Btc e bot trading software free download

32 comments

Litecoin trading platforms comparison

The digital currency Bitcoin has hit the headlines in recent times for its novelty, as well as for its phenomenal rise in price over the past few years. But how much of the Bitcoin sensation is hype, and what is the reality? Bitcoin is a method of payment and a digital currency that was launched in One of its key features is its decentralised structure that prevents regulation of the currency by a central authority or bank.

It is this aspect of Bitcoin that is trumpeted by utopian libertarians who see it as the embryo of capitalism without regulation or control, a dream that is already being scuppered by the realities of the modern world.

Others see Bitcoin simply as an opportunity to get rich quick and then get out before the bubble bursts, and in that sense Bitcoin paints a microcosmic picture of the nightmarish short-termism and irresponsibility that is the hallmark of capitalism in decline. It is hardly surprising that such a phenomenon should take off in the midst of a global crisis of capitalism.

According to some, the technology pioneered by Bitcoin and other so-called crypto-currencies is potentially game-changing when it comes to online transactions, with as much potential for a revolution in payment processing as Napster was able to achieve with music downloads. However, what is already becoming clear is that this technology can never be used to its full potential under capitalism: The most hardcore Bitcoin enthusiasts insist that the crypto-currency hails a brighter future free from human error and untrustworthy governments.

The economic collapse in Cyprus in , which led to the government seizing a percentage of the deposits of the wealthiest accounts in Cypriot banks, was seized upon by Bitcoin developers who pointed out that such a situation would never arise if only those deposits were held in Bitcoins, out of reach of governments who need bailing out when crisis hits. Similarly, supporters of Bitcoin point to the eye-watering quantitative easing that is being carried out, most notably in the USA, and the damage and instability the tapering of that easing is causing in the emerging markets, as evidence of the irresponsibility of central banks when it comes to managing currencies.

This decentralised setup makes it impossible for one person or entity to control the currency; instead any changes to the network have to be agreed upon by all those who work to maintain it.

This may look good on paper, but the proof of the pudding is in the eating; and in the complex and dynamic reality of the modern economy Bitcoin seems to be leaving libertarians with an unpleasant taste in their mouths.

The value of a bitcoin is incredibly volatile. Recently it increased in value by 60 times over the course of a single year, reaching over USD 1, in December , only to have fallen to around USD today. It goes without saying that such a volatile commodity makes for an extremely bad currency.

Bitcoin enthusiasts insist that the currency will stabilise given time and wider adoption of Bitcoin, but this seems unlikely. The use of a commodity as a currency gives it a two-fold function. Firstly it makes it into the universal equivalent in which the value of all other commodities can be measured. And secondly it makes it into a means of exchange. These two functions are closely linked. Historically, precious metals like gold have been used for this task because they concentrate a lot of value - i.

This is possible because gold, as a rare metal, requires a significant quantity of socially necessary human labour to extract and form into a tradable commodity. It therefore does not require much gold to reflect the value of large quantities of other commodities, making it easier to transport and thus facilitate trade.

Its physical property of durability also recommends it as a means of exchange. What matters when it comes to currency as a means of exchange is not the intrinsic value of the currency but the ease with which it can be moved around. The function of being a universal equivalent in which all value can be measured must still be fulfilled by a commodity that has a real value i. For this reason, any tokens that are used as currency must be backed up by a commodity of real value, i. Going into a high street bank and demanding the equivalent in gold of a ten pound note is not likely to get you very far.

So where does Bitcoin fit into all this? Clearly it is a means of exchange, but it is not backed up by a government and a national economy. Bitcoins do not have an economic anchor and so their value is entirely driven by speculation and subject to the whims of investors.

