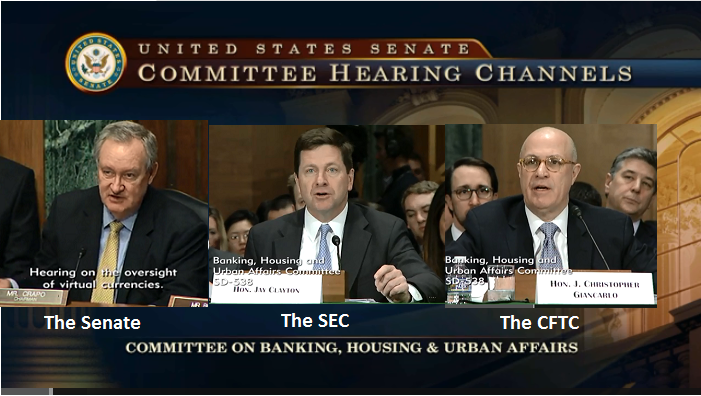

Bitcoin Traders Are Relieved at CFTC and SEC Cryptocurrency Senate Hearing Testimony

4 stars based on

45 reviews

Company Filings More Search Options. Chairman Crapo, Ranking Member Brown and distinguished senators of the Committee, thank you for the opportunity to testify before you today. Cryptocurrencies, ICOs and related subjects are the latest in a host of market issues on which we and our staffs have been closely collaborating to strengthen our capital markets for investors and market participants.

The mission of the SEC is to protect investors, maintain fair, orderly and efficient markets and facilitate capital formation. For those who seek to raise capital to fund an enterprise, as many in the ICO space have sought to do, a primary entry into the SEC's jurisdiction is the offer and sale of securities, as set forth in the Securities Act of The cryptocurrency and ICO markets, while new, have grown rapidly, gained greater prominence in the public conscience and attracted significant capital from retail investors.

We have seen historical instances where such a rush into certain investments has benefitted our economy and those investors who backed the senate banking committee bitcoin hearing ventures. But when our laws are not followed, the risks to all investors are high and numerous — including risks caused by or related to poor, incorrect or non-existent disclosure, volatility, manipulation, fraud and theft.

To be clear, I am very optimistic that developments in financial technology will help facilitate capital formation, providing promising investment opportunities for institutional and Main Street investors alike. From a financial regulatory perspective, these developments may enable us to better monitor transactions, holdings and obligations including credit exposures and other activities and characteristics senate banking committee bitcoin hearing our markets, thereby facilitating our regulatory mission, including, importantly, investor protection.

At the senate banking committee bitcoin hearing time, regardless of the promise of this technology, those who invest their hard-earned money in opportunities that fall within the scope of the federal securities laws deserve the full protections afforded under those laws. Fraudsters and other bad actors prey senate banking committee bitcoin hearing this enthusiasm.

The SEC and the CFTC, as federal market regulators, are charged with establishing a regulatory environment for investors and market participants that fosters innovation, market integrity and ultimately confidence.

To that end, a number of steps the SEC has taken relating to cryptocurrencies, ICOs and related assets are discussed below. Before discussing regulation in more detail, I would like to reiterate my message to Main Street investors from a statement I issued in December. In dealing with these issues, my key consideration — as it is for all issues that come before the Commission — is to serve the long term interests of our Main Street investors.

My efforts — and the tireless efforts of the SEC staff — have been driven by senate banking committee bitcoin hearing factors, but most significantly by the concern that too many Main Street investors do not understand all the material facts and risks involved. There should be no misunderstanding about the law.

When investors are offered and sold securities — which to date ICOs have largely been —they are entitled to the benefits of state and federal securities laws and sellers and other market participants must follow these laws. Yes, we do ask our investors to use common sense, and we recognize that many senate banking committee bitcoin hearing decisions will prove to be incorrect senate banking committee bitcoin hearing hindsight.

