Error establishing a database connection

4 stars based on

63 reviews

And as most cryptocurrencies are not under the control of Federal Governments or central banks, their different mediums of exchange are outside the realms of state monetary policy and remain unaffected by their actions.

As cryptocurrencies are bitcoin development archives definition and encrypted in nature, counterfeit copies cannot be produced, as is possible with traditional payment methods.

No personal information is shared: No cryptocurrency transactions carry personal data about the user; privacy is sacrosanct. No middleman, low fees: Through cryptocurrencies, users eliminate middlemen like brokers and lawyers from the arena, who usually charge service fees on the transaction. Swift and easy payment: Users simply require the address of the other person to transfer funds. As a result, processing time is almost negligible and the whole transaction is completed bitcoin development archives definition a matter of seconds.

The users are always in control of their currency units and there is no central authority in the network. Digital currency is recognised all over the world at a particular value so there is no exchange rate risk.

Bitcoin was the first cryptocurrency. It launched inand is based on a peer-to-peer digital payment system. Since then, numerous cryptocurrencies have emerged in the landscape, claiming they are improved versions of Bitcoin. These are called alternative cryptocurrencies altcoins.

However, Bitcoin remains the de facto leader in the cryptocurrency space. It involves solving difficult puzzles to discover a new block. This is added to the blockchain, and in turn miners are rewarded with Bitcoins. A typical feature of Bitcoin is the limited supply. However, they bitcoin development archives definition be further divided into smaller parts.

As increasing numbers of Bitcoins are created daily, the difficulty level of the mining process also increases. This calls for more bitcoin development archives definition units and bitcoin development archives definition. Cryptocurrencies like Bitcoin were created in the aftermath of the global financial crisis of to operate freely without any intervention from governments, banks bitcoin development archives definition other financial institutions.

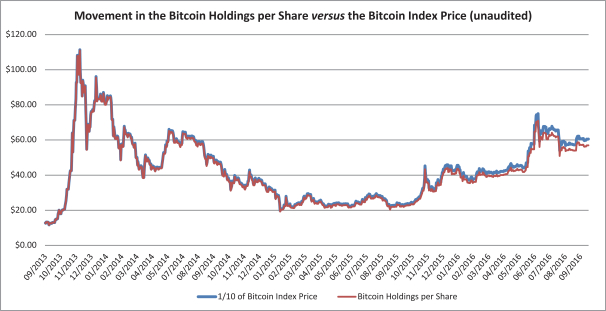

Over these nine years, Bitcoin has experienced its share of volatility, facing both bitcoin development archives definition and support, and continually fluctuating markets. The initial demand for cryptocurrencies stemmed largely from Asian and European nations following their economic and monetary problems. Investors who were looking for alternative investment options started buying into cryptocurrency. Bitcoin was the best performing asset in and has enjoyed a great start to this year.

This recent performance was driven by increasing demand from Asia. The buzz surrounding Bitcoin is the primary main driver for now. Major gains came in the second quarter bitcoin development archives definition the year after it received support from key governments and institutional investors. The Japanese Government passed a law accepting Bitcoin as a legal payment method in April, with major retailers giving support.

Since then, the nation has been a huge driver for this unprecedented rally. Trading in the country increased as investors rushed to swap Yen for Bitcoin. Additionally, Russian Deputy Finance Minister, Alexey Moiseev, suggested that authorities could legalise cryptocurrencies in to tackle money laundering. Their aim is to further promote bitcoin development archives definition in blockchain and other allied technologies.

The latter has found support from major corporates who want to use the underlying technology for smart contract applications. JPMorgan, Microsoft and Intel have joined this alliance. Cryptocurrencies also surged in the May-June period on hopes that the Securities and Exchange Commission SEC would approve a Bitcoin exchange-traded fund backed by the Winklevoss brothers. In recent years, bitcoin development archives definition in cryptocurrencies has shifted to Blockchain, the underlying technology powering them.

It is poised to bring significant disruption to the financial markets. This system helped in increasing the speed of transactions on the network. Since then it has been hoped that such changes will be introduced to the Bitcoin network as well, helping to speed up processing time and solve the current scaling problem. Chinese buyers have been using Bitcoin as a channel to transfer large amounts of cash from the mainland, therefore bypassing tough regulations on capital outflows.

People in China have acquired Bitcoin by using Yuan to sell them on another exchange for Dollars or Euros. Trading in Bitcoin rose after major Chinese Bitcoin exchanges lifted restrictions on withdrawals after a four-month hiatus. The cryptocurrency sector has lost substantial market capitalisation in recent weeks, pushing it into bear market territory.

