Ethereum classic summit

45 comments

Cryptocurrency exchange reviews uk

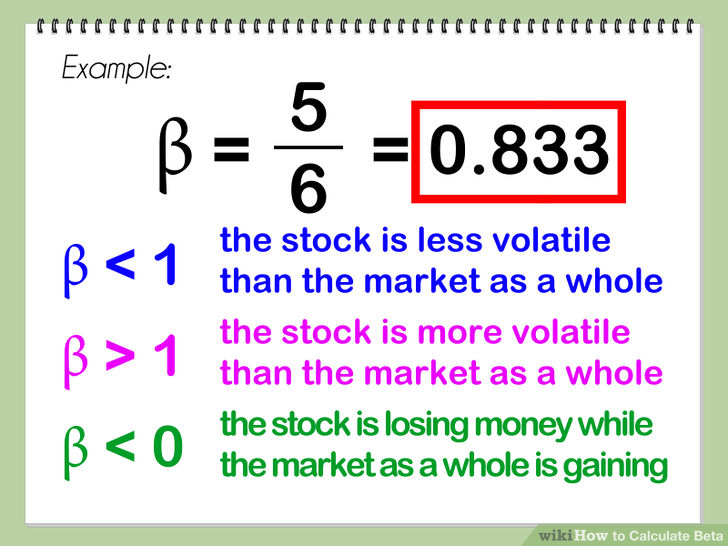

Beta is a measure of the risk arising from exposure to general market movements as opposed to idiosyncratic factors. The market portfolio of all investable assets has a beta of exactly 1. A beta below 1 can indicate either an investment with lower volatility than the market, or a volatile investment whose price movements are not highly correlated with the market.

An example of the first is a treasury bill: An example of the second is gold. The price of gold does go up and down a lot, but not in the same direction or at the same time as the market. A beta greater than 1 generally means that the asset both is volatile and tends to move up and down with the market.

An example is a stock in a big technology company. Negative betas are possible for investments that tend to go down when the market goes up, and vice versa. There are few fundamental investments with consistent and significant negative betas, but some derivatives like put options can have large negative betas.

Beta is important because it measures the risk of an investment that cannot be reduced by diversification. It does not measure the risk of an investment held on a stand-alone basis, but the amount of risk the investment adds to an already-diversified portfolio.

In the Capital Asset Pricing Model CAPM , beta risk is the only kind of risk for which investors should receive an expected return higher than the risk-free rate of interest. The definition above covers only theoretical beta. The term is used in many related ways in finance. For example, the betas commonly quoted in mutual fund analyses generally measure the risk of the fund arising from exposure to a benchmark for the fund, rather than from exposure to the entire market portfolio.

Thus they measure the amount of risk the fund adds to a diversified portfolio of funds of the same type, rather than to a portfolio diversified among all fund types. It is an example of regression toward the mean. A statistical estimate of beta is calculated by a regression method. For a given asset and a benchmark, the goal is to find an approximate formula. Since practical data are typically available as a discrete time series of samples, the statistical model is.

By using the relationships between standard deviation, variance and correlation: If a refers to the investment and b refers to the market, it now becomes clear that the interpretation of beta as 'the volatility of an investment relative to the market volatility' is inconsistent with how beta is calculated; this is due to the presence of the correlation in the above formula.

Beta can be computed for prices in the past, where the data is known, which is historical beta. However, what most people are interested in is future beta , which relates to risks going forward.

Estimating future beta is a difficult problem. One guess is that future beta equals historical beta. From this, we find that beta can be explained as "correlated relative volatility".

This has three components:. Beta is also referred to as financial elasticity or correlated relative volatility , and can be referred to as a measure of the sensitivity of the asset 's returns to market returns, its non-diversifiable risk , its systematic risk , or market risk.

On an individual asset level, measuring beta can give clues to volatility and liquidity in the marketplace. In fund management, measuring beta is thought to separate a manager's skill from his or her willingness to take risk.

The portfolio of interest in the CAPM formulation is the market portfolio that contains all risky assets, and so the r b terms in the formula are replaced by r m , the rate of return of the market. The regression line is then called the security characteristic line SCL.

Both coefficients have an important role in modern portfolio theory. Because this higher return is theoretically possible merely by taking a leveraged position in the broad market to double the beta so it is exactly 2. If one of the managers' portfolios has an average beta of 3. Whether investors can expect the second manager to duplicate that performance in future periods is of course a different question.

The x -axis represents the risk beta , and the y -axis represents the expected return. The market risk premium is determined from the slope of the SML. The security market line can be regarded as representing a single-factor model of the asset price, where beta is exposure to changes in value of the market. The equation of the SML, giving the expected value of the return on asset i , is thus:.