However, we do not ask investors to use their common sense in a vacuum, but rather, with the benefit of information and other requirements where judgments can reasonably be made. This is a core principle of our federal securities laws and is embodied in the SEC's registration requirements. Investors should understand that to date no ICOs have been registered with the SEC, and the SEC also has not approved for listing and trading any exchange-traded products such as ETFs holding cryptocurrencies or other assets related to cryptocurrencies.

If any person today says otherwise, investors should be especially wary. Investors who are considering investing in these products should also recognize that these markets span national borders and that significant trading may occur on systems and platforms outside the U. As a result, risks can be amplified, including the risk that U. Further, there are significant security risks that can arise by transacting in these markets, including the loss of investment and personal information due to hacks of online trading platforms and individual digital asset "wallets.

In order to arm investors with additional information, the SEC staff has issued investor alerts, bulletins and statements on ICOs and cryptocurrency-related investments, including with respect to the marketing of certain offerings and investments by celebrities and others. I would strongly urge investors — especially retail investors — to review the sample questions and investor alerts issued by the SEC's Office of Investor Education and Advocacy.

These warnings are not an effort to undermine the fostering of innovation through our capital markets — Senate banking committee bitcoin hearing was built on the ingenuity, vision and spirit of entrepreneurs who tackled old and new problems in new, innovative ways. Rather, they are meant to educate Main Street investors senate banking committee bitcoin hearing many promoters of ICOs and cryptocurrencies are not complying with our securities laws and, as a result, the risks are significant.

With my remaining testimony, I would like to provide the Committee an overview of the Commission's ongoing work on cryptocurrencies and ICOs. Speaking broadly, cryptocurrencies purport to be items of inherent value similar, for instance, to cash or gold that are designed to enable purchases, sales and other financial transactions. Many are promoted as providing the same functions as long-established currencies such as the U.

While cryptocurrencies currently being marketed vary in different respects, proponents of cryptocurrencies often tout their novelty and other potential beneficial features, including the ability to make transfers without an intermediary and without geographic limitation and lower transaction costs compared to other forms of payment. Critics of cryptocurrencies note that the purported benefits highlighted by proponents are unproven and other touted benefits, such as the personal anonymity of the purchasers and sellers and the absence of government regulation or oversight, could also facilitate illicit trading and financial transactions, as well as fraud.

The recent proliferation and subsequent popularity of cryptocurrency markets creates a question for market regulators as to whether senate banking committee bitcoin hearing historic approach to the regulation of sovereign currency transactions is appropriate for these new markets. These markets may look like our regulated securities markets, with quoted prices and other information. Many trading platforms are even referred to as "exchanges.

In reality, investors transacting on these trading platforms do not receive many of the market protections that they would when transacting through broker-dealers on registered exchanges or alternative trading systems ATSssuch as best execution, prohibitions on senate banking committee bitcoin hearing running, short sale restrictions, and custody senate banking committee bitcoin hearing capital requirements.

I am concerned that Main Street investors do not appreciate these differences and the resulting substantially heightened risk profile. It appears that many of the U. Traditionally, from an oversight perspective, these predominantly state-regulated payment services have not been subject to direct oversight by the SEC or the CFTC.

Traditionally, from a function perspective, these money transfer services have not quoted prices or offered other services akin to securities, commodities and currency exchanges. In short, the currently applicable regulatory framework for cryptocurrency trading was not designed with trading of the type we are witnessing in mind. As Chairman Giancarlo and I stated recently, we are open to exploring with Congress, as well as with our federal and state colleagues, whether increased federal regulation of cryptocurrency trading platforms is necessary or appropriate.

We also are supportive of regulatory and policy efforts to bring clarity and fairness to this space. The SEC regulates securities transactions and certain individuals and firms who participate in our securities markets. The SEC does not have direct oversight of transactions in currencies or commodities, including currency trading platforms.

