Guy named Koch bought 5,000 bitcoins in 2009 for $27, now worth $886,000

4 stars based on

78 reviews

He received a doctorate of business administration from Mississippi State University. Bitcoin is november 2013 bitcoin mineral digital currency devised by a programmer or a group of programmers under the pseudonym of Satoshi Nakamoto. Bitcoin has emerged as the most widely used digital currency, with proponents lauding its usefulness as an alternative currency. This paper attempts to answer these questions.

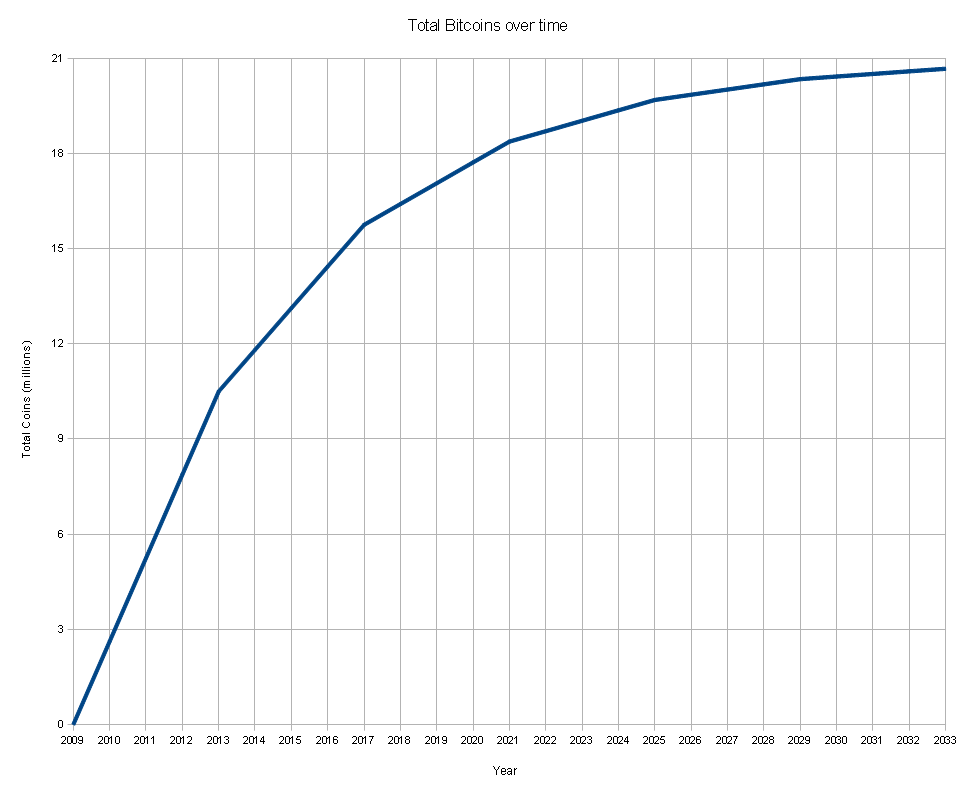

Bitcoins are created at a steady but diminishing rate until november 2013 bitcoin mineral arbitrary limit of 21 million has been november 2013 bitcoin mineral Grinberg To date, about This limit to the creation november 2013 bitcoin mineral bitcoins is very appealing to those wary of high inflation resulting from the extremely stimulative monetary policies of major western central banks, particularly the U.

For the same reason, bitcoin is november 2013 bitcoin mineral appealing to proponents november 2013 bitcoin mineral a return to the gold standard. These individuals see bitcoin as analogous to a naturally occurring mineral with a limited and exhaustible supply.

The most common way to purchase bitcoins is through an account with a bitcoin exchange, such as coinbase. These exchanges also post current exchange rates between one bitcoin and major currencies, including the U.

After an account has been created, one can directly transfer money from a financial intermediary, including banks and Paypal. Once the transfer has been cleared, one can use the funds to purchase if applicable, fractional bitcoins from the exchange for a november 2013 bitcoin mineral as an example, bter.

At this point, the bitcoins are ready to be sold back to the exchange or used for purchases. Confusion reigns in the tax treatment of bitcoins for citizens of many countries. However, as virtual currencies become more popular, tax authorities in a handful of countries have started to provide guidance on how virtual currency transactions must be treated.

