Bitcoin bot growth login bitcoin asic miner 1th september 2016

45 comments

1 dogecoin rate

People called cypherpunks, cryptographers, and of unfortunately, hackers, were first to stake their claim in the new market. Now that bitcoin mining has grown from a handful of early enthusiasts into a specialized industrial-level venture, you may be wondering if there are still profits to be made.

Today, miners with high-powered machines are most likely to come back with bitcoins. While mining is still possible for anyone, without an efficient setup, including potential access to cheap or free electricity, you will probably find that you spend more money on electricity than can be generated through mining. Proof of Work hashing: The work which miners perform to define a new block.

Hashing keeps the blockchain going and the problems miners complete using computational power are called hashes. Miners are rewarded with bitcoins for correctly hashing the current block. The number of newly-created bitcoins, awarded to miners. When bitcoin was first starting, the number was set to 50, it was halved to 25 in late, and decreased to The next reduction is expected around mid and the halving process will continue every four years at , blocks, until all 21 million bitcoins are created.

With hashrates increasing, it might seem that blocks would be found more quickly by miners. When total hashrate rises, the difficulty of Proof of Work hashing rises, and when the rate lowers, the Proof of Work also lowers with difficulty auto-adjusting every two weeks or 2, blocks.

The current fiat price of Bitcoin; critical for calculating profitability. This represents watts per hashrate per second.

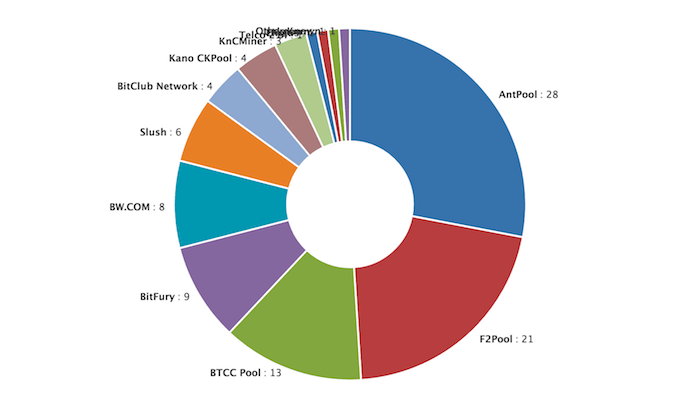

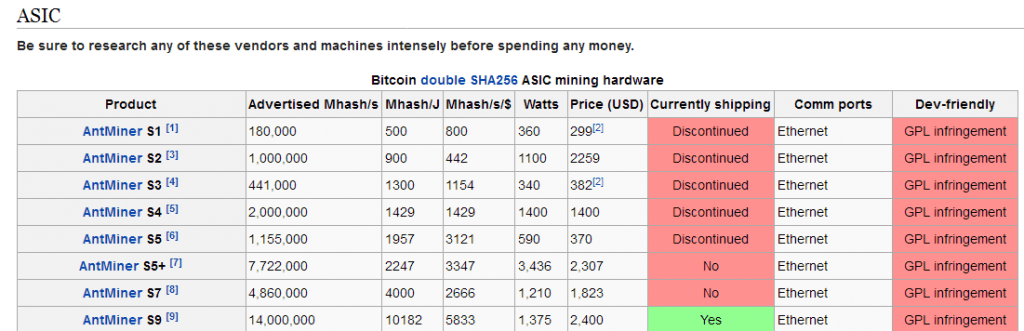

With electricity being the major cost of Bitcoin mining the price paid per watt will greatly influence profitability. Unless you command a huge hashrate, your odds of solving a block by yourself i. Whenever a pool solves blocks, miners are awarded individually according to their contributed hashrate minus commissions and other fees. AntMiner S9 is a modern mining rig which offers a good hashrate for its power consumption, and is considered the cutting edge of mining tech.

In other words, the unit will pay for itself within a year. Occasionally, bitcoin hashrates spikes as a big new mining pool comes online, for example, this happened in early In mid, Swedish bitcoin mining firm KnCMiner declared bankruptcy. The home miner really has virtually no chance to compete in a challenging environment, unless they have access to free or extremely low-cost electricity.

Bitcoin mining hardware is also being constantly updated and will quickly become obsolete. New, more efficient mining hardware may be released at any time, although the hardware is beginning to reach its efficiency limitations.

Be aware of shipping, manufacturing, shipping, customs, or other delays. Remember that profitability is unlikely given the current bitcoin circumstances, however, that situation may change once ASIC mining hardware innovation reaches the point of diminishing returns.

Eventually, cheap, sustainable power solutions may see Bitcoin mining be profitable for individual miners. Skip to content Tokens Basic bitcoin mining terms Block: In early , the hashrate reached nearly 4 Exahash. You can begin assessing profitability by using a ASIC mining rig.

First Name Email address: