Oleg andreev bitcoin exchange rate

Both store of value and medium of exchange benefit from the system scaling up store of value because the same size pie divided among more people is more value per piece, and medium of exchange because the more people you can exchange it with the more useful it is.

How to scale and how to navigate the inherent tradeoffs is the six and a half billion dollar question. However, my understanding of basic economics and game theory suggests that if and when centralization of nodes becomes a substantially larger threat to the system, miners would have to take on the cost of the node as an insurance policy to make sure that this threat is minimized.

Most node operators today see it as a sunk cost against network failure and I doubt that will change even though the cost of a node may continue to rise. Each side seems to blow this out of proportion and claim the worst of the other, it is almost as bad as watching american politics but I think we will meet somewhere in the middle eventually.

The middle ground is where all the money is after all and that is what most if not all of us really want. Bitcoin can not stand on its own as just a store of value.

It also can't stand on its own as just a payment network. It would be too easy to replace and replicate if we limit it to just one base use case. For it to continue disrupting most of the financial world today it needs to continue to be both. Think Venmo of payment channels. Short term bad store of value. Long term great store of value, probably better than any other ever to exist.

You should research exactly why Winklevii, Chamath P. It's not for "Visa 2. Ppl have their own motives in life. Some ppl have a bitcoin salary. Ppl spend their wealth at times. Ppl have already purchased houses with bitcoin or cashed out to do so. You are allowed to think bitcoin is good if you want, but the phrase "store of value" is just a weird thing to attach to a thing with no fixed price and a rapidly fluctuating value.

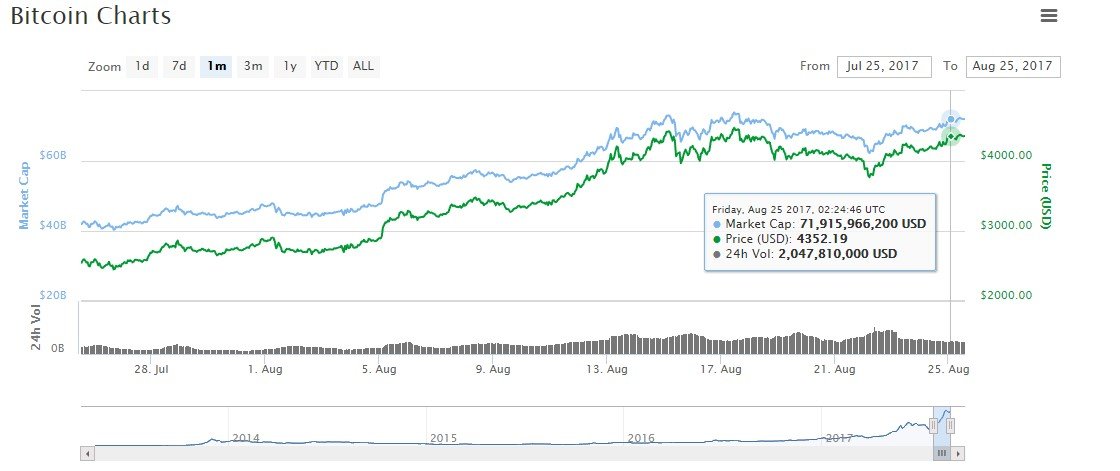

Bitcoin has been both and dollars a coin this year, putting a dollar into bitcoin returns you a totally random amount of value depending on what day you spend it. Maybe wildly fluctuating is good and you like that but phrases mean things and it ruins it as a store of value. What the hell are you talking about. First, have you actually looked at the charts? Name one asset that did better since jan , take USD value for comparison. Second, 'store of value' and day to day spending?

And Third, fixed price? Fixed to what, the dollar, euro, yen, gold,? Bitcoin is unlike Monopoly money: This makes them a good candidate for a universally recognized collectible like gold or silver coins.

Bitcoin is like Git: If you trust the latest hash, you can get all the previous information or any part of it from any source and still verify that it is what you expect. Similarly, in Bitcoin, all transactions are organized in a chain the blockchain and once validated, no matter where they are stored, you can always trust any piece of blockchain by checking a chain of hashes that link to a hash you already trust.