On March 25,the November 2013 bitcoin mineral. Internal Revenue Service issued its guidance on virtual currencies via IR According to the IRS, virtual currencies including bitcoins are treated as property for taxation purposes. As such, wages and payments to independent contractors paid in the form of bitcoins are taxable using applicable income tax rates. In keeping with the growing fascination with bitcoin as its price skyrocketed inpopular media began to report stories of individuals becoming rich with well-timed bitcoin investments and more disturbingly, instances of individuals losing large sums as a result of technical issues or plunges in bitcoin prices.

On the other hand, a British man named James Howells lost 7, bitcoins purchased for a trivial amount in when he threw away the laptop containing the private key to his bitcoin wallet Hern The unregulated, decentralized, and anonymous nature of bitcoins means in cases like this, there is no protection for either consumers or investors. It is estimated that nearly 4 percent of all bitcoins outstanding have been permanently lost because of issues such as hard-disk failure, hacking, fraud, or outright theft Williams More recently, the bankruptcy of the leading bitcoin exchange, known as Mt.

The volatile price history of bitcoins can also rapidly expose investors to losses. The supply of bitcoins is limited by the amount november 2013 bitcoin mineral electricity and computer CPU time needed to mine it. There is no central clearinghouse, nor are any financial institutions november 2013 bitcoin mineral as banks involved in facilitating transactions, which are both faster and cheaper than transactions involving traditional means of payment. The bitcoin user community performs the function of maintaining the block chain, a public and distributed ledger, to keep track of transactions between anonymous accounts on a peer-to-peer network.

Without such a ledger, the same bitcoin could be exchanged for cash, products, or services more than once. This is known as the double spending problem. Finally, the number of bitcoins generated per block is set to fall according to a rule that will result in a maximum of 21 million bitcoins in circulation byaccording to the November 2013 bitcoin mineral Central Bank.

Thus, the supply of bitcoins is independent of any central bank policy. This is also the most powerful reason why many of its backers and users prefer bitcoin to fiat currencies. If true, this will avoid both inflation and business cycles that they believe are products of manipulation of the money supply. Instead, bitcoin may suffer from november 2013 bitcoin mineral deflationary spiral in which its owners postpone consumption in anticipation of falling prices of goods and services when denominated in bitcoin.

However, this is a distant prospect at the moment because the number of bitcoins in circulation is far below the 21 million limit, according to the ECB report. In addition, bitcoin is not the legal tender of any country or currency union. As such, bitcoins are only linked november 2013 bitcoin mineral the supply of goods and services provided by merchants that accept bitcoins.

Therefore, the possibility exists that merchants may choose to reduce the supply of goods and services denominated in bitcoin to avoid such a deflationary spiral.

The ECB report also mentions the many drawbacks of bitcoin as a currency. Bitcoin is also vulnerable to theft since bitcoin owners need a public and private key to use it.

If the file that contains this information november 2013 bitcoin mineral altered or lost, say as a result of a hard disk failure, a computer virus, or hacking, the bitcoin associated with the keys is lost. This has been reported by several users, according to the report. Cyber-attacks have even targeted exchanges that serve to facilitate bitcoin transactions, causing the value of bitcoins to plunge.

On another level, bitcoin has no intrinsic value and can be seen as an example of a Ponzi scheme because early users and owners can only receive fiat currency for bitcoin they own if new users enter the community and november 2013 bitcoin mineral willing to buy bitcoin using a fiat currency.

From a law enforcement perspective, the anonymity of bitcoin accounts makes it ideal for november 2013 bitcoin mineral laundering, tax evasion, and black market trading of contraband goods Brustein ; Goldberg To date, there has been very little academic research on the economic aspects of bitcoin. Four reasons help explain the paucity of research. One is the relative obscurity of bitcoin to those outside of the computing and cryptography community Lee Another is that the number and value of bitcoins created so far have been quite small in relation to the size of november 2013 bitcoin mineral global economy Velde Bitcoin is also difficult to use for the payment of goods and services in the physical world, and, as per records available from the website blockchain.

Finally, many bitcoin enthusiasts and active members of the community that govern the mining of bitcoins november 2013 bitcoin mineral maintain the records of their transactions are extremely skeptical of central banks entrusted with the management of fiat currencies. Mainstream economists generally have little respect for these views and may have, by extension, ignored something favored by these groups Lee However, the sharp spike in bitcoin price in attracted attention from the popular press.

In line with the mining of additional bitcoins and their rapidly rising value, the november 2013 bitcoin mineral of daily transactions has mushroomed to tens of thousands. In late MarchFinCEN announced steps to extend monitoring of money laundering activities to include companies that deal in bitcoins.