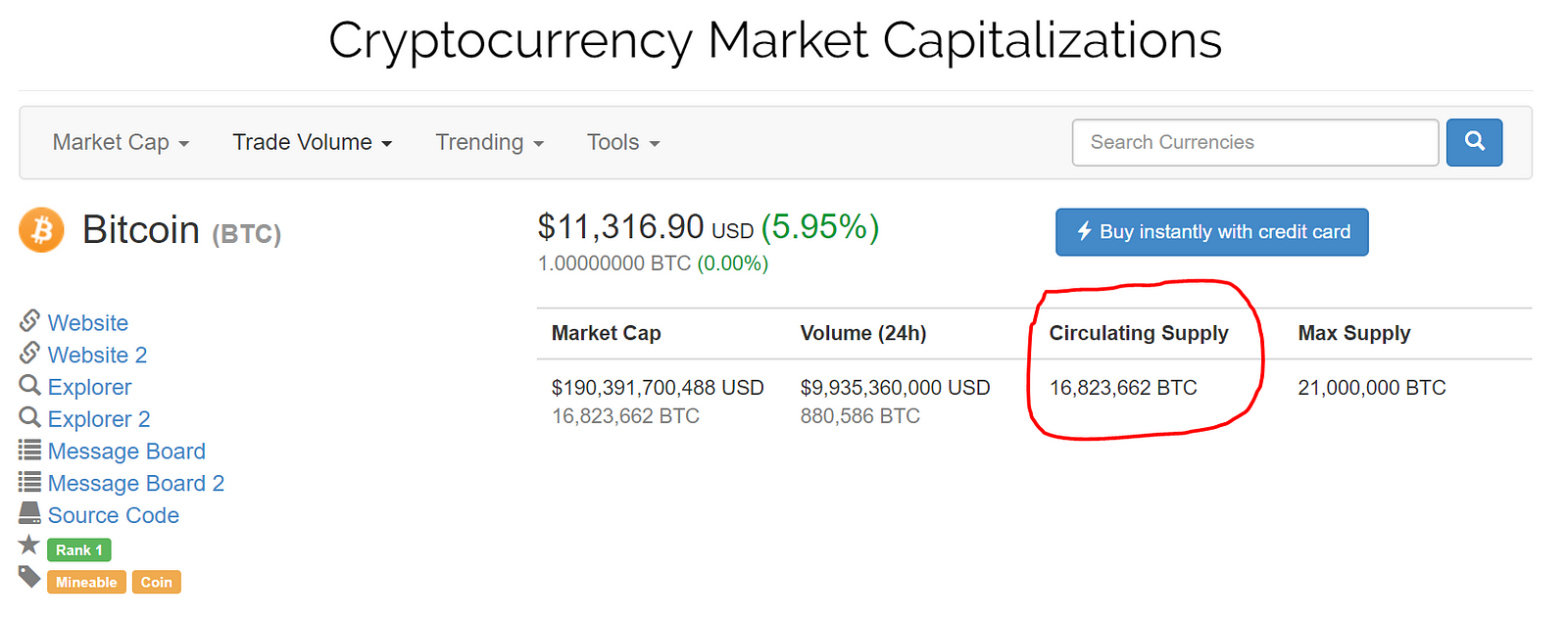

Such an empty currency really cannot be considered a currency at all as it is entirely crippled by contradictions. There is an upper limit on the number of bitcoins that will ever be produced, which has been set by its developers, and which will not be reached until the early 22nd Century. But this is entirely arbitrary. Marx points out that when it comes to money, the amount in circulation in a given economy is determined by the sum of all the prices of the commodities being exchanged, divided by the speed at which those commodities change hands.

In other words, the amount of money needed in circulation for the economy to function properly cannot be set arbitrarily or on a whim, but is determined by the strength and development of the economy as a whole. Bitcoin is not tied into an economy; in fact it is extremely hard to find real commodities to buy with bitcoins, and therefore the number in circulation is entirely divorced from the real world. It is this abstract attitude to the concept of money that seems to plague every aspect of Bitcoin.

Strangely for a man so closely linked with the world of social networking, Winklevoss seems unable to grasp the fact that money is, by definition, social. It is not possible to separate money from the societies that use it, nor to place it outside of the influence of the real people who use money throughout the wider economy. This is the reason, historically, why central banks arose in the first place — not as a dark conspiracy forced on society by incompetent governments, but as a result of the development of trade using a universal equivalent.

In that sense it is a socialising instrument and can no more be separated from society and placed under mathematical control than trade as a whole could be. Bitcoin transactions are currently illegal in Russia, and Chinese banks have been banned from handling Bitcoin transactions. Singapore has classed bitcoins as goods rather than currency, but Britain has scrapped plans to charge VAT on the mining of bitcoins. The USA is reviewing the situation and has yet to indicate what its stance in relation to the crypto-currency will be.

The status of Bitcoin at the moment is clearly not that of a legitimate currency, but it is also obvious that governments are not entirely sure in what way they should classify it. Could Bitcoin ever become a bona fide currency as its advocates argue?

