WHAT IS BLOCKCHAIN? A SHORT INTRODUCTION

4 stars based on

71 reviews

Like the internet in its early years, blockchain technology is hard to understand and the economist blockchain technology how does it works, but could become ubiquitous in the exchange of digital and physical goods, information, and online platforms. Figure it out now. What is a blockchain? Blockchain is a term widely used to represent an entire new suite of technologies.

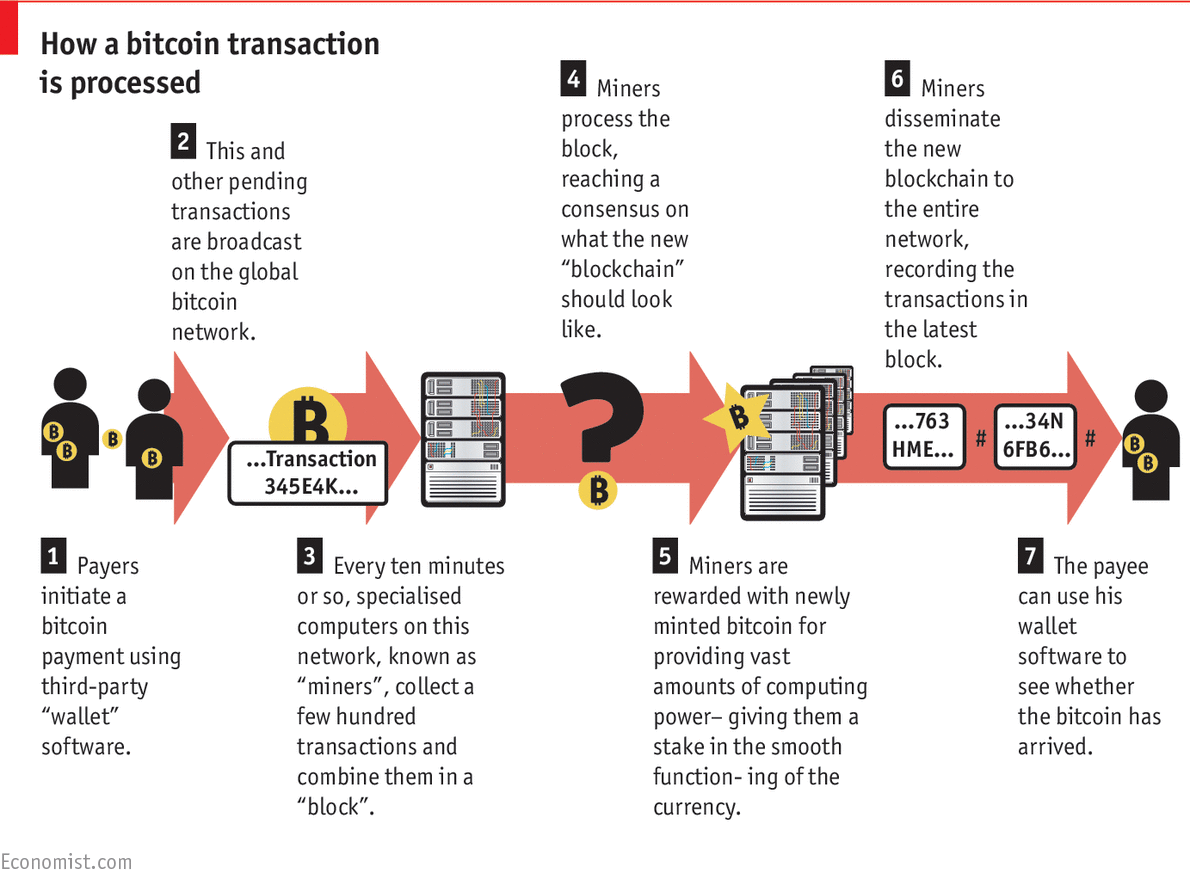

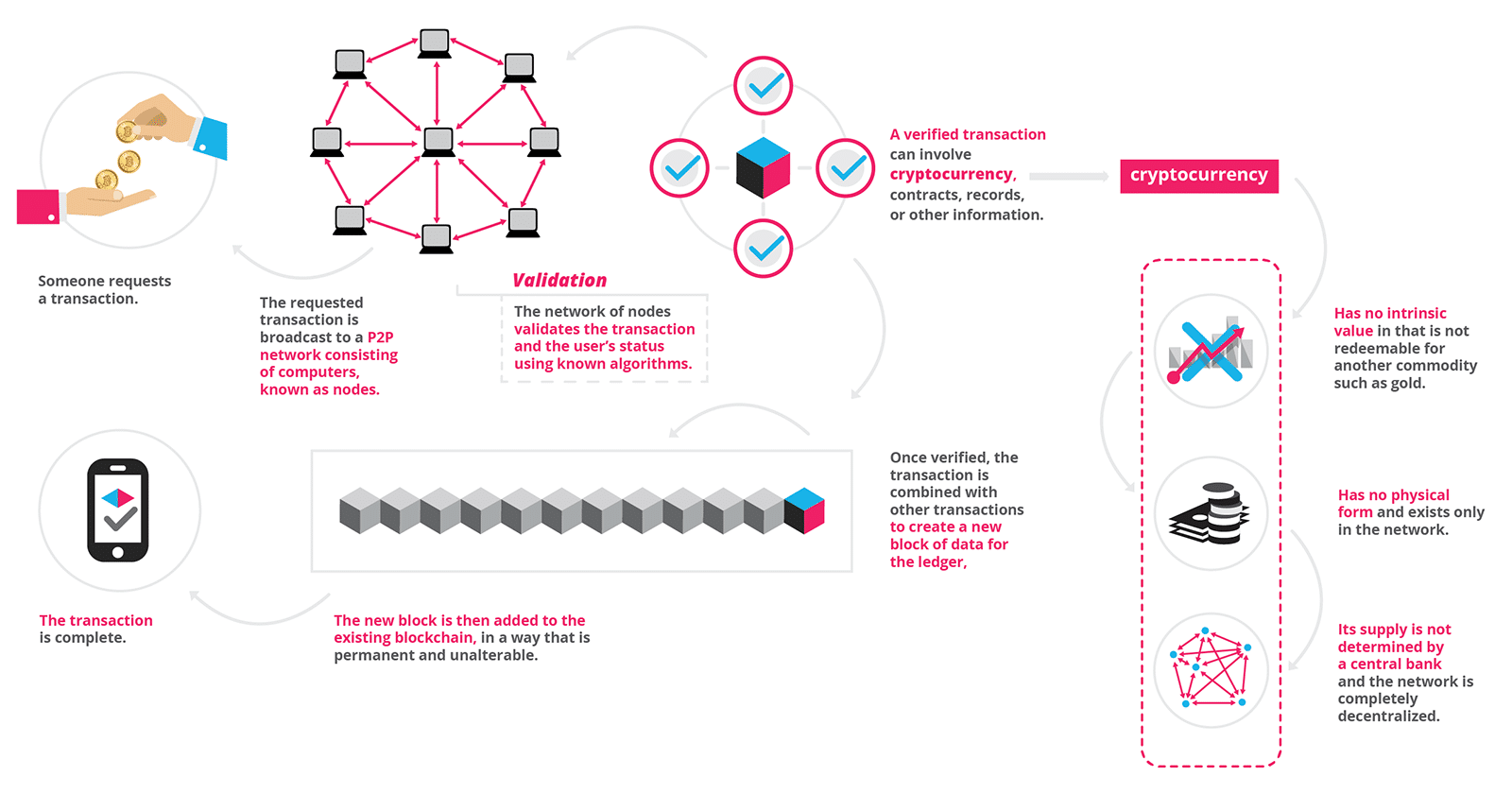

There is substantial confusion around its definition because the technology is early-stage, and can be implemented in many ways depending on the objective. The ledger is often secured through a clever mix of cryptography and game theory, and does not require trusted nodes like traditional networks. This is what allows bitcoin to transfer value across the globe without resorting to traditional intermediaries such as banks.

On a blockchain, transactions are recorded chronologically, forming an immutable chain, and can be more or less private or anonymous depending on how the technology is implemented. Instead, copies exist and are simultaneously updated with every fully participating node in the ecosystem.

Every node that participates in the network can verify the true state of the ledger and transact on it at a very low cost. This is one step away from a distributed marketplace, and will enable new types of digital platforms. How is blockchain related to bitcoin? While a lot of media attention has shifted from bitcoin to blockchain, the two are intertwined.

In logistics the attention is all on how you can use the immutable audit trail generated by a blockchain to improve the tracking of goods through the economy. Others are fascinated by the possibility to use this as a better identity and authentication system. There are two types of costs blockchain could reduce for you: Every business and organization engages in many types of transactions every day.

