Bitcoin price weekly anlaysis 21st of august 2017

33 comments

Dogecoin reddit prediction

As you may know Bitcoin was developed by Satoshi Nakamoto whoever he is in Not the first overall digital currency, but the first one to solve the problems associated with decentralization. What problems may that be? I can prove I own one bitcoin by presenting a valid digital signature. I can also sign over ownership of that bitcoin to you by attaching your bitcoin address to it before signing.

The problem we run into, however, is that there is no way to know whether I also signed over ownership of that same coin to someone else or even to another address controlled by myself before transferring it to you.

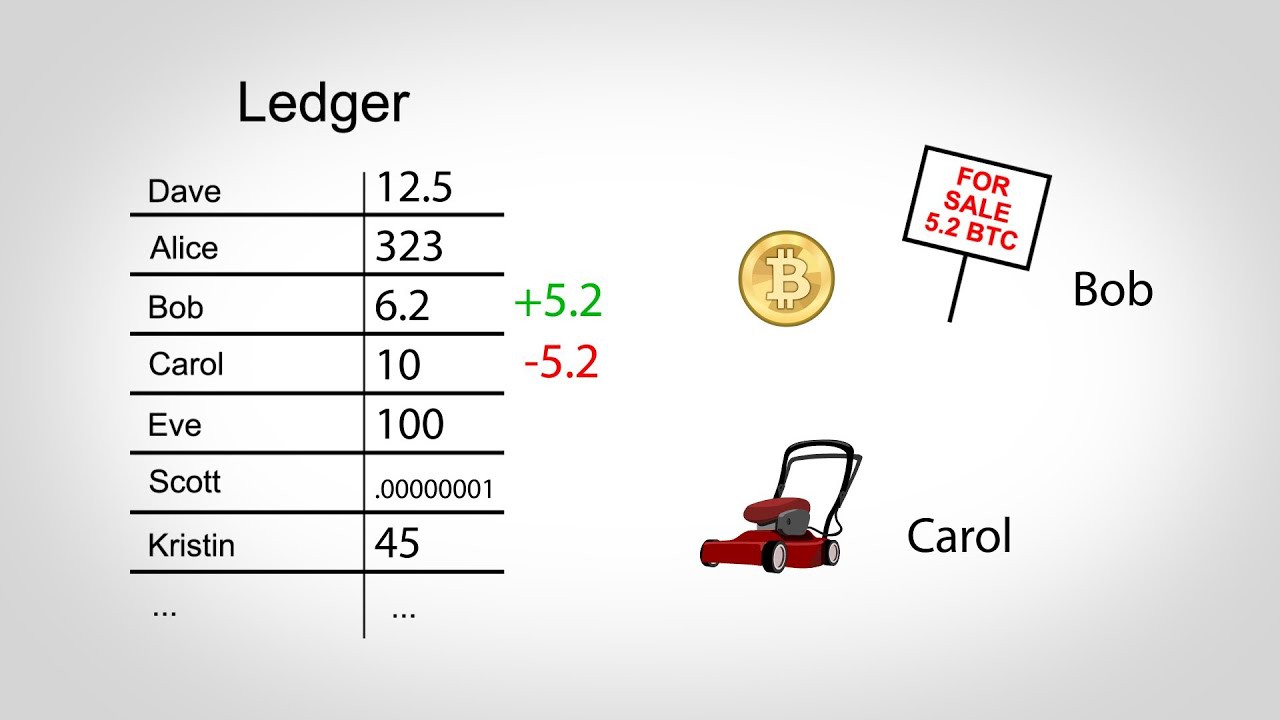

Since bitcoins are digital, they are not scarce and can be copied ad infinitum. Centralized digital currencies attempt to solve this problem by keeping a log of all the transactions ever to have taken place.

Before accepting a payment from me, you would check with the issuing company to make sure I have not previously transferred the same coin to someone else.

This works well enough except that the centralized issuer creates a single point of failure. This is exactly what happened to Liberty Reserve. The company had over a million customers before it was shut down by the U. Needless to say, this creates a need for a censorship resistant digital currency that does not have a single point of failure and cannot be shut down by an arbitrary decree of the government.

The solution Bitcoin employs is to simply make the transaction history public. Each user will download and store a copy of the transaction history and can check this ledger before accepting payment to verify that the coins have not been previously spent. Well, this method ends up creating more problems than it solves. For starters, how do you get all the users to agree on a single transaction history? How likely is it that millions of users around the globe will form a consensus about prior transactions?

Consider how each user has an incentive to see to it that their transactions are left out of the global transaction history. In computer science this problem is known as the Byzantine Generals Problem. Without solving this problem, Bitcoin would be forever plagued by multiple competing transaction histories, and fraudulent transactions. One potential solution could be to allow users to vote for which transaction history they believe to be valid, but there are multiple problems here.

Any one-IP-address-one-vote scheme would be corrupted fairly easily. Even if you could guarantee only one vote per user, the incentive still remains to vote only for the transaction history which favors you the most.