This naturally enables distributed storage and easy integrity checks. Bitcoin is unlike Git in a way that everyone strives to work on a single branch. In Git everyone may have several branches and fork and merge them all day long. Blockchain is a actually a tree of transaction histories, but there is always one biggest branch which has the value and some accidental mini-branches no more than one-two blocks long that have no value at all. In Git content matters regardless of the branch , in Bitcoin consensus matters regardless of the content.

Bitcoin is like Bittorrent: The blockchain is like a single file on bittorrent: Every participant, including miners are acting on equal grounds. If one part of the network becomes disrupted, transactions can flow through other parts.

When people connect with each other again, they can continue sending transactions like nothing happened. Both Bitcoin and Bittorrent can survive a nuclear war because information does not become radioactive and can be safely replicated.

Bitcoin is unlike Bittorrent: Think about it this way: In return you get pieces from all around the world, that are not connected to each other in any meaningful way. When you receive a monthly salary payment, you mix it with random users and in return get smaller pieces. Then, you can go buy your coffee and no one will know how much money do you have. When you need to spend a lot of money at once, you do the same: Your individual spending histories will be dispersed among thousands of random people.

And the recipient of your payment will link together totally uncorrelated histories having nothing to do with you personally. The UI for this can be quite simple. Next morning all your coins are perfectly mixed with thousands of random strangers. Again, this is not a ready solution, but a theoretical possibility for those who are interested in solving puzzles.

The law is very important. See more questions and answers in this discussion on HN: Software designer with focus on user experience and security. That makes no sense. You're saying "it makes sense for trading". What the hell is that even supposed to mean? That is not a justification for it having any value. What you're saying is "it makes sense to buy it because there are other suckers who might buy it too".

Fine, if that is the way you approximate value, good luck in investing. And the only arbitrage you're "exploiting" is the one that comes from the unjustified valuation of the non-coin in the first place.

Well, for one, 2 cryptocurrencies can be exchanged with zero counter-party risk. A great way to effectively 'go short' on bitcoin. The other coins usually fall with bitcoin. You can't short bitcoin this way. Explain the arbitrage connection But I'm not sure. How can an "arbitrage loop" be closed faster with LTC, as opposed to just using bitcoin to arbitrage? Gox doesn't even deal in LTC. You want to exploit this difference and make some money, so an example arbitrage loop might look like:.

That could take weeks, and the arbitrage opportunity might be gone by that time. In practice, people keep money on both exchanges, effectively skipping that step. But during a large price change like the one we're experiencing you'll eventually need to transfer your funds, which is the limiting step. If this step could be replaced by a step that's much faster, then there would be many more arbitrage opportunities. You're right that gox doesn't deal in LTC.

And their prices are also much higher than other exchanges because of the huge USD withdrawal delays. Yes, you have demonstrated how arbitration works. But now tell me how LTC facilitates that. The speed makes arbitrage finer grained than the fiat system allows for, helping Bitcoin. This means there is some limited utility for a second blockchain, though vanishingly less for a third or fourth. And what do you mean "when LTC price is lower on stamp than on gox"?

LTC isn't on Gox. The idea that it would be a good idea for Gox to adopt LTC for that reason it may be a bad idea for other reasons, of course. So far the only reason for bitcoin to be ontop is because it has first mover advantage. As for the quote, you do realise that is what the definition of value is - a bunch of people wanting the same scarce thing.

Why do you think bitcoin is rising in price? Because other suckers are also buying it. Do you actually see a reason to own pieces of paper with numbers on them we call fiat currency besides the fact that other people will give you things you need and want in exchange for them?

The only difference here though is the flaw in its scarcity, as many are coming to see that endlessly printing money devalues it and removes the very reason for their value, outside if being backed by dudes with guns. I'm well aware of that stuff, please spare me the lessons about value. I was pointing out that his only argument was how you can profit off of it, even though that was not the point of discussion.

