Bitcoin arbitrage 2015

Take your zealotry elsewhere. I want to talk about the effect that the launch of Bitcoin futures trading may bitcoin arbitrage 2015 on Bitcoin. In case you missed it, the CME announced the imminent launch of Bitcoin futures. The cliff notes are:. I am not an expert in Bitcoin, but I am pretty well versed in the concept of arbitrage, bitcoin arbitrage 2015 is a constant across asset classes. The easier that mechanism is, the easier the arbitrage is to perform, and the less we should expect the futures bitcoin arbitrage 2015 trade out of whack with the spot BTC.

Again, bitcoin arbitrage 2015 more on this, see bitcoin arbitrage 2015 whole post I wrote years ago. So how easy will it be to trade the Bitcoin settlement price? When the price of the future BTC-F exceeds ie: Are you with me so far? How about excess supply of BTC-F? If everyone wants to sell BTC-F, and the futures trade cheap to their fair value, the arbitrageur will need to buy the futures and sell BTC. This might not be quite so easy: Thus, it seems likely that the arbitrage is more readily executable in one direction: I guess that remains to be seen.

Reality, I am guessing, will prove to be the opposite. If an evil cartel wished to sell BTC-F relentlessly with no regard for profit, either the futures would trade cheap to fair value, or at some point arbitrageurs would step in and try to right the mispricing putting pressure on the underlying BTC: I am guessing that many arbs are already long BTC currently, and if the price is right they could buy the futures and sell their BTC.

So could this crush the price of Bitcoin? Maybe, temporarilyuntil bitcoin arbitrage 2015 — then what happens? Either 1 the evil cartel buys back their short BTC futures, in which case the arbitrageur will now be in position to sell BTC-F and buy BTC, reversing the initial downward price impact, or 2 the evil cartel lets his manipulative short futures expire: Kid Dynamite is a participant in the Amazon Services LLC Associates Program, an affiliate advertising program bitcoin arbitrage 2015 to provide a means for sites to earn advertising fees by advertising and linking to Amazon.

If you click on my Amazon. Thank you for your bitcoin arbitrage 2015. The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment.

I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer. This blog has morphed from a discussion of poker hands and theory into an evaluation of financial markets from the point of view of a former trader. This material is provided for informational purposes only, as of the date hereof, and is subject to change without notice. This material may not be suitable for all investors and is not intended to be bitcoin arbitrage 2015 offer, or the bitcoin arbitrage 2015 of any offer, to buy or sell any securities.

Home About Contact StockTwits.

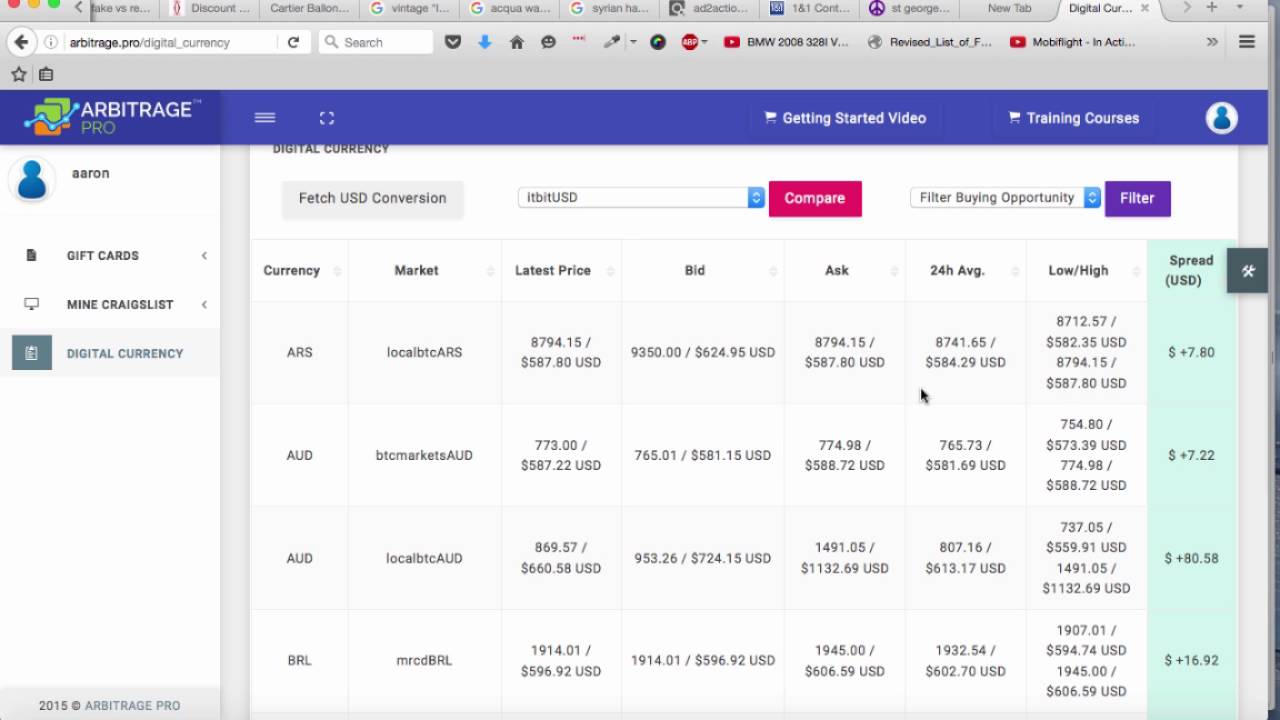

The Arbitrage Made Easy lessons will present simple yet profitable arbitrage strategies that can be employed by traders using a combination of spot Bitcoin trading and BitMEX derivatives contracts. After spending some time trading XBT, traders will notice that sometimes there are large differences between exchanges. Savvy traders can capture these price differentials in a riskless manner.

Therefore, the trader wants zero risk in USD terms. The goal as with any trade is to buy low on exchange A, and sell high on exchange B. If a trader started with just USD the following steps would have to be taken to conduct the arbitrage:.

There are several problems with that trade flow. Wiring USD can take upwards of 5 bitcoin arbitrage 2015 days depending on the bank and country. By the time the funds reach exchange A, the arbitrage opportunity could have bitcoin arbitrage 2015. In bitcoin arbitrage 2015 3, the price of XBT could move against the trader before he is able to sell on exchange B. When an opportunity presents itself, traders can act immediately and capture the arbitrage before it evaporates.

Trading BitMEX futures contracts is the best way to eliminate currency risk. To determine the proper amount of contracts to sell, the trader should consider the USD value of XBT that bitcoin arbitrage 2015 wishes to hedge. Now the Bitcoin price volatility will not affect the returns from this arbitrage strategy.

Now that the portfolio has been constructed and hedged to eliminate currency risk, it is time to capture riskless profits. The below steps describe how to arbitrage the two exchanges. USD deposit and withdrawal fees as well as bitcoin arbitrage 2015 trading fees must be deducted.

The result will be the net profit from this arbitrage trade. The amount of times the portfolio can be churned is limited by the speed of USD wire transfers and the size of price gap between exchange A and B. Notice that only 7 XBT could be used as working capital for the arbitrage opportunity. Instead of withdrawing USD from exchange B and transferring again back to exchange A, a trader can play the spread between the two exchanges.

The below steps describe how to spread trade. USD deposit and exchange trading fees must be deducted. Spread trading does not require bitcoin arbitrage 2015 withdrawal of USD from exchange B and subsequent deposit onto exchange A which reduces fees paid. However, traders must wait for the spread to collapse before the portfolio can be rebalanced.