This is where Nakamoto really showed off his brilliance. When you first open your Bitcoin wallet, your computer automatically connects to a handful of other users called peers who are also operating the wallet software. Upon receiving the transaction, each peer will perform a series of about 20 checks to make sure the transaction is valid including checking the digital signature to verify that you are in fact the owner , then relay it to its peers. Through this process the transaction will propagate throughout the network eventually reaching all users.

In the early days of Bitcoin every user was also a miner. After a miner receives and verifies a transaction, he adds it to a memory pool along with all other unconfirmed transactions and begins assembling them into a block. A typical block will contain about two to three hundred transactions. A critical point to keep in mind here is that all miners receive all transactions and independently work to create a block. Once a miner creates a valid block, he broadcasts it to the network.

Each user will check its validity then add it to their local copy of the public ledger called — the block chain. Whichever miner creates a valid block is rewarded for his effort with newly created bitcoins hence the term mining.

The protocol regulates the rate at which bitcoins are created. So if just anyone with the right hardware can create a block, what stops miners from each creating blocks with favorable transaction histories, relaying them, and creating multiple versions of the block chain?

The difficulty of this math problem is calibrated such that only one miner will solve this math problem every ten minutes on average. It is designed such that blocks can be found much quicker collectively rather than individually. In this case the math problems that need to be solved are different for each chain. When confronted with this situation, each miner needs to decide for himself which chain he is going to work to extend. Now as a matter of arithmetic, the chain with the most processing power devoted to extending it will always be the longest chain.

As a result, the more time that passes, the larger the gap between chain A and chain B will become. From the perspective of an individual miner, you always want to mine on the majority chain. Consider the following example: The last block in the chain is block three and a malicious miner just spent BTC on a new car. Given that it takes the entire network an average of 10 minutes to solve the math problems needed to find a block, this individual miner will take minutes on average to find a block.

When this happens the miner has a decision to make: Does he give up his attack, accept the legitimate block four, and begin work on block five or does he continue working to find a block four with his version of the transaction history? If he chooses the latter, again the probabilities suggest the rest of the network will find block five and blocks six, seven, etc before he finds his version of block four. Whenever he does manage to find and relay his fraudulent block four, it will just simply be ignored orphaned in Bitcoin parlance since the main chain is longer than his alternate chain.

The only way such an attack could succeed is for the malicious miner to continue adding blocks to his alternate chain and somehow extend it longer than the main chain. As we already mentioned, however, the chain with the majority of the processing power will always grow to be longest chain, so unless this attacker can muster up a ton of processing power, the attack will not succeed. Surely the NSA has some powerful supercomputers right?

Well, considering that the total processing power in the Bitcoin network is faster at computing these math problems than the top supercomputers in the world combined ………….

Not only that, but as we speak people are bringing more processing power online in an attempt to mine blocks and earn the reward. Check out this chart of the total processing power in the network:. So to sum up, given the likelihood of failure, the only rational thing to do is simply to give up mining alternative chains, accept the network consensus and move on.

The opportunity cost of mining blocks that will not be included in the main chain is just too high. Because of this incentive structure, profit maximizing miners will always choose to mine on the majority chain guaranteeing that the millions of disparate Bitcoin users will be able to agree on a single transaction history.

So there you have it. He designed Bitcoin in such a way that it essentially channels private self-interest into public good. Miners are led as if by the invisible hand of Satoshi himself to come to a consensus. In Part 2 we will take a deeper look at the cryptography involved in Bitcoin mining and how it is used to secure the network. Tweet Email Pocket Like this: Bitcoin and Other Altcoins: Heya i am for the first time here.

I hope to give something back and aid others like you aided me. Will you kindly drop me a e-mail? I drop a leave a response when I like a article on a site or if I have something to contribute to the discussion. Part 1 — Incentives Escape Velocity. Is it only me or does it look like like some of these remarks come across like coming from brain dead visitors? Would you list all of your social sites like your Facebook page, twitter feed, or linkedin profile?

Good respond in return of this issue with genuine arguments and describing everything about that. Wie entstehen Bitcoins und was ist Mining?

Bitcoin Online resources collected The Bitcoin Journey Como funciona o bitcoin: Do you think it makes sense to have a fund that tracks and invests in the 20 biggest Crypto currencies. The Bitcoin — The Bibliophile. Look how everybody was doubting in BTC and still, always coming back — its just the first and best cryptocoin. BTC just has 21Million Coins in total once all mined, thats what will surge the price up and the reason i stick to that!

At these prices i use cloudmining to get more coins! Already in hashflare https: Professional Cryptocurrencies mining company. Trying to steal market shares from Hashflare and Genesis!! Cryptocurrencies — An Introduction Stewart. Quantum computers are the most powerful tech threat cryptocurrency will face.

You are commenting using your WordPress. You are commenting using your Twitter account. You are commenting using your Facebook account.

Notify me of new comments via email. Notify me of new posts via email. A number of people have told me that I have a knack for explaining complex topics in a way that is easy to understand. These first few posts will be about Bitcoin mining.

Hopefully, these posts will serve as a nice educational resource for beginners. In part 1 we will take a look at what Bitcoin mining is and how it makes this digital currency tick. Bitcoin is surprisingly very accessible, and these are ELI5 posts after all. Mark Lyford Crypto May 9, at 8: Mark Lyford Bitcoin May 10, at 8: