Dogecoin wallet windows inserts

21 comments

What is a bitcoin trading bot

We're going to be talking about the economics of the blockchain and digital currencies more broadly. This is a really fascinating conversation. Before we get started, I'd like to ask you a favor. If you enjoy this show, please leave us your review on iTunes. Now, getting onto the show. Welcome to the show, Christian, really excited to have you here. Our first topic of conversation is going to be the economics of Bitcoin and the blockchain.

Maybe first, you can tell us how you got interested in this topic as a researcher. Thanks for having me here. The story started very much when I joined Sloan. I had been looking at this space for some time, and in particular Bitcoin. As many juniors on the job market, you have to keep focusing on your job market paper, and not divert to other topics, so I left that in the back burner.

I was fascinated by their idea. I convinced them to turn it into a research study. They had already pretty much raised the capital from a group of our alumni. When Catherine Tucker and I got involved, the idea was really to first make it safe so that the moment where we were starting to drop half a million dollars on campus, we wouldn't be crazy, but also to learn something from it from a research perspective. I think we were fascinated by the possibility to observe, for the first time, a contrafactural diffusion curve.

Often when technology diffuses in society, it does so endogenously, right? Early adopters will adopt first. Then, over time, as the costs decrease, you see more and more people adopting. Here, we had a setting where there was still a lot of uncertainty around the role of the technology. Use cases were very limited.

There was a lot of enthusiasm, but I think it was really unclear which direction the technology could go. MIT was a particularly interesting setting for this, because there's a lot of raw talent in our undergraduates. I think people were excited beyond Bitcoin as the currency and were thinking about Bitcoin as the application stack.

As an operating system for a new set of applications that could increase access to banking in developing countries, improve financial services, and really revolutionize how we think about currencies. While Bitcoin was just an interesting new technology, in some sense you had a broader economic question in mind here. More than just do people use the Bitcoin or not. What did you find? I think the students were actually really interested in getting people to adopt Bitcoin and turning MIT into the first economy that was running on a cryptocurrency.

From an economic perspective, there were a set of questions that we had in mind around, of course, the role of network effects and the adoption of new technology, how privacy concerns interact with that. Bitcoin is a really interesting technology when it comes to financial transaction privacy. The broader level, I think we were interested in what kind of role do early adopters play in further diffusion?

Do they generate positive spill overs as it's often assumed in literature or can they actually deter innovation and diffusion from taking place when they are not on board? We had a broad set of questions on diffusion and adoption, but also on how privacy challenges are a conception of financial transaction in a world that's becoming more and more digital. First of all, actually, this is something that's interesting.

How does one define an early adopter anyway? We all have this vague conception that some people are really into technology and they are going to get the fancy new gadget first.

I've never actually seen that operationalized in economics. I think as economists, we decided to go for reveal preferences. When many start-ups launch a new product, they usually open up some sort of mailing list or wait list for people that want to adopt the technology first.

That's essentially what we did. We gave students five days to register. Then, we used the speed at which they sign up for the distribution as a proxy for their early adopter status. Of course, we need to check that they weren't just more in need for cash. We used survey measure to corroborate that these are people that usually adopt [inaudible We find that actually the reveal preference approach is pretty robust in terms of spotting the early adopters.

How did these early adopters use the Bitcoin? What was the interesting variation between the different early adopters? As I was mentioning before, what we could observe here for the first time was a contrafactual diffusion curve.

What I mean by that is we had settings where your typical early adopters were forced to wait. That variation would give us a chance to observe what happens when people that really wanted it first that were your typical technology gatekeepers don't get the technology first.

We used that delay to estimate what happens later to diffusion and adoption. In terms of results, first of all, surprisingly, most of the students still to date are holding on to their Bitcoin. This is not really something we expected. It's interesting that in the sign up survey when students were mentioning the reasons for using Bitcoin, the top answer was actually as an investment vehicle.

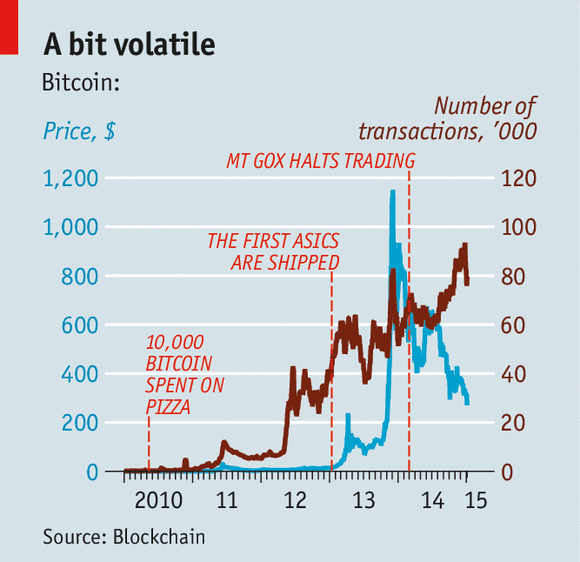

We spent a lot of time convincing them that Bitcoin is a very volatile asset. At the end, they were right. The ones that are holding are actually making a very profitable gain on it. Activity on the other side, was really low. I think to economists, that's not surprising, because on a campus like MIT, you can use all sort of digital payment systems, from credit cards, debit cards, Apple Pay.

Our students are clear early adopters of Venmo and the like. Some people cashed out, of course. They told us, "This is not for me". Most people cashed out later when the price was above the original distribution price.

I think what's interesting is that when we delayed early adopters, they were way more likely to cash out. This was really surprising to us, because by all accounts, these were the people that you would have expected to hold on to the currency, maybe convince their friends to use it.

