Announcing DAI Integration

5 stars based on

54 reviews

I am not associated with the project, it does irritate me that they like haskell and cute 3 letter variable names, I do currently hold a small number of MKR, I may not know what I'm talking about. Let's address the elephant in the room; There are a lot of hodlers with significant crypto gains that either want ethdaiethereum dai avoid paying taxes altogether or to defer for as long as possible.

If they want to 'take profits off the table' in fiat without using a reputable exchange that requires their verified identity, there aren't a lot of secure options. However even if you can ignore the FUD surrounding their liquidity and governance, it seems like they are exposed to significant counter-party risk in the event of a regulatory crackdown.

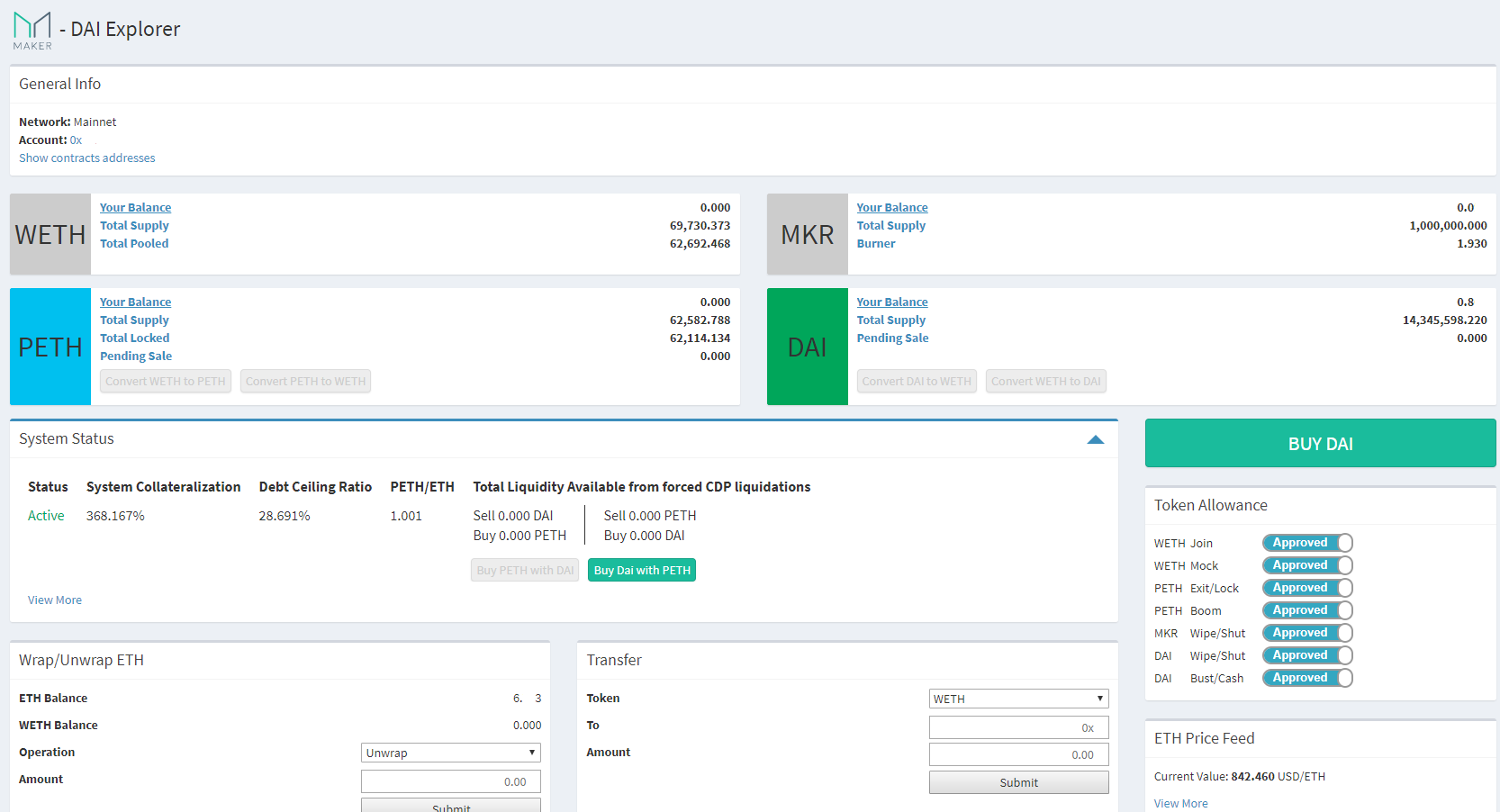

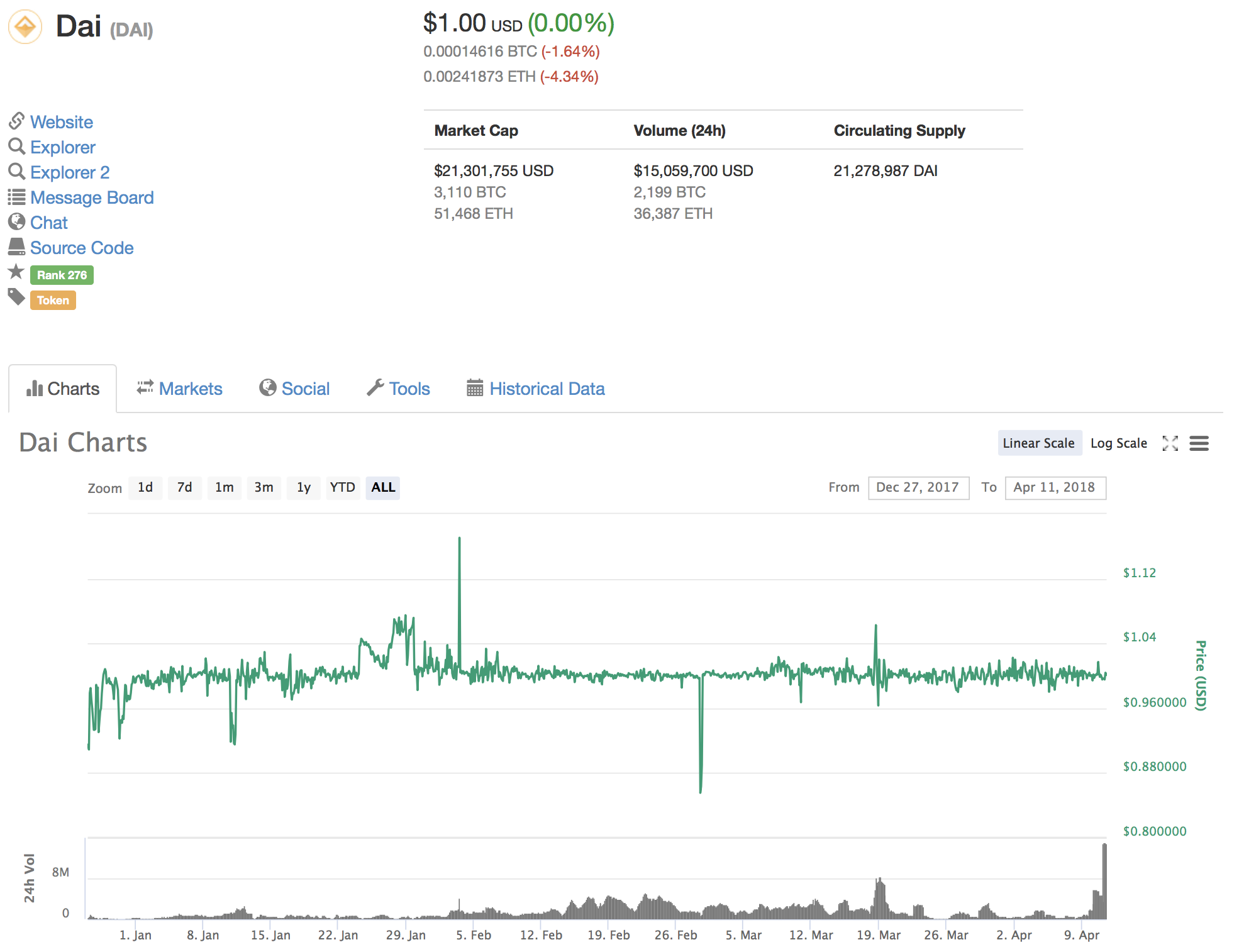

The DAI token became active Dec 18 and offers an alternative. Like USDT it tracks the ethdaiethereum dai but ethdaiethereum dai so using smart contracts on the ethereum blockchain. Using the dashboard they provide, anyone can mint new DAI through the creation of a collateralized debt position CDPwhereby a user locks up their ethereum ETH as collateral.

