Bitcoin miner best hardware

25 comments

Exxon to sell stations oil company

A bitcoin exchange is an online marketplace where traders buy and sell bitcoins using fiat currencies US Dollar, Euro, Yen, etc. It serves as a platform and an intermediary between cryptocurrency buyers and sellers. You will have to do three things when you buy or sell bitcoins in a bitcoin exchange.

You can use the criteria below for determining whether a bitcoin exchange is good enough for your needs. All bitcoin exchanges work keep hacking at bay every day. As hackers improve every day, exchanges must improve at the same rate if not better.

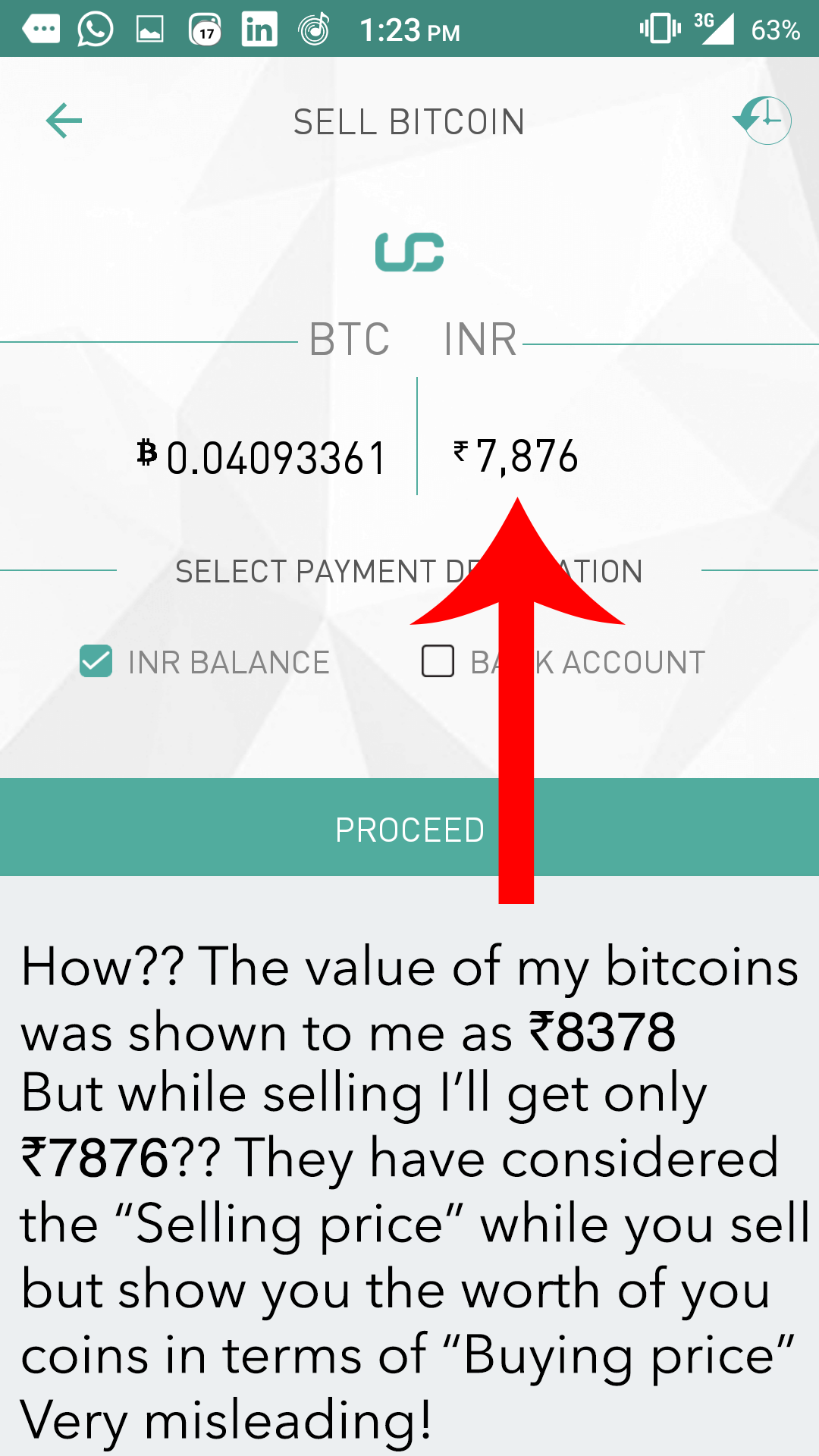

However, not all exchanges support this. There are no official exchange rates for Bitcoin in the currency markets. Thus, prices are based on the average rates across all exchanges. Look for reliable sites that offer industry rate averages for Bitcoin. You can get bitcoins fast through Bitcoin ATMs. Another way is to find exchanges or brokers that offer instant buy through bank transfer, debit card, or credit card. Exchange fees should reasonable.

They can change as time passes and vary from one exchange to another. Some exchanges charge extra fees other than transaction fees. Some exchanges give fee deductions to reward your loyalty and transaction frequency.

Like in a conventional stock exchange, bitcoin exchanges match buyers and sellers. Traders opt to buy and sell Bitcoin by entering a market order or a limit order. Market orders authorize the trader to trade his coins at the best currently available price in the marketplace. Limit orders , on the other hand, authorizes the trader to trade his coins at a price lower than the current ask price when buying or above the current bid price when selling. You will need a Bitcoin wallet to receive, store, or spend your bitcoins.

