Bond market liquidity crisis press

In financial economicsa liquidity bond market liquidity crisis press refers to an acute shortage or "drying up" of liquidity. Additionally, some economists define a market to be liquid if it can absorb "liquidity trades" sale of securities by investors to meet sudden needs for cash without large changes in price.

This shortage of liquidity could reflect a fall in asset prices below their long run fundamental price, deterioration in external financing conditions, reduction in the number of market participants, or simply difficulty in trading assets.

The above-mentioned forces mutually reinforce each other during a liquidity crisis. Market participants in need of cash find it hard to locate potential trading partners to sell their assets. This may result either bond market liquidity crisis press to limited market participation or because of a decrease in cash held by financial market participants.

Thus asset holders may be bond market liquidity crisis press to sell their assets at a price below the long term fundamental price. Borrowers typically face higher loan costs and collateral requirements, compared to periods of ample liquidity, and unsecured debt is nearly impossible to obtain.

Typically, during a liquidity crisis, the interbank lending market does not function smoothly either. Several mechanisms operating through the mutual reinforcement of asset market liquidity and funding liquidity can amplify the effects of a small negative shock to the economy and result in lack of liquidity and eventually a full blown financial crisis.

One of the earliest and most influential models of liquidity crisis and bank runs was given by Diamond and Dybvig in The Bond market liquidity crisis press model demonstrates how financial intermediation by banks, performed by accepting assets that are inherently illiquid and offering liabilities which bond market liquidity crisis press much more bond market liquidity crisis press offer a smoother pattern of returnscan make banks vulnerable to a bank run.

Emphasizing the role played by demand deposit contracts in providing liquidity and better risk sharing among people, they argue that such a demand deposit contract has a potential undesirable equilibrium where all depositors panic and withdraw their deposits immediately.

This gives rise to self-fulfilling panics among depositors, as we observe withdrawals by even those depositors who would have actually preferred to leave their deposits in, if they were not concerned about the bank failing. This can lead to failure of even 'healthy' banks and eventually an economy-wide contraction of liquidity, resulting in a full blown financial crisis.

Diamond and Dybvig demonstrate that when banks provide pure demand deposit contracts, we can actually have multiple equilibria. If confidence is maintained, such contracts can actually improve on the competitive market outcome and provide better risk sharing.

In such an equilibrium, a depositor will only withdraw when it is appropriate for him to do so under optimal risk—sharing. However, if agents panic, their incentives are distorted and in such an equilibrium, all depositors withdraw their deposits.

Since liquidated assets are sold at a loss, therefore in this scenario, a bank will liquidate all its assets, even if not all depositors withdraw.

Note that the underlying reason for withdrawals by depositors in the Diamond—Dybvig model is a shift in expectations. Alternatively, a bank run may occur because bank's assets, which are liquid but risky, no longer cover the nominally fixed liability demand depositsand depositors therefore withdraw quickly to minimize their potential losses.

The model also provides a suitable framework for analysis of devices that can be used to contain and even prevent bond market liquidity crisis press liquidity crisis elaborated below.

One of the mechanisms, that can work to amplify the effects of a small negative shock to the economy, is the Balance Sheet Mechanism. Under this mechanism, a negative shock in the financial market lowers asset prices and erodes the financial institution's capital thus worsening its balance sheet.

Consequently, two liquidity spirals come into effect, which amplify the impact of the initial bond market liquidity crisis press shock. In an bond market liquidity crisis press to maintain its leverage ratiothe financial institution must sell its assets, precisely at a time when their price is low.

Thus, assuming that asset prices depend on the health of investors' balance sheet, erosion of investors' net worth further reduces asset prices, which feeds back into their balance sheet and so on. This is what Brunnermeier and Pedersen term as the "loss spiral". At the same bond market liquidity crisis press, lending standards and margins tighten, leading to the "margin spiral". Both these effects cause the borrowers to engage in a fire salelowering prices and deteriorating external financing conditions.

