How Does a General Ledger Account Work?

4 stars based on

80 reviews

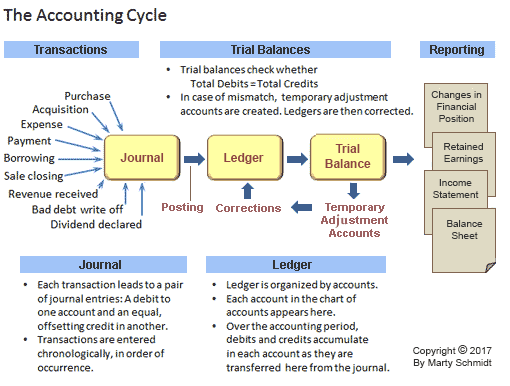

The term, accounting cycle, is commonly referred to as accounting process or the steps involved for all the business activities during an accounting period. The series of activities begin with a transaction and ends with its inclusion in the financial statements. Accounting entails recording, classifying and summarizing of business transactions.

It is a process of identification, measurement and communication of economic information. The accounting cycle is like a circle which begins at one point and revolves through specific steps around recognizing financial transactions and reporting the results thereof.

The accounting cycle includes the following 8 steps. The accounting process starts with financial transactions. This step involves identifying and analyzing business transactions. The transactions are first identified and are then analyzed in order to determine what accounts are affected post transactions to ledger accounts should be arranged well as the amount to be recorded.

It should be noted that not all transactions and events are entered in the accounting system. Only those events that involve money or payments, such as, borrowing money, depositing money into a bank etc.

Thus, in order to measure as a business transaction, an activity or an event must be of financial character in a certain amount of money.

Every transaction is listed in the appropriate journal which is maintained in chronological order. All the transactions are recorded through journal entries that show the recording date of transactions, account names, Ledger Folio or Reference, brief narration, amounts, and whether those accounts are to be recorded in debit or credit side of the accounts.

The journals are known as the books of original entry. Journals are used to systematically record all accounting transactions before they are entered into the general ledger. Thus, the general journal is a place to first record an entry before it gets posted to the appropriate accounts. The third step in the accounting cycle is to post each journal entry to the appropriate ledger accounts.

Every transaction is posted to the account that it impacts. Ledger posting is the process by which all the transactions are synthesized account-wise, so that the accumulated balance of each of those accounts can be determined.

The process of ledger posting is vitally important as it helps post transactions to ledger accounts should be arranged ascertaining the net effect of various transactions during a given period.

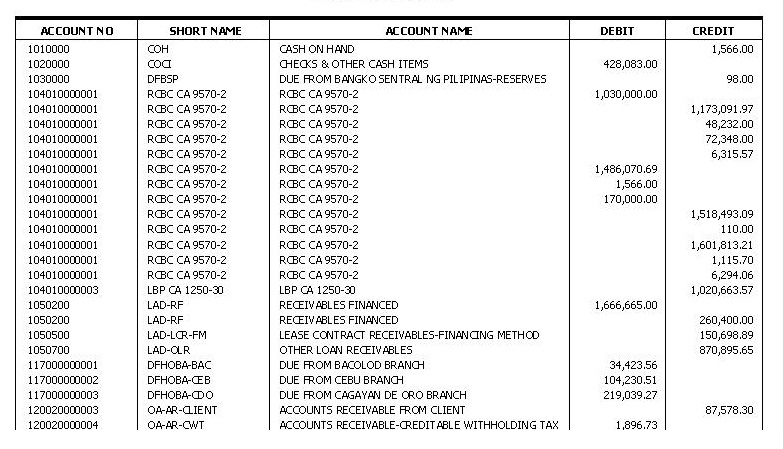

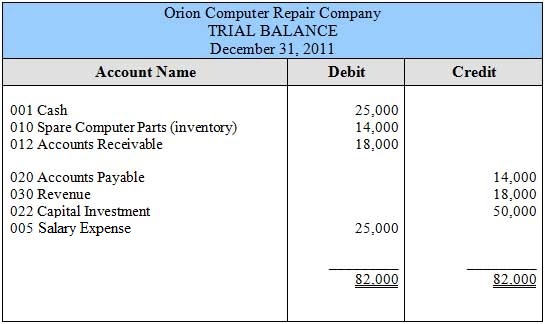

Preparing a trial balance is a key step in the accounting cycle. Depending on the business practices or when it publishes its financial statements, the trial balance is prepared at the end of the accounting period. It could be monthly, quarterly or yearly. The information used in a trial balance comes from the ledgers. Thus, a post transactions to ledger accounts should be arranged balance is a list of all accounts and their balances at a point in time.

Preparing the trial balance involves the arrangement of all ledger accounts having been aggregated into debit and credit balances. This activity enables to check and confirm whether the total of debits is equal to that of credits. There is possibility of errors in the accounts which cannot be deducted thoroughly or even meticulously sometimes.

This requires making adjustment entries employing worksheet. It is through this step you need to make any corrections needed to the affected accounts. It involves making adjustment entries. Adjusting entries are journal entries that are recorded at the end of the accounting period to adjust income and expense accounts, so that they can conform to the accrual concept of accounting. The purpose of adjusting entries is to match incomes with expense during the accounting period.

It must be noted that the transactions that are recorded through adjusting entries do not arise without any cause, but they are relevant and spread over a period of time. Adjusting entry involves either income or expense accounts. The adjusting entries are related to Accruals, prepayments and non-cash items, such as, depreciation expense, allowance for doubtful debts etc.

They are sometimes called Balance Day adjustments, because they are made on balance day. After you make and record adjustments, you take another trial balance to be sure that the accounts are in balance. Now that the trial balance is made, it can be used to prepare the financial statements.

An adjusted trial balance is post transactions to ledger accounts should be arranged listing of all company accounts that will appear on the financial statements after year-end adjusting journal entries have been made. In this way, after having made all the adjustment entries and prepared the final trial balance, you prepare the balance sheet and income statement using the corrected account balances. Preparing general purpose financial statements includes the post transactions to ledger accounts should be arranged sheet, income statement, statement of retained earnings.

At this stage, it is important to mention that closing all temporary accounts to the retained earnings account is faster than using the income summary account method because it saves a step as well as efforts.

Since there is a need for determining the profit and loss on month by month, quarter by quarter and year by year bases, Revenue and expense accounts must be started with a Zero Balance at the beginning of each accounting period, whereas, the asset, liability and Equity accounts are carried over from cycle to cycle.

A complete accounting cycle is vital to producing accurate financial statements.