According to data from coinmarketcap. Unlike previous shocks to the market, there were no major factors, like a hacking event, which caused the significant decrease. It simply indicates the deflation of a bubble created by speculators who had rushed into the market in May and June. The recent spurt in Bitcoin trading volumes has led to decreases in transaction speed, making an urgent case for updating the software.

It also came under severe pressure amid a growing split bitcoin development archives definition developers and miners within the community about how to increase trading capacity. Various solutions were proposed, but no consensus has been reached. Concerns are growing that two rival groups might implement competing software updates on the bitcoin development archives definition at the end of July, splitting Bitcoin in two.

This uncertainty weighed on demand in recent weeks. Last week however, cryptocurrencies have recouped some of their losses. If the miners use this new technology consistently until 31 July, the whole Bitcoin community will have no choice but to accept it.

So, there is no doubt that the recent surge in cryptocurrencies has raised a red flag amid fears of a bubble. However, the technology behind it cannot be ignored it seems primed for a bright future. History tells us that new technologies generally experience a series of booms and busts before being widely recognised by the global community.

Cryptocurrencies, it seems, are currently going through this phase. An Individual Savings Account, commonly referred to as ISA, form a beneficial vehicle for long-term savings, sheltered from taxation. They enable individuals to save or invest bitcoin development archives definition without paying income or capital gains tax on investment returns accrued. It should be remembered though that tax rules are liable to alteration, and personal circumstances can affect how beneficial they are.

Stocks and Shares ISAs were introduced in and provide retail investors resident in the United Kingdom with one of the most tax efficient bitcoin development archives definition wrappers available: Whilst Cash ISAs are the most popular, interest rates are poor currently, and have been for a while. Stocks and Shares ISAs are not limited by bitcoin development archives definition rates in the same way, and as long as you are happy with the level of risk they can offer an effective and efficient vehicle for saving.

Within a Stocks and Shares ISA it is possible to hold a variety of investments, including funds, shares and corporate bonds, amongst others, bitcoin development archives definition any returns from tax. They are generally regarded as being most effective for longer term investing, as they can produce significantly higher returns. Junior Stocks and Shares ISAs allow parents or guardians with parental responsibility to invest in a tax efficient investment wrapper on behalf of a child.

House Speaker Paul Ryan was forced to withdraw the bill, due to a lack of supporting votes. Reduction in Federal Deficit: He intends to repeal and replace Obamacare for good.

Republicans now have two options to move forward on the health bitcoin development archives definition reform. The second and relatively easier option is to negotiate with the Democrats and reform Obamacare. In latest development, top White House officials started discussions with moderate and conservative Republicans in the US House of Representatives with an aim to revive a plan to repeal and replace Obamacare.

Unanswered Questions will be long remembered as a year of great change both politically and potentially economically. Many questions have arisen, that are yet to be answered: Will Trump move bitcoin development archives definition US forward or backwards? Can the UK implement a clear and manageable plan for Brexit? With several key elections in Europe, will populist ideals continue to win out over the status quo?

Perhaps most importantly, can renewed optimism over economic conditions and inflation finally find real justification, or is this merely another false dawn? Managing Change Politically change is palpable on both side of the Atlantic. However in spite of the posturing, we are yet to see clear evidence of change on the economic front. At national treasury level as well as in the central banking sphere, the key players need to find a way to balance the colossal debt overhang that has been building since Such an increase would create considerable instability given we are now living through the most overleveraged economic conditions the world has ever seen.

Zero rates and QE have facilitated both a substantial rise in asset prices whilst allowing for the explosion of debt levels. This balancing act will be the main issue for the financial markets as we move from a monetarily lead expansion to a fiscally led one.

There are many issues at play alongside the interest rate story which will have a big impact on the global economy. The hefty rise in the dollar, or we should say increase in the reserve currency of the world, is as big an issue as the rise in bitcoin development archives definition rates.

US bitcoin development archives definition policy and in particular QE, expanded the availability of US dollars globally which the world gratefully accepted. To turn up the heat stronger dollar on a fragile world still reliant on US dollar funding now mostly for corporate use will be extremely challenging. Any future policy action that propels the dollar further will potentially undermine any potential positive economic impact a renewed fiscal expansion might bring.

The ongoing challenges for the Chinese economy and their increasing diseconomies of scale declining return on investment will have a major bearing on the global economy. One suspects will be much like in China as it continues to try and steer the ship away from continuous stimulus packages. As these challenges become more extreme one should expect the Communist party to increase their nationalistic rhetoric. Trump looks to be making himself a very easy target.

The significant issues surrounding the upcoming fiscal challenges of growing entitlement payments in the West make clear the scale of the challenge. Change was needed for sure, but do populist movements possess the policies that will achieve their stated unstated goals without pulling the rug from under the whole system?

Vigilance Required From a markets perspective, one needs to be increasingly vigilant.