That delay really affected them. After we rule out a number of alternative explanation like pure effects and learning, the one that seems the most plausible to us at this point is they do get consumption value and utility from being first to adopt. Early adopters do care about that exclusivity period that they usually get when they are able to sign up in line for the new iPhone or wake up at midnight to order it online. When you take that away, that takes out the fun. For some of these probably being by-passed as early adopters and maybe being challenged in the role as gatekeepers for new technologies within their peers in environments where this is heavily socialized, like in dorms, that really mattered.

I think one of the contributions of our paper is to highlight that we tend to think of early adopters as generating positive network effects. They clearly do, right? They bring other people on board when the technology is obscure. By the way, do you measure that?

That they bring others on board. We didn't measure it directly in this setting, right? What we see is that when an above the median share of the early adopter is delayed, you can measure this either at the dorm level or within a social cluster, after weeks, what we see is that other people start dropping out of Bitcoin too.

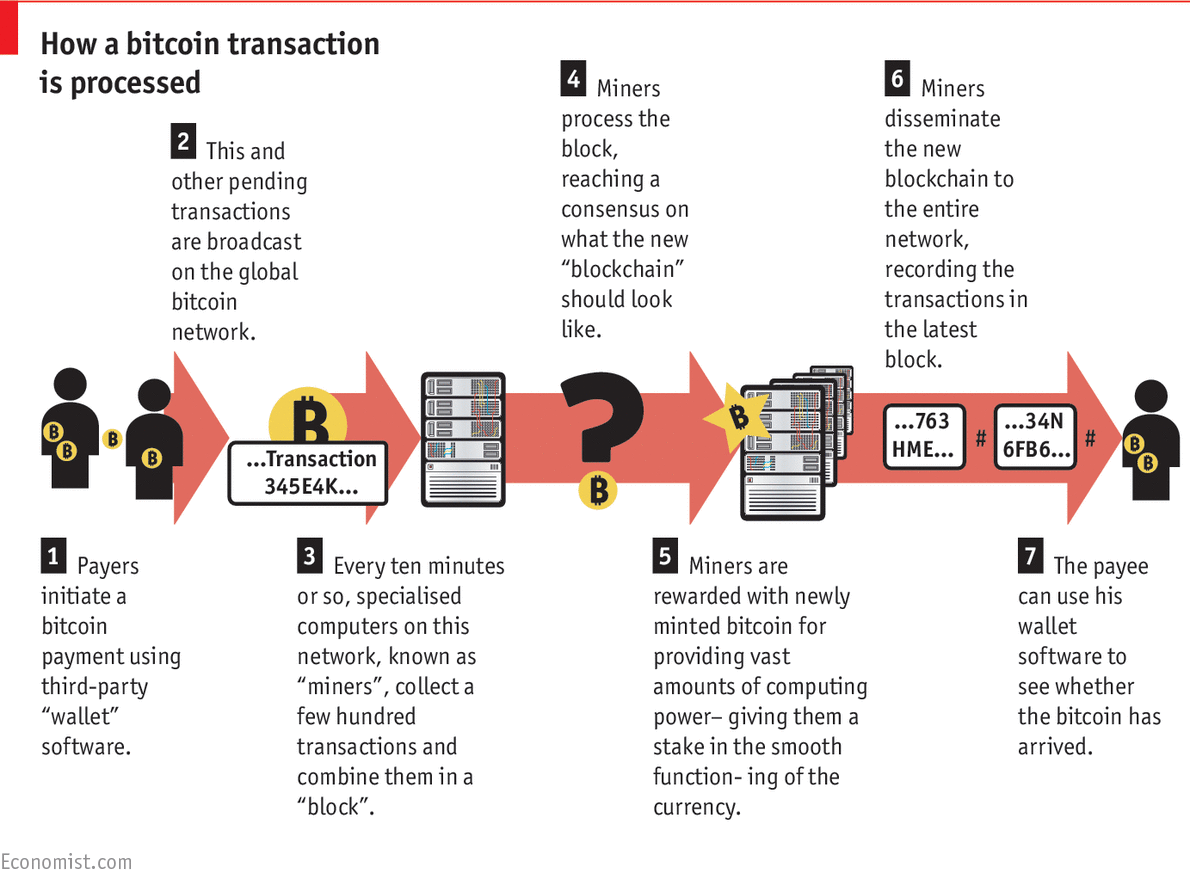

This adoption is much faster in environments where the early adopters are not holding on. The opposite story is essentially one where you can imagine we did everything right. We seeded the technology to early adopters first. Just a clarification, how do you define activity? Just the fac that they chose to receive the Bitcoins into a wallet? Or are they actually doing something with it? First of all, we get transaction data from the wallet intermediaries.

We track it on the blockchain. We use machine learning to do all of that. For that one, we explicitly looked at people that kept adding money to their Bitcoin holdings. These are people that, not only are maybe actively using it, but are also increasing their assets in Bitcoin. I think what's interesting is, again, many people are holding it possibly as a speculation device.

Also that people seem to be looking at these early adopters for advice and reference in these environments. Just turning back to these slower adopters. You mechanically delay the adoption of people who would otherwise have chose to adopt earlier. This resulted in them being less excited about that technology.

I think that's actually a really interesting finding, because I think a baseline model for early adopters might just say that the people that adopt early get more utility from the technology itself. Here you're just showing that a lot of it is due to the fact that it makes them cool or fashionable. It's more like a social benefit rather than an actual benefit in terms of the consumption sense. I think you're absolutely right.