This is a classically abstract and utopian idea. Purely hypothetically this idea may be true, in much the same way that if everybody simply stopped obeying the law then the law would no longer exist. But an idea is not correct simply because it looks good on paper; its validity is proven only by its capacity to be implemented in practice.

It seems highly unlikely that Bitcoin will gain wide acceptance for a number of reasons. Governments and central banks are unlikely to give up their control of national economies, precisely because that is the method by which they seek to regulate the economy. The good sense and impact of this policy on millions of workers around the world has been discussed elsewhere. It is important to note for now that this is viewed by the bourgeoisie as one of the only solutions they have to the crisis.

Any threat to take that kind of control out of their hands to be dispersed through a decentralised structure is going to be met with the full weight of the bourgeoisie and their state apparatus in opposition to such an attempt. For Bitcoin to be widely adopted it would have to offer something better for people than the currency they already use. This may be an attractive prospect for all the wealthy Russians who lost money when the crisis took hold in Cyprus, but for the vast majority of people Bitcoin, as a method of exchange, offers them nothing because they have no money to exchange for commodities in the first place.

Whether we use Bitcoin or Dollars, it makes no difference if we have none of either. Bitcoin as a currency has no impact on the ownership of the commanding heights of the economy and therefore is of little interest to the vast majority of ordinary people.

Also, already this year USD 2. Some of these thefts have been possible due to bugs in the software that supports the bitcoin network, demonstrating the vulnerability of an entirely digital currency.

Because Bitcoin transactions and owners are anonymous, trading with Bitcoin is akin to handing over a bag of cash down a dark alleyway; and storing it is like keeping wads of cash in a shoebox under your bed. Even firms who specialise in keeping bitcoins safe seem unable to protect themselves against hackers, so to expect everyone to have the technological skill to protect their computers sufficiently to avoid the theft of their life savings is frankly ridiculous.

Banks spend billions protecting themselves from theft; for Bitcoin to be widely adopted would require similar efforts on the part of each and every member of the public — such a situation would be impossible. Making Bitcoin a currency is not simply a case of declaring it to be so and watching it take off.

At the moment it clearly is not a currency, given its abstract nature and lack of an economic anchor, and its prospects for becoming one are slim.

It exists in a world that already has historically evolved and established currencies, compared to which it has little to recommend itself for the majority of people. On top of that, at a time of economic crisis when governments are doing all they can to regulate their own money supply, and with increasingly nationalist inclinations as is inevitable at a time of capitalist crisis, a decentralised, international currency will be met with firm opposition if it tries to begin to tether itself to any kind of real economic activity.