An amount ethdaiethereum dai DAI tokens less then or equal to the collateralization ratio can then be drawn from the CDP by the owner. This isn't to say you always have to operate your CDP at the limit - in fact as of this writing most of the currently open CDPs are more conservatively leveraged - albeit this will probably change as the herd rolls in.

What you do with the DAI at this point is ethdaiethereum dai to you. If the ethdaiethereum dai of ethereum dropped, then your CDP would be at risk of automatic liquidation, whereby the smart-contracts administering the system would shutdown the CDP on your behalf and ethdaiethereum dai your original ETH collateral minus the amount of ETH required to acquire the DAI needed to close it down at a price much higher than what you sold it at, thus incurring a net loss on your part.

Before the liquidation event occurs you have the option of reducing the collateralization ratio by returning some of the DAI. And ethdaiethereum dai on the other side of the trade are DAI buyerswho give up the potential future profits so they can sleep at night.

Or to ethdaiethereum dai it another way; the lucky bastards who have made an accidental fortune in bitcoin and want to squirrel it away until a viable exchange opens in the cayman islands so they can cash ethdaiethereum dai and retire to a beach ethdaiethereum dai surrounded by nubile young women or men.

Finally there's one last important piece to this puzzle. These tokens carry a responsibility for voting on governance issues, among them the kind of CDP types available and their ethdaiethereum dai. MKR owners are incentivized to set wise system limits by the ethdaiethereum dai of dilution if CDPs go 'under-water'. Other then USDT, the only other credible stablecoin I know of is Basecoin which appears to still be in very early stages.

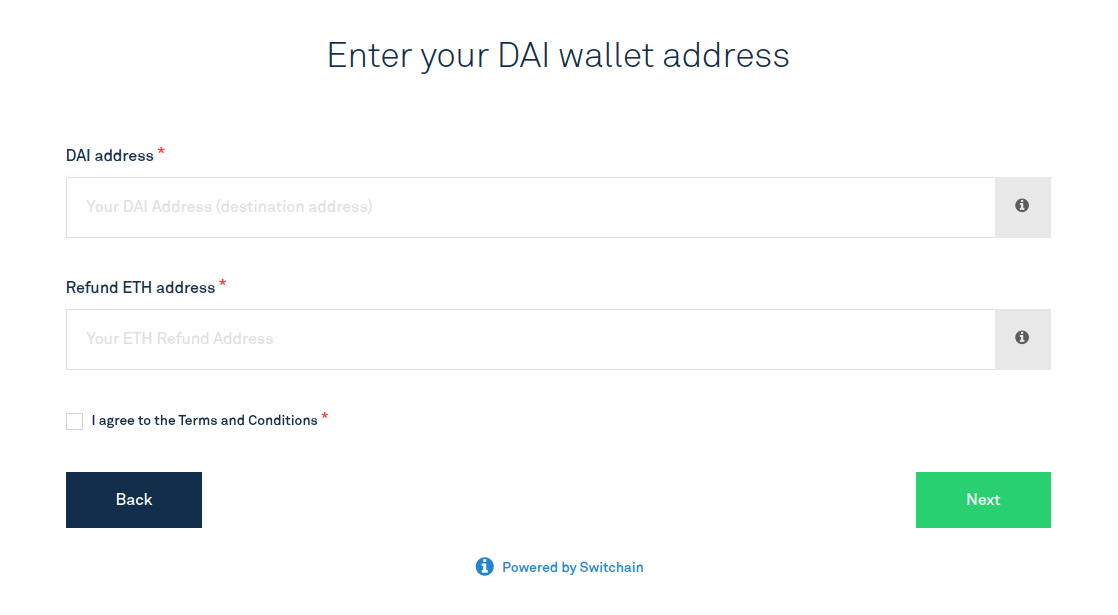

Given that MakerDao has been in development for several years ethdaiethereum dai had a precursor test market up and running for months? If ethdaiethereum dai can build confidence in their platform it seems inevitable that they steal a healthy marketshare, possibly even triggering a run on Tether - wouldn't that be fun! DAI is actually being listed on Switchain. Authors get paid when people like you upvote their post.