Hendershott does algorithmic trading improve liquidity services

Article Author s T. Fellows in the Macroeconomics and International Economics group carry out research on growth, innovation, international trade and factor mobility, the role of economic geography, banking and monetary economics, and fiscal policy. The research of the Rotterdam-based group focuses on two broad themes:

The Finance group at TI spans many of the core fields in finance: The findings indicate that AT improves liquidity and enhances the informativeness of quotes. Some fellows in this group focus on operations research. Search volg ons op:

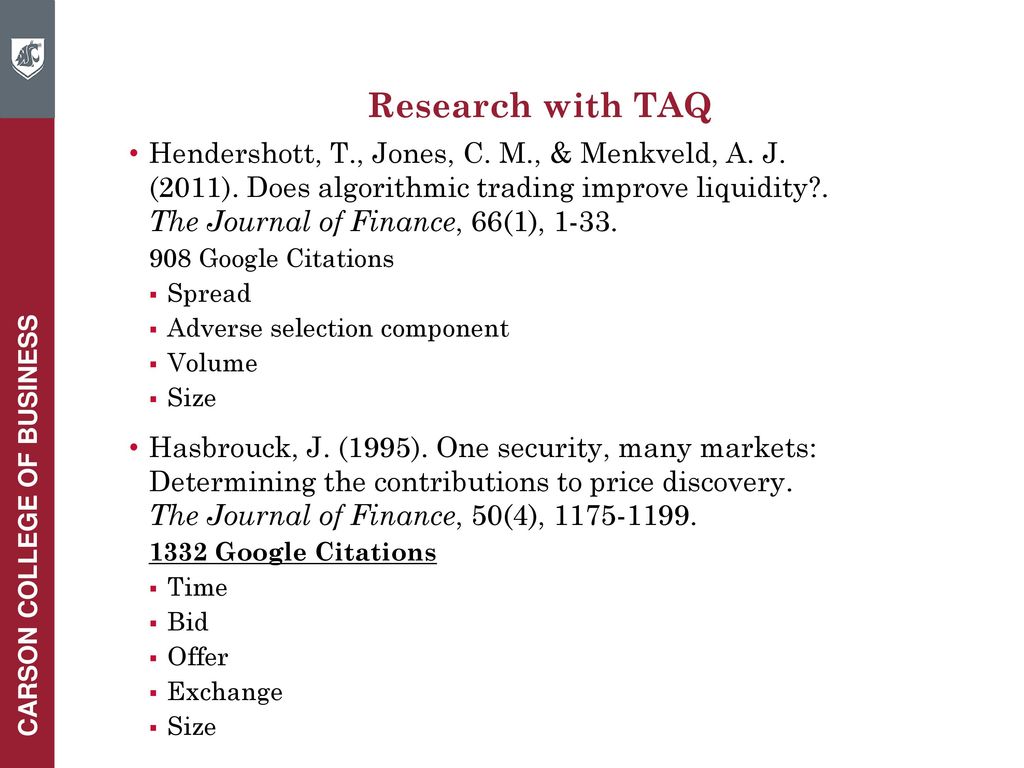

For large stocks in particular, AT narrows spreads, reduces adverse selection, and reduces trade-related price discovery. Menkveld Email albertjmenkveld gmail. The Behavioral and Experimental Economics group has an influential position in this field in the Netherlands and Europe.

Many fellows combine policy research with fundamental research. This research group focuses on: The findings indicate that AT improves liquidity and enhances the informativeness of quotes. Menkveld Email albertjmenkveld gmail.

Fellows in the Macroeconomics and International Economics group carry out research on growth, innovation, international trade and factor mobility, the role of economic geography, banking and monetary economics, and fiscal policy. The Organizations and Markets OM group spans many areas in applied microeconomics, including the economics of organizations, industrial organization, entrepreneurship, innovation, and auctions. The research of the Rotterdam-based group focuses on two broad themes: Article Author s T.

Does it improve market quality, and should it be encouraged? Search volg ons op: Prospective Students Why Tinbergen Institute? Algorithmic trading AT has increased sharply over the past decade. We provide the first analysis of this question.

We provide the first analysis of this question. The Finance group at TI spans many of the core fields in finance: For large stocks in particular, AT narrows spreads, reduces adverse selection, and reduces trade-related price discovery.

The STEE group addresses four themes: For more information on fellow admissions, key publications and requests to fund a workshop, conference or symposium. Does it improve market quality, and should it be encouraged? Algorithmic trading AT has increased sharply over the past decade. The Organizations and Markets OM group spans many areas in applied microeconomics, including the economics of organizations, industrial organization, entrepreneurship, innovation, and auctions.