These firms must keep more detailed records of bitcoin transactions and report high volume transactions Satter Grinberg examined the economic aspects of bitcoin and pointed out that bitcoin has a competitive advantage in micropayments because it is divisible to eight decimal places. In addition, it is competitive in the online gaming world because it is not tied to any one particular november 2013 bitcoin mineral such as Facebook credits, Linden dollars, and World of Warcraft WoW gold, which are controlled by Facebook, Second Life, and Blizzard Entertainment, respectively.

However, bitcoin is also vulnerable to the emergence of a competing virtual currency because barriers to entry and start-up costs are extremely low or a crisis of confidence caused by abuse of discretionary authority by the leaders of the bitcoin community Grinberg Currently, the electronic money directive of the European Union does not offer such clarity because bitcoin may qualify to be exempt from the regulation Jacobs However, it appears that legislators are moving toward introducing regulations that would make bitcoin transactions more secure and transparent even though the use of bitcoins for economic transactions is extremely november 2013 bitcoin mineral, especially if illegal activities are excluded.

Veldein his capacity as senior economist of the Chicago Federal Reserve, concluded his discussion of bitcoins with an intriguing possible scenario that bitcoins could eventually form the basis of a new monetary system. In a throwback to the gold standard era, money will not be based on a fiat currency and central banks will have only limited flexibility in its creation.

However, the quantity of money would not be affected by the geological and political uncertainties associated with physical gold. In particular, this study examines whether bitcoin has the three main attributes of a november 2013 bitcoin mineral This paper also investigates the value of bitcoin as an investable financial asset by incorporating it in portfolios that include major world currencies, U. This study assesses whether the inclusion of bitcoins in such an investment portfolio enhances its efficiency.

Daily closing prices and trading volume of bitcoins was taken from bitcoincharts. Gold is often considered a good hedge and a safe haven currency during times of extreme financial distress Bauer and Lucey Hence, in addition to major world currencies, we also compared bitcoin price returns november 2013 bitcoin mineral gold price returns. We obtained daily price quotes for gold from the Bloomberg Professional database. To assess november 2013 bitcoin mineral performance of bitcoins when this asset is included in a diversified portfolio with major asset classes, we needed proxy portfolios of various asset classes.

For this part of the study, we included major indexes representing each asset class. This index evaluates the U. For the final part of the analysis, we needed investable assets representing these asset classes in order to capture market capitalization data. Exchange traded funds November 2013 bitcoin mineral provided the solution.

In an attempt to examine if bitcoin behaves like a currency, we examined the distributional properties of its returns along with those of other major currencies and gold. Another objective of the analysis presented here was to examine whether bitcoins can serve to enhance portfolio performance metrics. As mentioned earlier, we examined portfolios formed with indices representing currencies, stocks, bonds, real estate, commodities, and the fear index with and without the addition of bitcoins to these portfolios.

Optimum portfolios were examined after a simulation of 1, trials in which random weights for each asset class were drawn in each trial; then the portfolio that optimized each examined measure was selected for illustration.

Consistent with most investor preferences, we chose to examine long-only portfolios. At first, we examined portfolios that minimized the total variance.

This objective was defined as: The optimization of asset weights w pi in each portfolio p was conducted subject to the constraints that the portfolio is fully invested all asset weights sum up to 1 and that each asset weight is greater than or equal to zero long-only portfolios.

We examined two versions of the minimum variance portfolio: The november 2013 bitcoin mineral optimization procedure minimized the negative variance of long-only portfolios under the assumption that investors choose to ignore positive deviation and are only concerned about minimizing the negative deviation in portfolio returns. We also measured portfolio efficiency with the Sharpe ratio and the Sortino ratio. These measures maximize november 2013 bitcoin mineral adjusted excess returns.

The optimization process may be defined as: We used the risk-free rate RFR as the target return in the optimization process. Next, following post-modern portfolio theory, we examined the portfolios that maximize the measured Omega ratio. The Omega ratio is based on the proportional distribution of returns above and below a specified target. Among its many advantages see Shadwick and Keatingthe one that pertains most to an investor is that it minimizes the potential for extreme losses.

In the portfolio optimization process using the Omega ratio, we used zero as the target to differentiate positive from negative returns. The optimization process can be defined as: Where, F x dx represents the respective cumulative distribution functions. As mentioned earlier, 1, trials were conducted for each portfolio over the sample period november 2013 bitcoin mineral order to select the optimal portfolio weights.

/cdn.vox-cdn.com/uploads/chorus_asset/file/9829989/Screen_Shot_2017_12_07_at_3.13.11_PM.png)