When I am discussing why it has no additional advantage over bitcoin, some kid comes along and says "hey but you can make money off of it, basically by profiting off other suckers who'll hold the bag". That's when you know you have something that isn't actually worth anything, when the proponents don't even try to give rational reasons why the technology is supposed to be good, but instead tell you that it's good that "you can do arbitrage" with a pointless good. I know what a Litecoin is worth - it is worth what the market says it is worth.

But that doesn't mean the market has to be right. Quite the contrary, the market is wrong pretty much all the time. Especially in cryptoland, where people just gamble on these altcoins for fucking profit, without understanding their lack of underlying technology in any way. That is simply wrong. And your whole idea of what this is about is also completely wrong. You're one of those people that would gladly joined in on the tulip mania, because you'd think trading them "produces output".

What does that even mean? If you're going to arbitrage bitcoin, you don't need some intermediary coin to do it--you just buy the bitcoin from where it is cheaper and sell it where it is selling for more. That's all arbitrage is. In any market you will always have alternatives for consumers to feel like they have a choice. Whether that's truly necessary is irrelevant.

In that sense litecoin has key differences which may be more appealing to certain businesses. Money and communication tools have value in "network effect", so "the biggest one wins it all". You do need more than one bank because different banks have different risks and management people inside. For the same reason you'd put your bitcoins in different wallets - if one of them happens to be weak, you don't lose all your money.

Facebook is winning as the biggest "must have" one, but since the opportunity costs of joining alternative networks are almost zero unlike saving money , there are also other websites where people share photos and personal stories. Whats the difference between one money and many monies if they're all digital currencies that can be exchanged automatically and on the fly, completely transparent to the user?

Think of a bitpay like service that let's the both the buyer and seller choose their desired digital currency separately, and everything in between happens automatically for zero or effectively zero fees using P2P exchanges. They both equally serve your definition of the function of money. Eventually, there's going be a strong incentive for multiple cryptocurrencies.

If bitcoin became the 'one world currency' we'd effectively be living under the empire of bitcoin. Which is a pretty scary thought. For that reason alone, a future of multiple cryptocurrencies is inevitable.

You're right that switching costs will tend toward zero, but wrong to analogize Bitcoin to a government-enforced global currency. It's not about monopoly; it's merely about standards. Everyone is free to choose a different ledger if they don't like how Bitcoin is managed, but they likely won't because Bitcoin will be the best for most people thanks to its network effect attracting most of the blockchain maintenance talent.

We have plenty of resources on Earth for another billion people. We just can't allocate them efficiently until governments disappear. Automatically adjusted difficulty ensures that the amount of power to be spent is determined by the current demand in bitcoins, no more no less.

By design, every transaction may include a fee for it to be included in a block. Right now this fee is usually zero for big enough transactions and insignificantly small for small transactions in order to prevent spam. When the reward gets smaller, these fees will become the main motivation for generating blocks. Some have described him as the first ever stock trader at the Wall Street to employ the power of the mass media to misinform, introduce and drive hysteria amongst other traders for short selling purposes.

Just like how short selling happens today, Jay Gould would borrow stocks of particular companies from brokers and sell them as he anticipated their prices to fall so that he would retrieve them at the lower price and return them to the brokers, keeping the difference in price for himself.

However, instead of waiting for the market forces to determine the stock price movement, he would take matters into his hands. He would start spreading manufactured negative news about the corporation through the newspapers he owned. As expected, shareholders of the company will panic and start selling, which of course, would drive the price down.

When the price reached a point that promises him the highest yield, he would buy back borrowed the shares and return them to the brokerage and start the whole process again. He made huge kills at the market through unwarranted hysteria. He had so well mastered the art that thanks to it he grew to become at one time the ninth richest man in the US. He probably was the first stock trader to accumulate wealth this way, but, of course, he was not the last.

As a matter of fact, the global financial meltdown has partly been blamed on almost similar activities happening at the Wall Street. And it is this particular financial meltdown that apparently motivated Satoshi Nakamoto to design, develop and release the Bitcoin code.