To this point I would note that many products labeled as cryptocurrencies or related assets are increasingly being promoted as investment opportunities that rely on the efforts of others, with their utility as an efficient medium for commercial exchange being a distinct secondary characteristic. As discussed in more detail below, if a cryptocurrency, or a product with its value tied to one or more cryptocurrencies, is a security, its promoters cannot make offers or sales unless they comply with the registration and other requirements under our senate banking committee bitcoin hearing securities laws.

In this regard, the SEC is monitoring the cryptocurrency-related activities of the market participants it regulates, including brokers, dealers, investment advisers senate banking committee bitcoin hearing trading platforms. Brokers, dealers and other market participants that allow for payments in cryptocurrencies, allow customers to purchase cryptocurrencies including on margin senate banking committee bitcoin hearing otherwise use cryptocurrencies to facilitate securities transactions should exercise particular caution, including ensuring that their cryptocurrency activities are not undermining their anti-money laundering and know-your-customer obligations.

Finally, financial products that are linked to underlying digital assets, including cryptocurrencies, may be structured as securities products subject to the federal securities laws even if the underlying cryptocurrencies are not themselves securities.

Market participants have requested Commission approval for new products and services of this type that are focused on retail investors, including cryptocurrency-linked ETFs. While we appreciate the importance of continuing innovation in our retail fund space, there are a number of issues that need to be examined and resolved before we permit ETFs and other retail investor-oriented funds to invest in cryptocurrencies in a manner consistent with their obligations under the federal securities laws.

Last month, after working with several sponsors who ultimately decided to withdraw their registration statements, the Director of our Division of Investment Management issued a letter to provide an overview of certain substantive issues and related questions associated with registration requirements and to encourage others who may be considering a fund registered pursuant to the Investment Company Act of to engage in a robust discussion with the staff concerning the above-mentioned issues.

We will continue engaging in a dialogue with all interested parties to seek a path forward consistent with the SEC's tripartite mission.

Coinciding with the substantial growth in cryptocurrencies, companies and individuals increasingly have been using so-called ICOs to raise capital for businesses and projects. Typically, these offerings involve the opportunity for individual investors to exchange currency, such as U. These offerings can take different forms, and the rights and interests a coin is purported to provide the holder can vary widely.

A key question all ICO market participants — promoters, sellers, lawyers, officers and directors and accountants, as well as investors — should ask: But by and large, the structures of ICOs that I have seen involve the offer and sale of securities and directly senate banking committee bitcoin hearing the securities registration requirements and other investor protection provisions of our federal securities laws.

As noted above, the foundation of our federal securities laws is to provide investors with the procedural protections and information they need to make informed judgments about what they are investing in and the relevant risks involved. In addition, our federal securities laws provide a wide array of remedies, including criminal and civil actions brought by the DOJ and the SEC, as well as private rights of action.

The Commission previously urged market professionals, including securities lawyers, accountants and consultants, to read closely an investigative report it released. The Report also explained that issuers of distributed ledger or blockchain technology-based securities must register offers and sales of such securities unless a valid exemption from registration applies, and that platforms that provide for trading in such securities must register with the SEC as national securities exchanges or operate pursuant to an exemption from such registration.

The Commission's message to issuers senate banking committee bitcoin hearing market professionals in this space was clear: The Report and subsequent statements also explain that the use of such technology does not mean that an offering is necessarily problematic under those laws.

The registration process itself, or exemptions from registration, are available for offerings employing these novel methods. The statement I issued in December that was directed to Main Street investors and market professionals provided additional insight into senate banking committee bitcoin hearing practitioners should view ICOs in the context of our federal securities laws. Certain market professionals have attempted to highlight the utility or voucher-like characteristics of their proposed ICOs in an effort to claim that their proposed tokens or coins are not securities.

Many of these assertions that the federal securities laws do not apply to a particular ICO appear to elevate form over substance. The rise of these form-based arguments is a disturbing trend that deprives investors of mandatory protections that clearly are required as a result of the structure of the transaction. It is especially troubling when the promoters of these offerings emphasize the secondary market trading potential of these tokens, i.

