Counting down to the 2016 Bitcoin Halving

4 stars based on

40 reviews

In just a few days we will have the second bitcoin halving event. Often in bitcoin we forget that not everyone is elbow deep in code all day, not everyone has been 'with us' for years and while we may talk about things like 'The Halving' we probably don't do the best job at explaining exactly what it is, why it is, what happened last time and what might happen this time.

For completeness, I will add the following line of code to the ones above. What this code does is get the block subsidy in bitcoins. This subsidy is claimed by the miners of that particular block plus a small amount of transaction fees as payment for their work securing the bitcoin network. They use it to pay their bills mostly electricity and updating hardware and what is left over is their profit.

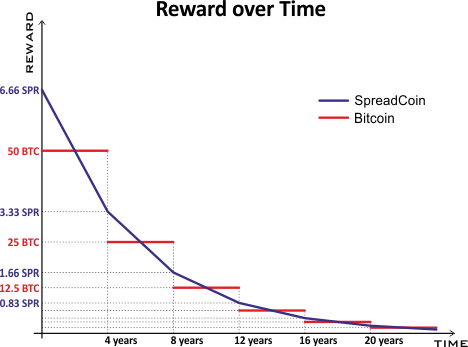

Since every block takes somewhere about 10 minutes because of the Poisson Process it works out to take approximately [1] 4 years for thosebitcoin block halving time to be generated, after which, the block subsidy bitcoin block halving time. In reality, because the total hash rate has been increasing so quickly since Satoshi mined block 0 as more and more miners have come online with better and even more specialised hardware the blocks have been found in less than 10 minutes on average but for the purpose of this article, we are just bitcoin block halving time to call them minute blocks and 4 years between halvings.

The intention is that as the subsidy decreases the fees will take over paying the miners to secure the network. Miners will, well beforebe relying totally on transaction fees and that time is coming soon in order to pay the bills and secure the bitcoin bitcoin block halving time.

Below is a table that lays it out from the beginning until so you can get a feel for the progression. Rough numbers only, where we are now in bold. Check out the bitcoin wiki for the full progression. The answer is a bitcoin block halving time philosophical sorry but it is one of the core tenants of bitcoin, controlled supply.

We also know exactly how many have been minted at any particular point in time. This is not actually a new concept, proponents of the Austrian School of Economic Thought have been bitcoin block halving time such a monetary system since the late 19th century.

It separates money from the state similar to how the church was separated from the state in many countries over the past bitcoin block halving time centuries.

It puts the value or price if you like directly into the hands of supply and demand and takes it away from any form of governance. No matter how much any authority wants they cannot print more, artificially fix or adjust supply in any way in order to manipulate their own and others economies.

Supply and demand are kings in bitcoin and since supply is fixed, demand is the only variable and the only way the price of bitcoin is discovered. Because bitcoin cannot be destroyed [3] but can be lost please backup your wallets now this also makes bitcoin a deflationary currency and that is a stark point of difference as to what we have now with our traditional fiat currencies.

Not everyone agrees that a deflationary currency is a good thing, in fact, most traditional economists subscribe to Keynesian Economics and they most definitely don't bitcoin block halving time it as a good thing. Satoshi never explained why he chose 21 million as the upper limit nor did he explain why he chose 4 bitcoin block halving time for each halving at least not when I was around or have found later apart from some vague references to gold mines. Like a lot of numbers in bitcoin they appear to be just arbitrary, perhaps they have some deeper meaning to him but in reality, the numbers are unimportant, what is important is that they exist and the effect controlled supply in a predictable manner that they have.

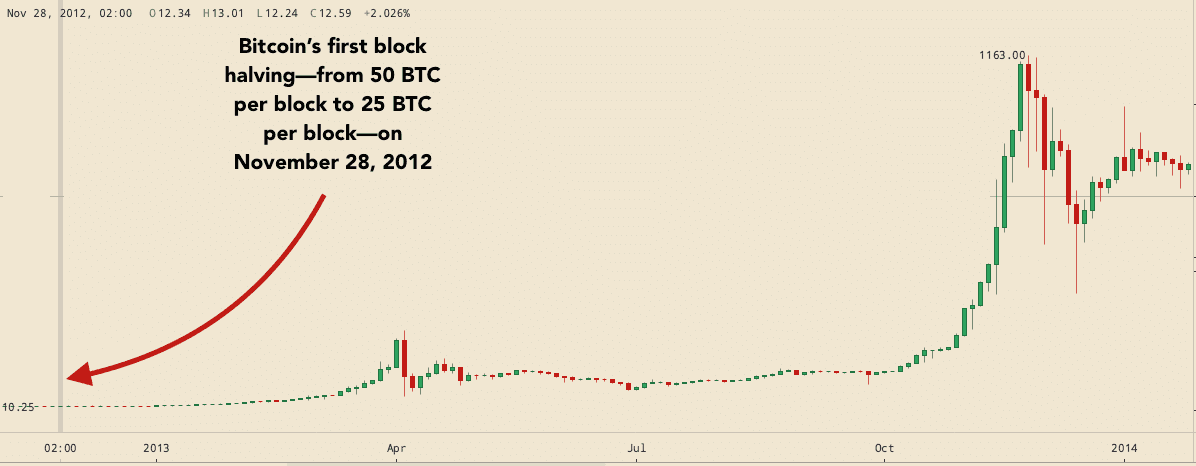

I wrote a few articles at the time. The block was found on slush's pool by a relatively new user called Laughingbear using a GPU in a standard PC that he normally used to play games. The entire block reward was It was almost a year before we had any serious price movement and it did not seem related to the halving at all.

Speculation with the mainstream media and more than a few bitcoiners was that bitcoin would be over, after all, how could mining continue at such a low return? The difficulty did bitcoin block halving time little dip before the halving but continued to grow, we knew at the time that the next generation cheaper and more efficient miners ASIC's were about to become generally available but we were still mining mostly with GPS's and FPGA's.

If you had more than bitcoin block halving time few gigs of mining power you were considered a serious miner. Bitcoin has always and will always be venturing into uncharted waters. What comes next is far from certain and looking to the past at what happened last time, for this halving at least, does not help much past telling us that we don't actually know what the future holds. For completeness, I will add the following line of code to the ones above;- consensus.

Why do we do it? Right, now the semi-technical stuff is out of the way the obvious question is why do we do this? What happened last time? All and all, it was a bit of a non-event. What will happen this time?

I would caution you to treat anyone who tells you that they do with scepticism. There are a few things to take into account though;- Unlike last time there are no 'next generation' miners hitting the market.

Mining has scaled up so it is no longer a hobby that can be run to make a few coins. Bitcoin block halving time farms now are serious investments with serious ongoing costs. At the current bitcoin price the current hash rate is unsustainable. It is 'close enough' to 4 years. There is also the chance that we may extend bitcoin beyond 8 decimal places.

For example In Blocka miner mined a solo block which underpaid the subsidy by a single Satoshi. Who knows what a satoshi will be worth decades from now.