This Is Why Bitcoin Is "Crashing" Right Now, And May Actually Pick Up Again Very Soon

4 stars based on

51 reviews

We know money — those coins and paper notes and those account balances we see when we log into our bank or brokerage accounts. And we know how to use it. You get the chocolate and the supermarket gets your money. The supermarket than uses those dollars and replenishes the stock of chocolate by giving some to the chocolate manufacturer while keeping some as profits.

So we see how bitcoin bubble bursts chocolates works. But why would a supermarket be willing to accept paper those dollars and exchange them for something physical and real chocolate? Because the people of a country that issues that currency have collectively decided to put their trust in that currency and consider it to be a safe and secured medium for exchange. Those dollar bills for example are backed by the full faith and credit of the United States government.

So those dollar bills are backed by the perceived strength of the United States as a country. Bitcoin bubble bursts chocolates so are the currencies of the other major economies around the world. Or so is the hope. The underlying technology blockchain though on which bitcoin is based is extremely fascinating and promising and regardless of what happens to bitcoin, is here to stay and will likely revolutionize many aspects of the transaction economy.

And had you invested a few hundred dollars when it first appeared on the scene, you would be a zillionaire now. Real money is not supposed to do that. I read somewhere that there is this finite quantity of bitcoin that will ever be mined so there is this supply-demand imbalance at work causing the price of bitcoins to fluctuate like crazy.

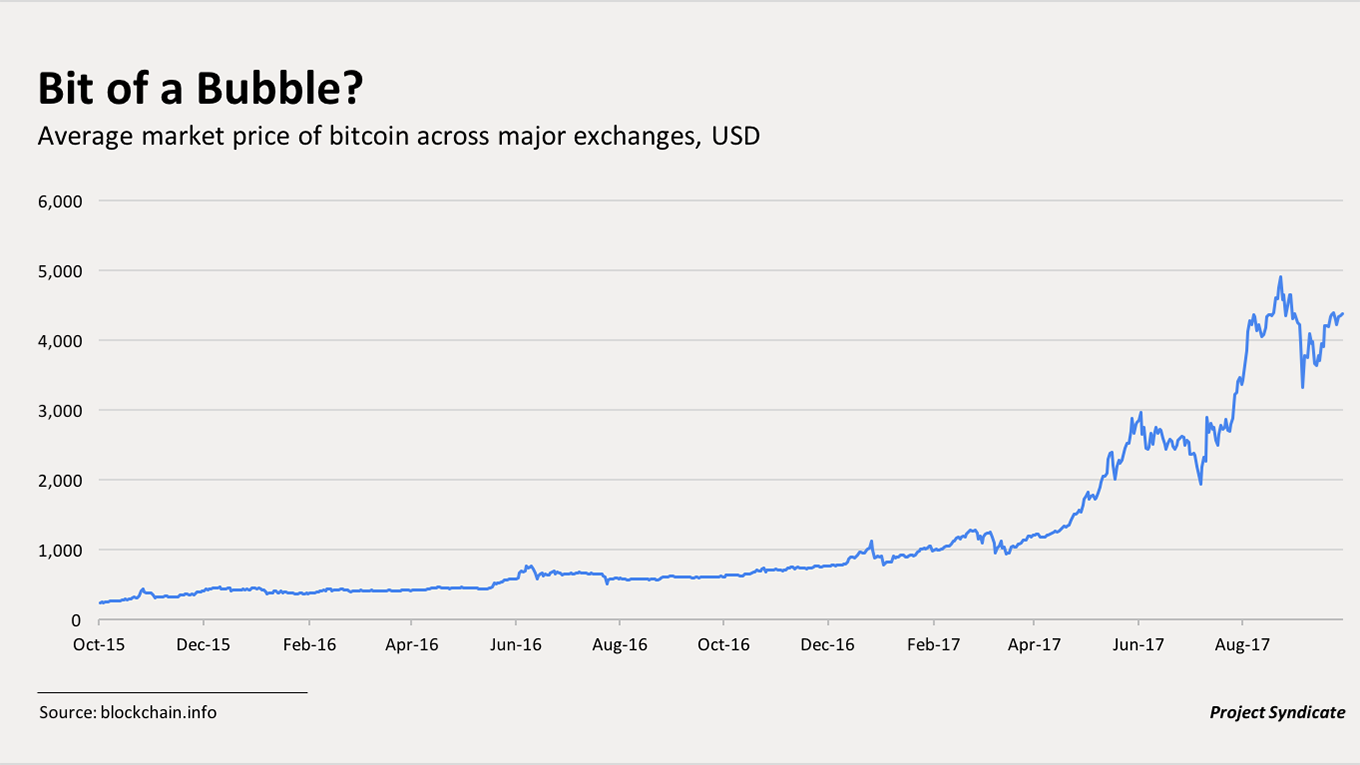

So is there a mania with the price of bitcoins? I am not smart enough to say that but just look at this price chart below. Can you spot a bubble? Soon, prices were rising so fast and bitcoin bubble bursts chocolates that people were trading their land, life savings, bitcoin bubble bursts chocolates anything else they could liquidate to get more tulip bulbs. Many Dutch persisted bitcoin bubble bursts chocolates believing they would sell their hoard to hapless and unenlightened foreigners, thereby bitcoin bubble bursts chocolates enormous profits.

Somehow, the originally overpriced tulips enjoyed a twenty-fold increase in value — in one month! As it happens in many speculative bubbles, some prudent people decided to sell and crystallize their profits.

A domino effect of progressively lower and lower prices took place as everyone tried to sell while not many were buying. The price began to dive, causing people to panic and sell regardless of losses.

And that is the hysteria and the promise and the hype that is feeding this phenomenon worldwide. The danger as it is with all manias is that eventually they collapse. These are in many ways not any different than Ponzi schemes.

Again, I am not saying bitcoin bitcoin bubble bursts chocolates Ethereum or fitcoin or whatever new coin is in vogue today is a bubble but you have seen the data and you can be the judge. It might look good for a while but then it would crash down to earth. And anybody who made money on fitcoins would be getting ill-gotten gains off the backs of other people. Think bitcoin bubble bursts chocolates that when a friend or a neighbor or someone at work, someone at church starts pitching you on the latest and greatest ICO.

Your only job would be to run, run the other way.

.png/400px-SP_500_Price_Earnings_Ratio_(CAPE).png)