Bitcoin mining pool pie chart

47 comments

Neo bot script paladin mistrockers

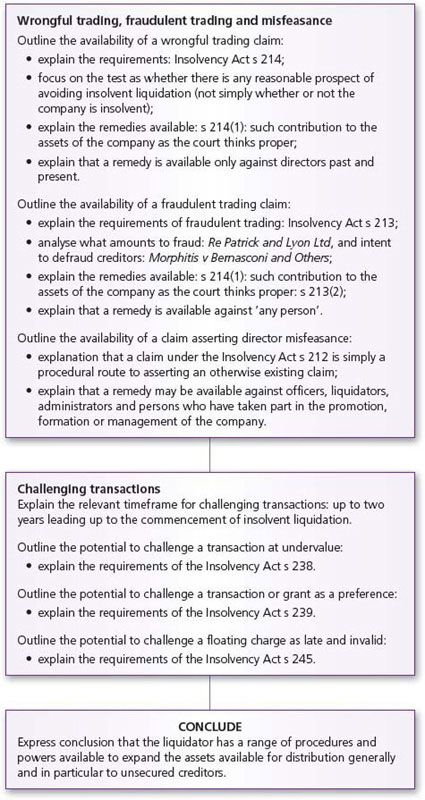

The following legal case illustrates the impact on directors of fraudulent trading - with fraudulent trading defined by Section of The Insolvency Act The High Court has ruled that directors who made representations that a company would meet its rental obligations on certain of its leases of property, when they had no intention of making payments after a certain date, were involved in fraudulent trading for the purposes of the Insolvency Act They were required to make a monetary contribution to the company's assets in its liquidation, as were solicitors involved in the scheme that resulted in non-payment of the rent see Morphites v Bernasconi [] 10 Current Law Section of the Insolvency Act provides that if, in the case of a company's winding-up, it appears that any company business has been carried on with intent to defraud its creditors or creditors of any other person, or for any fraudulent purpose, then the court may, on the liquidator's application, declare that any people who knowingly carried on the business in that way are to be liable to make such contributions if any to the company's assets as the court thinks proper.

The company was established as part of a road haulage franchise. It acquired some onerous leases through a former managing director, who was removed. The company's directors, with its solicitors devised a scheme under which the shares in the company were sold to the father-in-law of one of the directors, and the goodwill was acquired by a new company that continued to trade under another name.

The directors gave assurances to the landlord that the rent under the leases would continue to be paid. It wasn't, and the company went into liquidation. The liquidator asked the court for a declaration as to the director's liability to make a contribution to the funds of the company in liquidation. The court gave the declaration of liability. The directors had been closely involved in operating the business under the scheme, and the representation to the landlord about future payment of rent had been demonstrably false.

The case is a warning to directors not to represent to creditors that they will be paid the debts owed to them. In proving fraudulent trading, the dishonest element can be shown by the fact that the directors had no reason to think that funds would be available to make the payments. They do not have to intend or actually know that the payments will not be made see R v Grantham [] 3 All ER Fraudulent trading claims are not limited to directors, as wrongful trading claims under s of the Insolvency Act are.

In this case, a claim was also brought against the solicitors who had advised on the scheme. In terms of the loss arising, this in fact extinguished the director's liability in a payment sense. A cautionary tale for all corporate advisers - including of course accountants, at least where the non-payment of the debt is likely to arise from the advice given.

The decision The court gave the declaration of liability. Comment The case is a warning to directors not to represent to creditors that they will be paid the debts owed to them.