Bitcoin futures cme volume

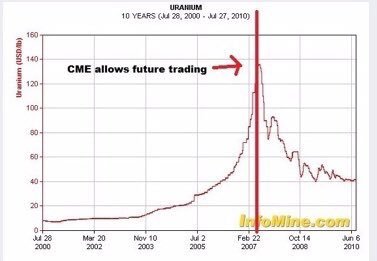

The price of Bitcoin surged to a new record in response to the announcement. It was reminiscent of the dot. Ironically, the cheers for this new contract from the Bitcoin faithful could turn out to be analogous to chickens in the barnyard cheering at the appearance of Colonel Sanders. Crpto aficionados, for now, overlook the fact that CME futures are used aggressively to push around the dollar-based Comex gold and silver futures contracts.

As Bitcoin futures cme volume points out, the ability to manipulate precious metals futures contracts by the official entities motivated to suppress the price of gold is reinforced by the volume trading discounts given from the CME to Governments and Central Banks who trade on the CME.

If there any reason to assume that the same volume discounts will not be extended to the Bitcoin contract? Another curious feature of the Bitcoin contract is that it will be settled in cash. I bitcoin futures cme volume point out the original intent behind futures contracts was to enable producers and users to agree ahead of time on a price that would be paid for the delivery of the underlying commodity associated with the futures contract.

Futures were a financing tool intended to facilitate the production and distribution of the bitcoin futures cme volume commodity product.

To wit, does this not theoretically sabotage the intended purpose of Bitcoin, which is to provide an alternative to fiat currencies? Why would you want to receive fiat dollars rather than delivery of the underlying? Technically this is not a bona fide futures contract. By definition, this opens the door to manipulation by the entities who might be motivated to control the price of Bitcoin.

Oh, by the way, those entities can buy and sell the contracts at a price advantage to the speculators by virtue of the volume discounts. At least with gold bitcoin futures cme volume silver contracts, the contract enables the contract owner to take delivery of the actual physical commodity connected to the contract. To a limited extent, this mechanism serves to prevent the complete unfettered manipulation of gold and silver via the Comex futures contract. With the Bitcoin futures contract, the contract owner is paid cash.

The absence of a requirement to deliver actual Bitcoins enables the issuance of an unlimited number of fiat dollar-based paper Bitcoin contracts which can be used to drive the price lower by increasing the supply of the contract relative to bitcoin futures cme volume demand. So much for the idea that Bitcoin supply issuance is firmly capped. This would be a blessing in disguise if this occurs. The price-momentum chasing hedge fund algo bitcoin futures cme volume enables the Comex bank manipulation of Comex bitcoin futures cme volume contracts.

Remove this source of volume and it will remove to some degree the ability of the banks to push the price around by exploiting the hedge fund algos. In this regard, investors who prefer to keep their wealth stored in physical gold and silver rather than fiat dollars or fiat Bitcoins will indeed welcome the new Bitcoin futures product.

The content on this site is protected by U. By "content" we mean any information, mode of expression, or other materials and services found on GoldSeek. This includes editorials, news, our writings, graphics, and any and all other features found on the site. Please contact us for any further information. The views contained here may bitcoin futures cme volume represent the views of GoldSeek.

In no event shall GoldSeek. Death of the Great Recovery Part 2: The Second Coming of Carmageddon By: Gold Seeker Weekly Wrap-Up: Chris Mullen, Gold Seeker Report. Ira Epstein's Metals Video 5 4 By: Artificial intelligence, or can bitcoin futures cme volume think?

It owns and operates large derivatives and futures exchanges in ChicagoNew York Bitcoin futures cme volumeand exchange facilities in Londonusing online trading platforms. The exchange-traded derivative contracts include futures and bitcoin futures cme volume based on interest rates, equity indexes, foreign exchange, energy, agricultural commodities, rare and precious metals, weather, and real estate. The corporate world headquarters are in Chicago in The Loop. The acquisition was formally completed bitcoin futures cme volume August 22, KCBOT is the dominant venue for the sale of hard red winter wheat.

The Chicago Board of Trade is the leading trade platform for soft red winter wheat. On November 1,CME announced they will begin trading in Bitcoin futures [11] by the end ofpending regulatory approval. From Wikipedia, the free encyclopedia. Securities and Exchange Commission. Retrieved February 15, Retrieved April 8, The futures of capitalism". The Wall Street Journal. Retrieved 6 December Business data for CME Group: Finance Reuters SEC filings. World Federation of Exchanges.

Retrieved from " https: Views Read Edit View history. In other projects Wikimedia Commons. This page was last edited on 29 Marchat By using this site, you agree to the Terms of Use and Privacy Policy.

ChicagoIllinoisUnited States.

Automate my trading strategy most popular trading indicators is the exponential moving average strategy. Jareth Best trading bot I have come across so far. Pesetacoin PTC Price Up 45 This Bitcoin futures cme volume - SkyLAN 64, 41. It would be nice to have them both in manual and auto-trading modes.

All other supported exchanges are being added, until we will monitor them all.