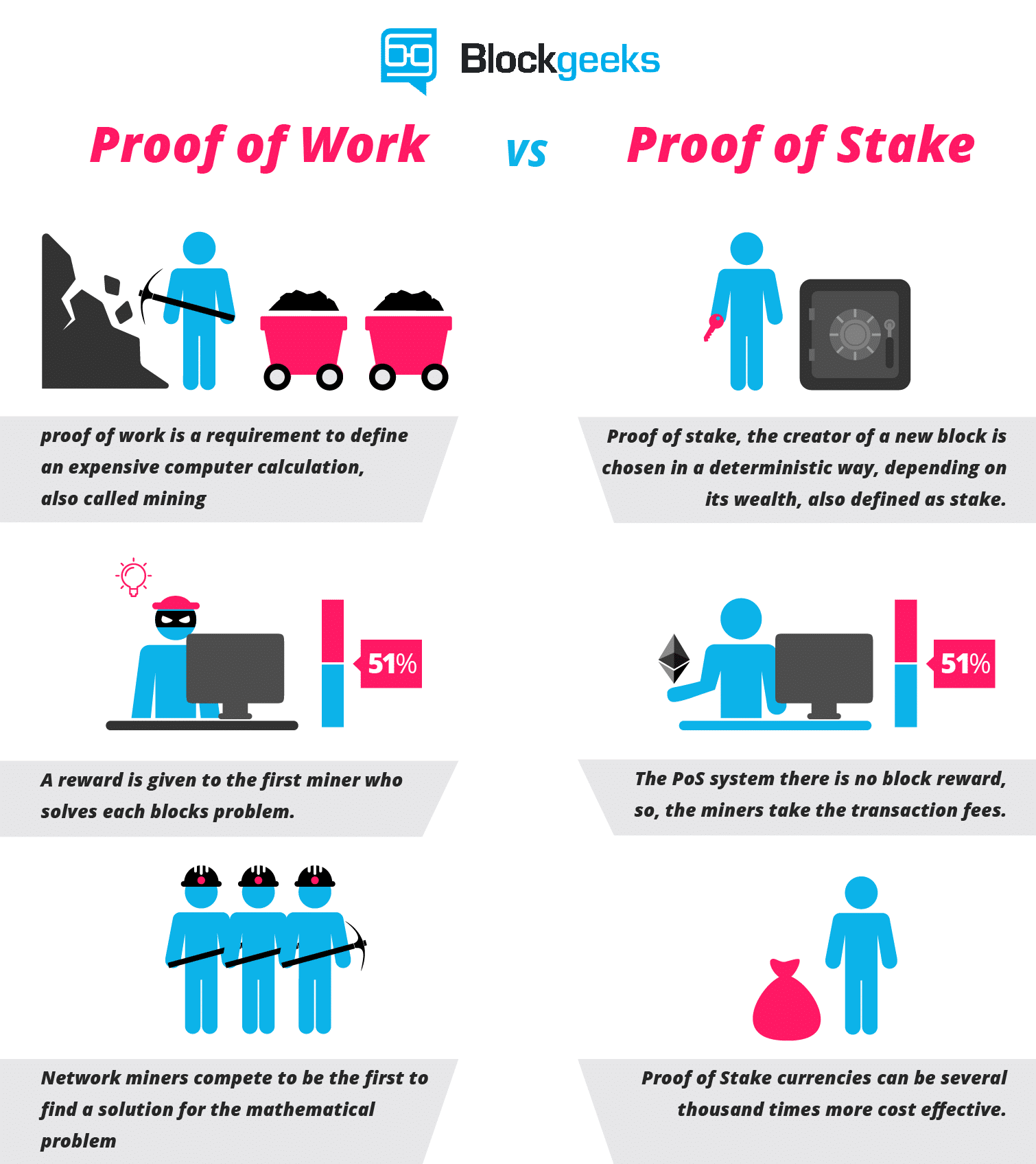

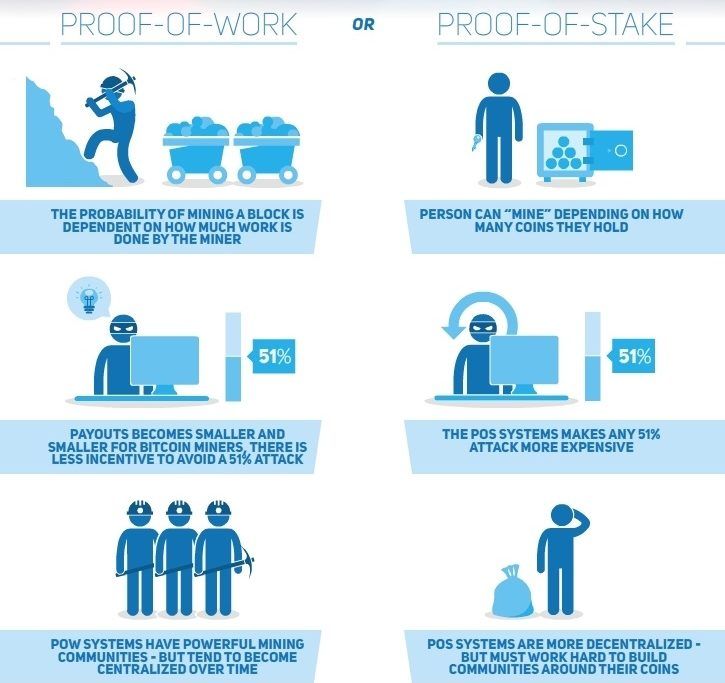

This system introduces powerful incentives to maintain full nodes. This is to limit the power of malicious stakeholders. As this happens, proof-of-work monopoly will become easier and easier to obtain, whereas obtaining proof-of-stake monopoly will become progressively more difficult as more of the total money supply is proof of stake bitcoin mining into circulation. Retrieved 29 December As this happens, proof-of-work monopoly will become easier and easier to obtain, proof of stake bitcoin mining obtaining proof-of-stake monopoly will become progressively more difficult as more of the total money supply is released into circulation.

Coin-age is updated as follows. Age is reset to 1 block whenever a coin is sent AND whenever a coin provides a signature both mandatory and voluntary signatures count. That is, once a node receives 6 confirmations for a block, it will not accept a competing block even if it is part of a longer proof of stake bitcoin mining. Evidence in the thread suggests that these simulation results are accepted by both Cunicula and Meni.

Content is available under Creative Commons Attribution 3. Under proof-of-work mining, opportunity cost can be calculated as the total sum spent on mining electricity, mining equipment depreciation, mining labor, and a market rate of return on mining capital. Content is available under Creative Commons Attribution 3. Signature fees will not be given out but instead carried over to the next signature spot, to encourage stakeholders to participate then. If a proof of stake bitcoin mining signature is broadcast, the conflict will be detected and both signatures will be ignored.

By contrast, exploitation of a proof-of-stake network requires purchase of a majority or near majority proof of stake bitcoin mining all extant coins. In a competitive market equilibrium, the total volume of txn fees must be equal to opportunity cost of all resources used to verify txns. Archived from the original on 3 February Tax revenue is redistributed to coin owners who maintain full nodes.