In short, prospective purchasers are being sold on the potential for tokens to increase in value — with the ability to lock in those increases by reselling the tokens on a secondary market — or to otherwise profit from the tokens based on the efforts of others. These are key hallmarks of a security and a securities offering.

On this and other points where the application of expertise and judgment is expected, I believe that gatekeepers and others, including securities lawyers, accountants and consultants, need to focus on their responsibilities.

I have urged these professionals to be guided by the principal motivation for our registration, offering process and disclosure requirements: I also have cautioned market participants against promoting or touting the offer and sale of coins without first determining whether the securities laws apply to those actions.

Similarly, my colleagues and I have cautioned those who operate systems and platforms that effect or facilitate transactions in these products that they may be operating unregistered exchanges or broker-dealers that are in violation of the Securities Exchange Act of I do want to recognize that recently social media platforms have restricted the ability of users to promote ICOs and cryptocurrencies on their platforms.

I appreciate the responsible step. A number senate banking committee bitcoin hearing concerns have been raised regarding the cryptocurrency and ICO markets, including that, as they are currently operating, there is substantially less investor protection than in our traditional securities markets, with correspondingly greater opportunities for fraud and manipulation.

The ability of bad actors to commit age-old frauds with new technologies coupled with the significant amount of capital — particularly from retail investors — that has poured into cryptocurrencies and ICOs in recent months and the offshore footprint of many of these activities have only heightened these concerns. In Septemberthe Division senate banking committee bitcoin hearing Enforcement established a new Cyber Unit focused on misconduct involving distributed ledger technology and ICOs, the spread of false information through electronic and social media, brokerage account takeovers, hacking to obtain nonpublic information and threats to trading platforms.

We believe this approach has enabled us to leverage our enforcement resources effectively and coordinate well within the Commission, as well as with other federal and state regulators. To date, we have brought a number of enforcement actions concerning ICOs for alleged violations of the federal securities laws. In Septemberwe brought charges against an individual for defrauding investors in a pair of ICOs purportedly backed by senate banking committee bitcoin hearing in senate banking committee bitcoin hearing estate and diamonds.

As another example, after being contacted by the SEC last December, a company halted its ICO to raise capital for a blockchain-based food review service, and then settled proceedings in which we determined that the ICO was an unregistered offering and sale of securities in violation of the federal securities laws.

And senate banking committee bitcoin hearing recently, we halted an allegedly fraudulent ICO that targeted retail investors promoting what it portrayed as the world's first decentralized bank. I also have been increasingly concerned with recent instances of public companies, with no meaningful track record in pursuing distributed ledger or blockchain technology, changing their business models and names to reflect a focus on distributed ledger technology without adequate disclosure to investors about their business model changes and the risks involved.

A number of these instances raise serious investor protection concerns about the adequacy of disclosure especially where an offer and sale of securities is involved. The SEC is looking closely at the disclosures of public companies that shift their business models to capitalize on the perceived promise of distributed ledger technology and whether the disclosures comply with the federal securities laws, particularly in the context of a securities offering.

With the support of my fellow Commissioners, I have asked the SEC's Division of Enforcement to continue to police these markets vigorously and recommend enforcement actions against those who conduct ICOs or engage in other actions relating to cryptocurrencies in violation of the federal securities laws.

Through the years, technological innovations have improved our markets, including through increased competition, lower senate banking committee bitcoin hearing to entry and decreased costs for market participants. Distributed ledger and other emerging technologies have the potential to further influence and improve the capital markets and the financial services industry. Businesses, especially smaller businesses without efficient access to traditional capital markets, can senate banking committee bitcoin hearing aided by financial technology in raising capital to establish and finance their operations, thereby allowing them to be more competitive both domestically and globally.

And these technological innovations can provide investors with new opportunities to offer support and capital to novel concepts and ideas.