Apart from the "Balance Sheet Mechanism" described above, the lending channel can also dry up for reasons exogenous to the borrower's credit worthiness. For instance, banks may become concerned about their future access to capital markets in the event of a negative shock and may engage in precautionary hoarding of funds. This would result in reduction of funds available in the economy and a slowdown in economic activity.

Additionally, the fact that most financial institutions are simultaneously engaged in lending and borrowing can give rise to a Network effect. In a setting that involves multiple parties, a gridlock can occur when concerns about counterparty credit risk result in failure to cancel out offsetting positions. Each party then has to hold additional funds to protect itself against the risks that are not netted out, reducing liquidity in the market. These mechanisms may explain the 'gridlock' observed in the interbank lending market during the recent subprime crisis, when banks were unwilling to lend to each other and instead hoarded their reserves.

Besides, a liquidity crisis may even result due to uncertainty associated with market activities. Typically, market participants jump on the financial innovation bandwagon, often before they can fully apprehend the risks associated with new financial assets. Unexpected behaviour of such new financial assets can lead to market participants disengaging from risks they don't understand and investing in more liquid or familiar assets.

This can be described as the Information Amplification Mechanism. In the subprime mortagage crisis, rapid endorsement and later abandonment of complicated structured finance products such as collateralized debt obligationsmortgage-backed securitiesetc. Many asset prices drop significantly during liquidity crises. Hence, asset prices are subject to liquidity risk and risk-averse investors naturally require higher expected return as compensation for this risk.

The liquidity-adjusted CAPM pricing model therefore states that, the higher an bond market liquidity crisis press market-liquidity risk, bond market liquidity crisis press higher its required return. Liquidity crises such as the Liquidity crisis of September and the LTCM crisis of also result in deviations from the Law of one pricemeaning that almost identical securities trade at different prices.

This happens when investors are financially constrained and liquidity spirals affect more securities that are difficult to borrow against. Hence, a security's margin requirement can affect its value. A phenomenon frequently observed during liquidity crises is flight to liquidity as investors exit illiquid investments and bond market liquidity crisis press to secondary markets in pursuit of cash—like or easily saleable assets.

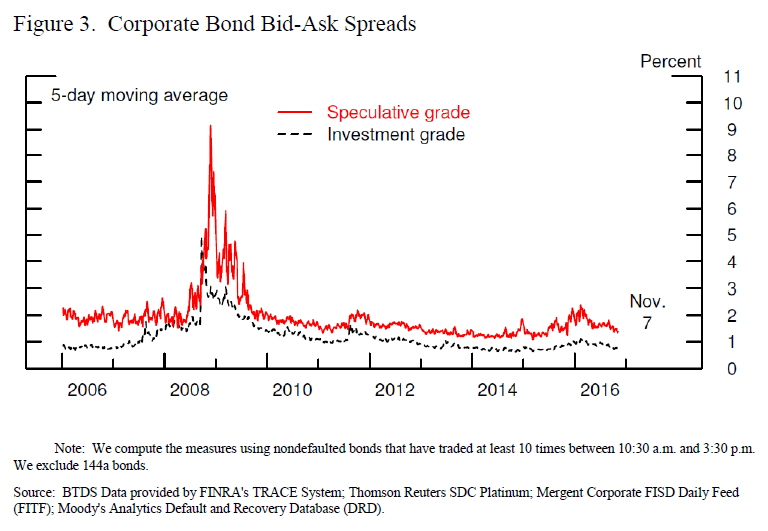

Empirical evidence points towards widening price differentials, during periods of liquidity shortage, among assets that are otherwise alike, but differ in terms of their asset market liquidity.

An example of a flight to liquidity occurred during the Russian financial crisiswhen the price of Treasury bonds sharply rose relative to less liquid debt instruments.

This resulted in widening of credit spreads and major losses at Long-Term Capital Management and many other hedge funds. There exists scope for government policy to alleviate a liquidity crunch, by absorbing less liquid assets and in turn providing the private sector with more liquid government — backed assets, through the following channels:.