It is a useful tool in determining if an asset being considered for a portfolio offers a reasonable expected return for risk. Individual securities are plotted on the SML graph. If the security's risk versus expected return is plotted above the SML, it is undervalued because the investor can expect a greater return for the inherent risk. A security plotted below the SML is overvalued because the investor would be accepting a lower return for the amount of risk assumed.

The benchmark is often chosen to be similar to the assets chosen by the investor. In practice a standard index is used. The choice of the index need not reflect the portfolio under question; e.

The restriction to stocks as a benchmark is somewhat arbitrary. A model portfolio may be stocks plus bonds. Sometimes the market is defined as "all investable assets" see Roll's critique ; unfortunately, this includes lots of things for which returns may be hard to measure. A stock whose returns vary more than the market's returns over time can have a beta whose absolute value is greater than 1. A stock whose returns vary less than the market's returns has a beta with an absolute value less than 1.

However, because beta also depends on the correlation of returns, there can be considerable variance about that average; the higher the correlation, the less variance; the lower the correlation, the higher the variance. Beta can also be negative, meaning the stock's returns tend to move in the opposite direction of the market's returns. Higher-beta stocks tend to be more volatile and therefore riskier, but provide the potential for higher returns.

Lower-beta stocks pose less risk but generally offer lower returns. Some have challenged this idea, claiming that the data show little relation between beta and potential reward, or even that lower-beta stocks are both less risky and more profitable contradicting CAPM.

Suppose an investor has all his money in an asset class X and wishes to move a small amount to an asset class Y. For example, X could be U. Then the new portfolio, Z, can be expressed symbolically. This assumes that variance is an accurate measure of risk, which is usually good. However, the beta does need to be computed with respect to what the investor currently owns.

Academic theory claims that higher-risk investments should have higher returns over the long-term. Wall Street has a saying that "higher return requires higher risk", not that a risky investment will automatically do better. Some things may just be poor investments e. Further, highly rational investors should consider correlated volatility beta instead of simple volatility sigma. Theoretically, a negative beta equity is possible; for example, an inverse ETF should have negative beta to the relevant index.

Also, a short position should have opposite beta. This expected return on equity, or equivalently, a firm's cost of equity , can be estimated using the capital asset pricing model CAPM. An indication of the systematic riskiness attaching to the returns on ordinary shares. It equates to the asset Beta for an ungeared firm, or is adjusted upwards to reflect the extra riskiness of shares in a geared firm.

The arbitrage pricing theory APT has multiple betas in its model. Each risk factor has a corresponding beta indicating the responsiveness of the asset being priced to that risk factor.

Multiple-factor models contradict CAPM by claiming that some other factors can influence return, therefore one may find two stocks or funds with equal beta, but one may be a better investment.

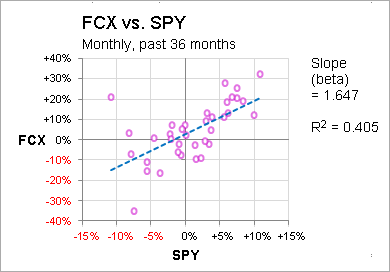

To estimate beta, one needs a list of returns for the asset and returns for the index; these returns can be daily, weekly or any period. Then one uses standard formulas from linear regression. The slope of the fitted line from the linear least-squares calculation is the estimated Beta. The y -intercept is the alpha. Myron Scholes and Joseph Williams provided a model for estimating betas from nonsynchronous data. Beta specifically gives the volatility ratio multiplied by the correlation of the plotted data.

To take an extreme example, something may have a beta of zero even though it is highly volatile, provided it is uncorrelated with the market. The relative volatility ratio described above is actually known as Total Beta at least by appraisers who practice business valuation. Total beta is equal to the identity: Total beta captures the security's risk as a stand-alone asset because the correlation coefficient, R, has been removed from beta , rather than part of a well-diversified portfolio.

Because appraisers frequently value closely held companies as stand-alone assets, total beta is gaining acceptance in the business valuation industry. Appraisers can now use total beta in the following equation: Some interpretations of beta are explained in the following table: It measures the part of the asset's statistical variance that cannot be removed by the diversification provided by the portfolio of many risky assets, because of the correlation of its returns with the returns of the other assets that are in the portfolio.

Beta can be estimated for individual companies using regression analysis against a stock market index. An alternative to standard beta is downside beta. Beta is always measured in respect to some benchmark. Therefore, an asset may have different betas depending on which benchmark is used.

Just a number is useless if the benchmark is not known. Seth Klarman of the Baupost group wrote in Margin of Safety: Beta views risk solely from the perspective of market prices, failing to take into consideration specific business fundamentals or economic developments. The price level is also ignored, as if IBM selling at 50 dollars per share would not be a lower-risk investment than the same IBM at dollars per share.

Beta fails to allow for the influence that investors themselves can exert on the riskiness of their holdings through such efforts as proxy contests , shareholder resolutions, communications with management, or the ultimate purchase of sufficient stock to gain corporate control and with it direct access to underlying value.