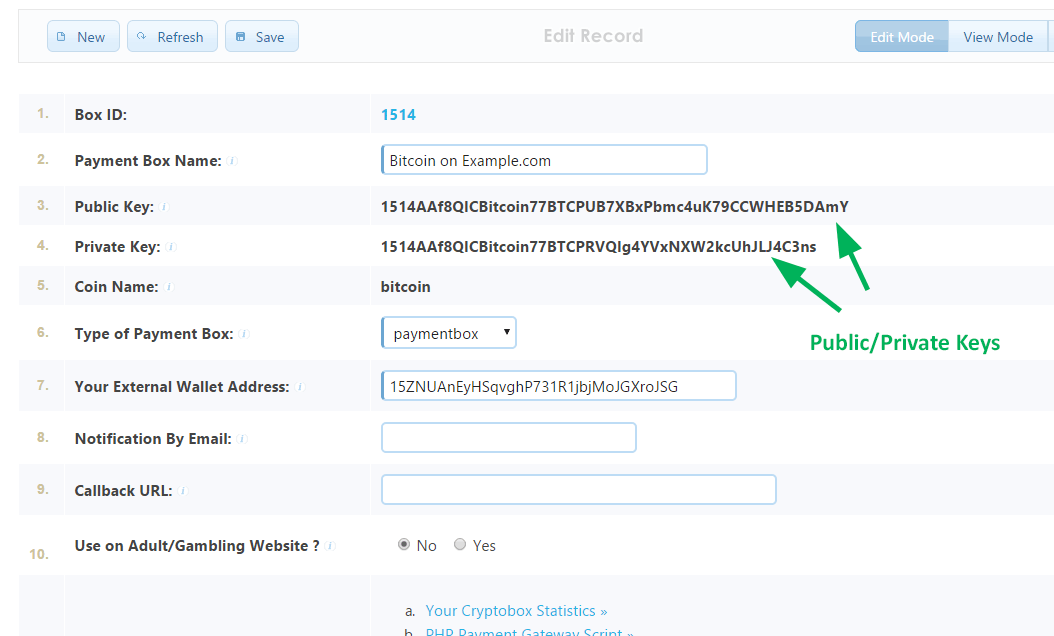

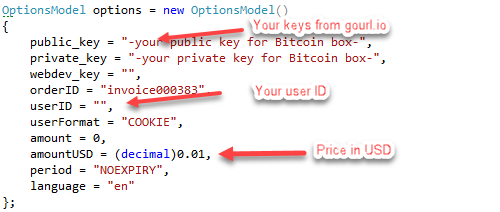

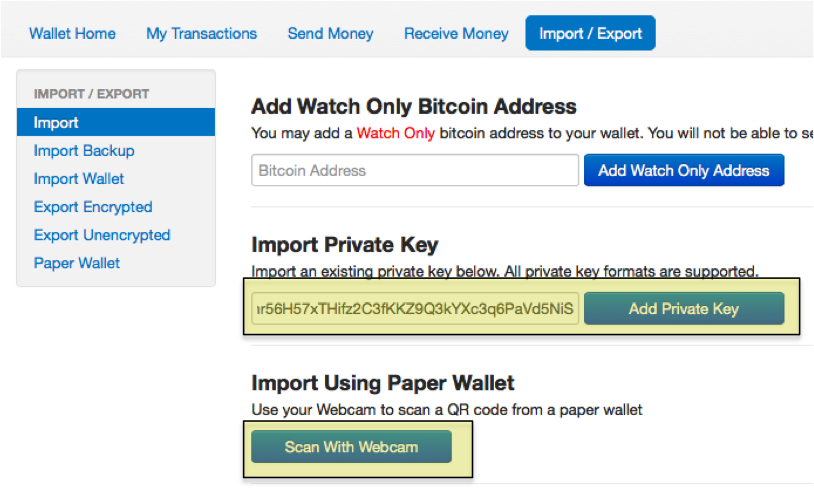

Bitcoin wallets can be websites, apps, devices, or software programs. They contain private keys that let you access your bitcoins. Bitcoin exchanges offer Bitcoin wallets when you sign up. Some people choose to hold their physical Bitcoin wallets or even physical bitcoins to store their crypto money.

There are two main types of Bitcoin wallets: These are physical electronic devices that resemble USB sticks or thumb drives. Their sole purpose is to manage your bitcoins. Quite a number of people prefer these because they perform like physical wallets — just connect them to a computer, phone, or tablet to spend Bitcoins inside.

The only way to lose bitcoins through a hardware wallet is when someone outright steals your bitcoins. However, you can choose to protect it using a PIN code. You can also make a secret backup code to maintain access to your bitcoins even when you lose your hardware wallet.

Hot wallets are apps or programs found on smartphone, tablets, and computers. They also generate your private Bitcoin keys. Small amounts of Bitcoin can be stored on hot wallets while main Bitcoin funds area ideally stored in cold wallets. The three main payment methods for buying Bitcoin are the following: This method is the most popular because most people who know their way around money have a bank account with or without a credit card or a debit card.

Debit and credit cards can offer instant access to bitcoins but for relatively higher fees and less anonymity because they will require your ID for validation. For larger transactions, bank transfers are preferred.

They charge lower fees but can take up to 5 business days to complete transactions. They also provide less anonymity like the cards. If you need anonymity, cash is your method of choice.