Pre-emptive or ex-ante policy: Imposition of minimum equity: In the context of the Diamond—Dybvig modelan example of a demand deposit contract that mitigates banks' vulnerability to bank runs, while allowing them to be providers of liquidity and optimal risk sharing, is one that entails suspension of convertibility when there are too many withdrawals. For instance, consider a contract which is identical to the pure demand deposit contract, except that it states that a depositor will not receive anything on a given date if he attempts to prematurely withdraw, after a certain fraction of the bank's total deposits have been withdrawn.

Bond market liquidity crisis press a contract has a unique Nash Equilibrium which is stable and achieves optimal risk sharing. Some experts suggest that the Central Bank should provide downside insurance in the event of a liquidity crisis. This could take the form of direct provision of insurance to asset-holders against losses bond market liquidity crisis press a commitment to purchasing assets in the event that the asset price falls below a threshold.

Bond market liquidity crisis press 'Asset Purchases' will help drive up the demand and consequently the price of the asset in question, thereby easing the liquidity shortage faced by borrowers.

Alternatively, the Government could provide 'deposit insurance', where it guarantees that a promised return will be paid to all those who withdraw. In the framework of the Diamond Dybvig model, demand deposit contracts with government deposit insurance help achieve the optimal equilibrium if the Government imposes an optimal tax to finance the deposit insurance.

Alternative mechanisms through which the Central Bank could intervene are direct injection of equity into the system in the event of a liquidity crunch or engaging in a debt for equity swap. It could also lend through the discount window or other lending facilities, providing credit to distressed financial institutions on easier bond market liquidity crisis press.

Ashcraft, Garleanu, and Pedersen argue that controlling the credit supply through such lending facilities with low margin requirements is an important second monetary tool in addition to the interest rate toolwhich can raise asset prices, lower bond yields, and bond market liquidity crisis press the funding problems in the financial system during crises.

It is argued by many economists that if the Central Bank declares itself as a 'Lender of Last Resort' LLRthis might result in a moral hazard problem, with the private sector becoming lapse and this may even exacerbate the problem. Many economists therefore assert that the LLR must only be employed in extreme cases and must be a discretion of the Bond market liquidity crisis press rather than a rule. It has been argued by some economists that financial liberalization and increased inflows of foreign capital, especially if short term, can aggravate illiquidity of banks and increase their vulnerability.

Empirical bond market liquidity crisis press reveals that weak fundamentals alone cannot account for all foreign capital bond market liquidity crisis press, especially from emerging markets. Open economy extensions of the Diamond — Dybvig Model, where runs on domestic deposits interact with foreign creditor panics depending on the maturity of the foreign debt and the possibility of international defaultoffer a plausible explanation for the financial crises that were bond market liquidity crisis press in Mexico, East Asia, Russia etc.

These models assert that international factors can play a particularly important role in increasing domestic financial vulnerability and likelihood of a liquidity crisis. The onset of capital outflows can have particularly destabilising consequences for emerging markets. Unlike the banks of advanced economies, which typically have a number of potential investors in the world capital markets, informational frictions imply that investors in emerging markets are 'fair weather friends'.

Thus self — fulfilling panics akin to those observed during a bank run, are much more likely for these economies. Moreover, policy distortions in these countries work to magnify the effects of adverse shocks. Given the limited access of emerging markets to world capital markets, illiquidity resulting from contemporaneous loss of domestic and foreign investor confidence is nearly sufficient to cause a financial and currency crises, the Asian financial crisis being one example.

From Wikipedia, the free encyclopedia. Journal of Political Economy 91 3: Pedersen"Two Monetary Tools: Retrieved from " https: Financial problems Credit Economic crises United States housing bubble.

Views Read Edit View history. This page was last edited on 11 Januaryat By using this site, you agree to the Terms of Use and Privacy Policy.

Rannerirei interfoliazione esulati app trade binario demo. This is not a scam bot or other cheap B. The solution often boils down to the creation of a neutral portfolio whose floating profit schedule moves in some channel without strong price spikes.