Each of those transactions requires verification. In many cases, that verification is easy. You know your customers, your clients, your colleagues, and your business partners. Having worked with them and their products, data, or information, you have a pretty good idea of their value and trustworthiness.

The marketplace slows down and you have to incur additional costs to match demand and supply. You can transfer value from here to anywhere on the globe at almost zero transaction cost. Sending secure messages that carry value does not require a bank or PayPal in the middle anymore. And the friction of the transaction is reduced, resulting in cost and time savings.

Using a blockchain can also reduce the cost of running a secure network. This will happen over a longer timeline, Catalini says, perhaps a decade. The internet has already allowed for a faster, less stilted exchange of goods and services. Blockchain technology could mean greater privacy and security for you and your customers.

Catalini calls it data leakage. In a business transaction context, Catalini says, a blockchain could be used to build a reputation score for a party, who could then be verified as trustworthy or solvent without having the economist blockchain technology how does it works open its books the economist blockchain technology how does it works a full audit.

Which industries could blockchain disrupt? The potential applications include lower settlement risk, more efficient taxation, faster cross-border payments, inter-bank payments, and novel approaches the economist blockchain technology how does it works quantitative easing.

Imagine a central bank stimulating the economist blockchain technology how does it works economy by delivering digital currency automatically to citizens. The economist blockchain technology how does it works risk is too high, Catalini says. But expect to see smaller, developed countries with a high tolerance for technology experimentation lead the way and possibly experiment with a fiat-backed, digital currency for some of their needs.

The busiest area of application so far, blockchain is being used by companies seeking to offer low cost, secure, verifiable international payments and settlement. They wanted to see what would happen and generate interest on campus. Catalini, together with Professor Catherine Tucker, designed the experiment and studied the results. While 11 percent immediately cashed out their bitcoin, 49 percent were still holding on to some bitcoin.

Some students used the funds to make purchases at local merchants, some of whom accepted bitcoin. Others traded with each other. Meanwhile, startups around the world competed to become the consumer trading application for bitcoin. Then PayPal bought Venmo, a payment platform that trades cash. The bitcoin-based consumer payment industry cooled down. But the application of blockchain remains attractive because of the lower costs it could offer parties in global, peer-to-peer transactions.

Web browser company Brave uses a blockchain to verify when users have viewed ads and, in turn, pays publishers when those same users consume content. What if, instead of subscribing to a news site online, you paid only for the articles you read? As you click through the web, your browser would track the pages and record them for payment. By reducing the cost of the transaction and verifying the legitimacy of parties on either end, blockchain could make these micropayments, new types of cross-platform subscriptions, and forms of crowdsourcing possible and practical.

Users can never completely mask their transactions. But others are trying. Zcash promises to be a fully private cryptocurrency. There are significant downsides to the anonymity a blockchain could offer, such as the ability to fund terrorism or facilitate money laundering. This application is still in the early stages, Catalini says, but by recording information on a blockchain, contracts could use that information to make themselves self-executing if certain conditions are met.

A blockchain could be used to record details about physical products, helping to verify the economist blockchain technology how does it works and prevent fraud and counterfeiting. At the same time, for all these applications, a blockchain is only as useful as the quality of the information recorded on it in the first place.

Internet of things, robotics, and artificial intelligence: What if they could barter or acquire resources?

What if a highway could verify the identity of and accept payment from a self-driving car, opening up a pay-per-use fast lane to commuters in a rush? At the outer edge of application, but not outside the realm of possibility, Catalini says.

When will this disruption happen? Over a period of more than ten years. Catalini is convinced blockchain has internet-level disruption potential, but like the internet it will come over a multi-decade timeline with fits and starts, and occasional setbacks. Some industries, especially finance, will see drastic change soon. Others will take longer. But the technology is maturing and growing. At some point, one of the startups in this space may reveal itself to be the Netscape of cryptocurrencies.

What would follow is something we have seen play out many times before in history. Ready to go deeper? Sign up there to receive updates with the latest and most important MIT work about blockchain.

He is an expert in blockchain technology and cryptocurrencies, equity crowdfunding, the adoption of technology standards, and science and technology interactions.

Skip to main content. Sign-up for the IDE Newsletter. Blockchain, Explained Monday, May 29, The same thing happens in commercial transactions.