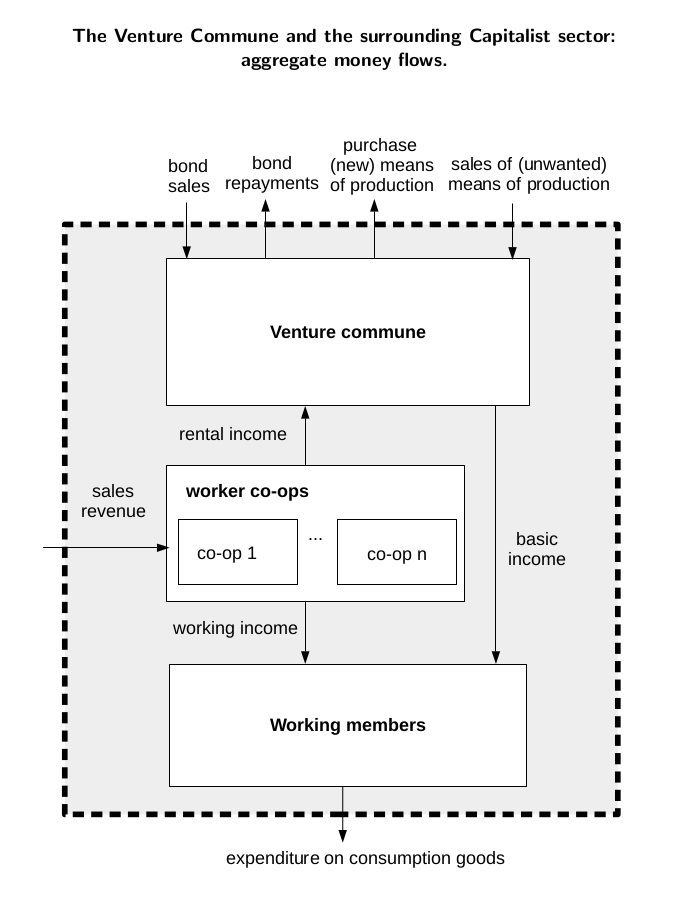

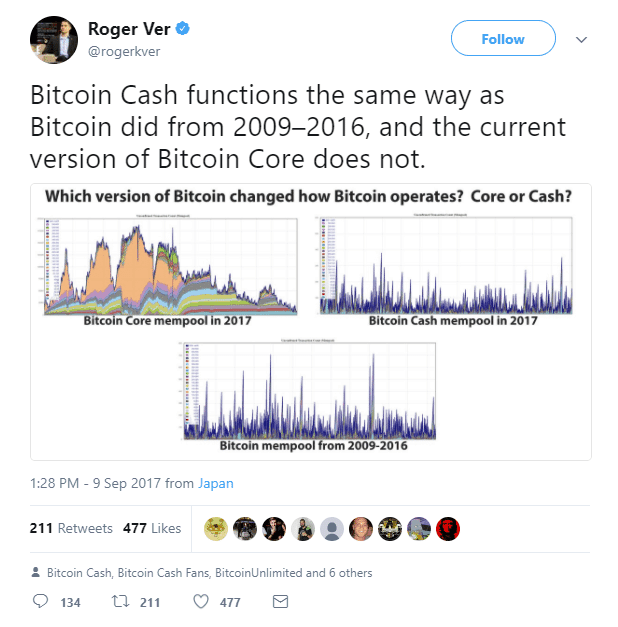

Bitcoin is supposed to prove that building a system that runs perfectly well without centralisation is possible. This is yet another fundamentally mistaken idea of how the economy works. Bitcoin was set up as a perfectly decentralised system, but to expect it to begin working on a capitalist basis and remain decentralised is pure fantasy.

Everything changes and nothing remains the same — under capitalism that change takes the form of concentration of capital and, in a capitalist system where capital equals power, that means the centralisation of power in the hands of a smaller and smaller number of people.

Under capitalism centralisation is inevitable. As has already been pointed out, central banks are not the result of conspiracy or accident, but the inevitable product of economic development and trade.

The utopians behind Bitcoin dream of giving people power over their own lives; but long as capitalism exists that will never be possible. We should not see centralisation as the enemy, but rather the class that controls these centralised institutions.

Marx points out that, when it comes to tokens as currency, those tokens only have a use-value if they have an exchange value. In other words, unless those tokens are accepted as a valid currency then they have no useful function whatsoever and therefore have absolutely no value even if human labour has gone into producing them. Why is this happening? This is a classic example of a speculative bubble. Bitcoin is new, fashionable and often in the news. Its cult status, anti-government aura and lack of clear regulation or understanding of it by the authorities makes it attractive to investors looking for somewhere to make some quick cash.

Because it does not have an economic anchor it is very susceptible to waves of speculation that can have a snowball effect in pushing the price of bitcoins up — hence a fold increase in price over the course of a year.

Of course, the same factors that mean the price can increase rapidly also mean that it can collapse in the blink of an eye. News of hacking or other malfunctions have caused Bitcoin prices to take a tumble multiple times in a short space of time.

Mere rumours, or rumours of rumours, can cause jumpy investors to abandon ship which, without any real value to back it up, has the capacity to cause Bitcoin prices to collapse entirely, wiping out fortunes in the process. Investing in Bitcoin is therefore a risky but potentially profitable business. At the present time this is a rare thing. The reason for this is the crisis of overproduction that is paralysing the global economy. In the last period capitalism has been extended well beyond its limits, primarily thanks to the vast expansion of credit.

Working people, who are paid less than the value of the goods that they produce, were able to borrow money to allow them to continue consuming. But this can only go so far, and for the last five years the economy has been suffering the hangover for the previous period of wild borrowing.

The result is that capitalists look to speculation and gambling on the stock markets to make their money.

In such circumstances, Bitcoin is an attractive prospect. It holds next to no real value, but it is something that can be invested in, traded and made a profit out of. Speculative bubbles such as this are prone to burst, and Bitcoin is extremely volatile and has seen its price rise and fall dramatically since its conception.

Normally such volatility would put investors off, with most looking to invest in something with more stability and a higher likelihood of a good return.