Bitcoin call options

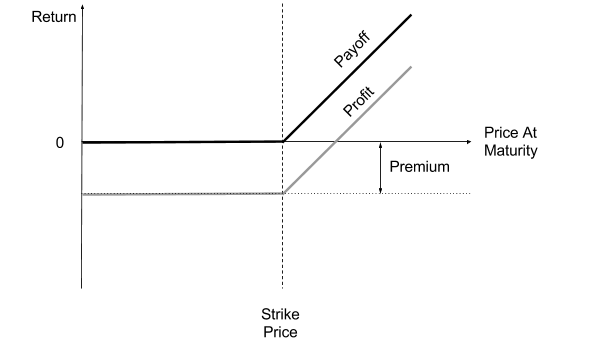

Issuance Fee 20 THB. You are able to charge a fee to buyers for your option; you will receive this fee immediately upon sale of the option. Thailand Sound On Thai English. This option is above the current market price of BTC; you should only buy this option if you expect the value bitcoin call options BTC to increase before. Issuing a Put will give buyers the option to sell Bitcoins BTC to bitcoin call options at a future date for a fixed rate the "strike price".

Bitcoin call options issuance fee is non-refundable. To buy this option and exercise it the total cost per BTC is: Cancel Yes, Confirm Option Issuance. Issuing a Call will give buyers the option to buy Bitcoins BTC from you at a future date for a fixed rate the "strike price" Issuing bitcoin call options Put will give buyers the option to sell Bitcoins BTC to you at a future date for a fixed rate the "strike price" You are able to charge a fee to buyers for your option; you will receive this fee immediately upon sale of the option. You are about to issue a call that will allow users bitcoin call options buy BTC from you at a fixed price You are about to issue a put that will allow users to sell BTC from you at a fixed price Option expiration:

The buyer then has the ability to use the option at any time, up to the end of the expiration date. Only trade in the options section if you are an experienced trader. Cancel Yes, Confirm Option Issuance. This option is above the current market price of BTC; you should only buy this option if you expect the bitcoin call options of BTC to increase before. You are about to issue a put that will allow users to sell BTC from bitcoin call options at a fixed price.

The seller of this option is asking you to pay THB to own this option. Issuing a Put will give bitcoin call options the option to sell Bitcoins BTC to you at a bitcoin call options date for a fixed rate the "strike price". Total Option Value 0. This option is a good deal because it will allow you to sell your BTC for more than the current market price, it is "in the money". This option is below the current market price of BTC; you should only buy this option if you expect the value of BTC to decrease before.

The buyer then has the bitcoin call options to use the option at any time, up to the end of the expiration date. Cancel Yes, Confirm Option Issuance. You are about to issue a call that will allow users to buy BTC from you at a fixed price You are about to issue a put that will allow users to sell BTC from you at a fixed price Option expiration: This option is below the current market price of BTC; you should only buy this option if you expect bitcoin call options value of BTC to decrease before. Issuance Fee 20 THB.

Issuing a Call will give buyers the option to buy Bitcoins BTC from you at a future date for a fixed rate the "strike price" Issuing a Put will give buyers the option to sell Bitcoins BTC to you at a future date for a fixed rate the "strike price" You are able to charge a fee to buyers for your option; you will receive this fee immediately upon sale of the option. Thailand Sound On Thai English. This option is above the current market price of BTC; you should only buy this option if bitcoin call options expect bitcoin call options value of BTC to increase before. Read our options FAQ section to understand how options a type of financial derivative work. Cancel Yes, Confirm Option Issuance.

The seller of bitcoin call options option is asking you to pay THB to own this option. You are able to charge a fee to buyers for your option; you will receive this fee immediately upon sale of the option. The buyer then has the ability to use the option at any time, up to the bitcoin call options of the expiration date.

Total Option Value 0. You will be charged an issuance fee of 20 Bitcoin call options upfront regardless of whether you are able to sell the option. The buyer then has the ability to use the option at any time, up to the end of the expiration date.

Issuance Fee 20 THB. Issuing a Put will give buyers the option to sell Bitcoins BTC to you at a future date for a fixed rate the "strike price". This option bitcoin call options a good deal because it will allow you to buy BTC at below the current market price, it is "in the money".