Cash transactions are also prone to scams and robberies. Try looking for nearby Bitcoin ATM in your location. Major cities typically have them. Some even have multiple Bitcoin ATMs. Unfortunately, they offer the same markup rates as cash transactions. Bitcoin exchanges have similarities and differences with other types of exchanges.

However, security and anonymity are emphasized as strong criteria when it comes to choosing the right exchanger for you. You are solely responsible for your bitcoins and other cryptocurrencies so make sure you do your homework before dealing with any Bitcoin exchange.

What is a bitcoin exchange? How to buy and sell bitcoins in a bitcoin exchange? Find and choose a good bitcoin exchange You can use the criteria below for determining whether a bitcoin exchange is good enough for your needs. Trade a currency for Bitcoins Like in a conventional stock exchange, bitcoin exchanges match buyers and sellers. Transfer your bitcoins to a secure Bitcoin wallet You will need a Bitcoin wallet to receive, store, or spend your bitcoins.

Hardware wallets These are physical electronic devices that resemble USB sticks or thumb drives. Hot wallets Hot wallets are apps or programs found on smartphone, tablets, and computers. Payment Methods The three main payment methods for buying Bitcoin are the following: Credit card, debit card, bank transfer This method is the most popular because most people who know their way around money have a bank account with or without a credit card or a debit card.

Local direct-to-seller cash or cash deposit If you need anonymity, cash is your method of choice. Conclusion Bitcoin exchanges have similarities and differences with other types of exchanges.