Could deflation cause problems for bitcoin?

4 stars based on

38 reviews

In the s, a turning point occurred in humanity. The British bitcoin deflation bad Dutch empires adopted a new concept, that enabled bitcoin deflation bad to take over the world and change it in the process. Their powerful bitcoin deflation bad weapon? The notion of credit, where they abandoned the idea that the old was sacred. In our lifetimes, we are about to see another transformation. And ironically, due to the opposite reason: Every man and his dog is talking about Bitcoin and crypto currency.

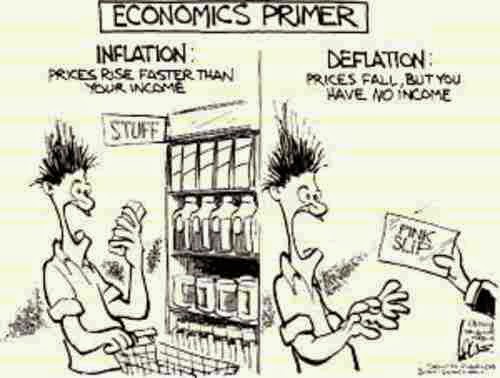

But one thing few people seem to talk about, let alone understand, is that Bitcoin has a fixed supply — specifically, 21 million. A world where prices, like what you pay for in shops and what you get paid as salary, are decreasing? Short term, it means producers of output get more money, which makes economic output higher. That is, in a best case bitcoin deflation bad.

Debt funds consumption and investment, which grows output in an economy. Savings are a leakage from the economy which do the opposite. So in this sense, this political philosophy broadly speaking, is aligned with growing the system. Economic output How do you grow an economy? The easy answer is that exports bring cash into an economy, but what about actual global output? If we take out this artificial growth, which is a transfer of cash between economies through trade, what actually creates net growth?

It basically comes down to two things: More people also means more workers, and remember, labour is a factor of production so the more available people and time we havethe more we can produce. If we can pair productivity growth to population bitcoin deflation bad, we get economic bitcoin deflation bad By the definition bitcoin deflation bad GDP, which is based on consumption, more goods being output and more people consuming means voila: Debt The invention of credit created the world we know today.

But a thing that makes me scratch my head is how every government and citizen in this world seems to be in debt. Which basically implies one thing: In the present, this is great: Which brings us to the magic of inflation: Bitcoin deflation bad of course, the highway robbery from cash holders continues and inflation is constant.

Inflation targets will now become de flation targets, but for the same goal of price stability. Instead of prices creeping up each year, they will creep down each bitcoin deflation bad. However, not all is lost. If investments can return a higher rate than what a saver would get hoarding their cash, then investment will still occur in the economy.

And with investment, comes not just more cash into a system but also innovation, which might spark productivity improvements. This increases economic output. Governments will be forced to stop abusing their position to borrow money to be paid by future generations, and instead, investment managers and entrepreneurs who can execute bitcoin deflation bad higher return than deflationary returns, will instead be the custodians of increased economic output.

Which bitcoin deflation bad creativity, risk taking, and ingenuity, as the sole creator of economic prosperity. Which is how it should be: In the process, this will make creativity the new scarcity, which is a powerful concept because it is less scarce than gold or fiat currency today.

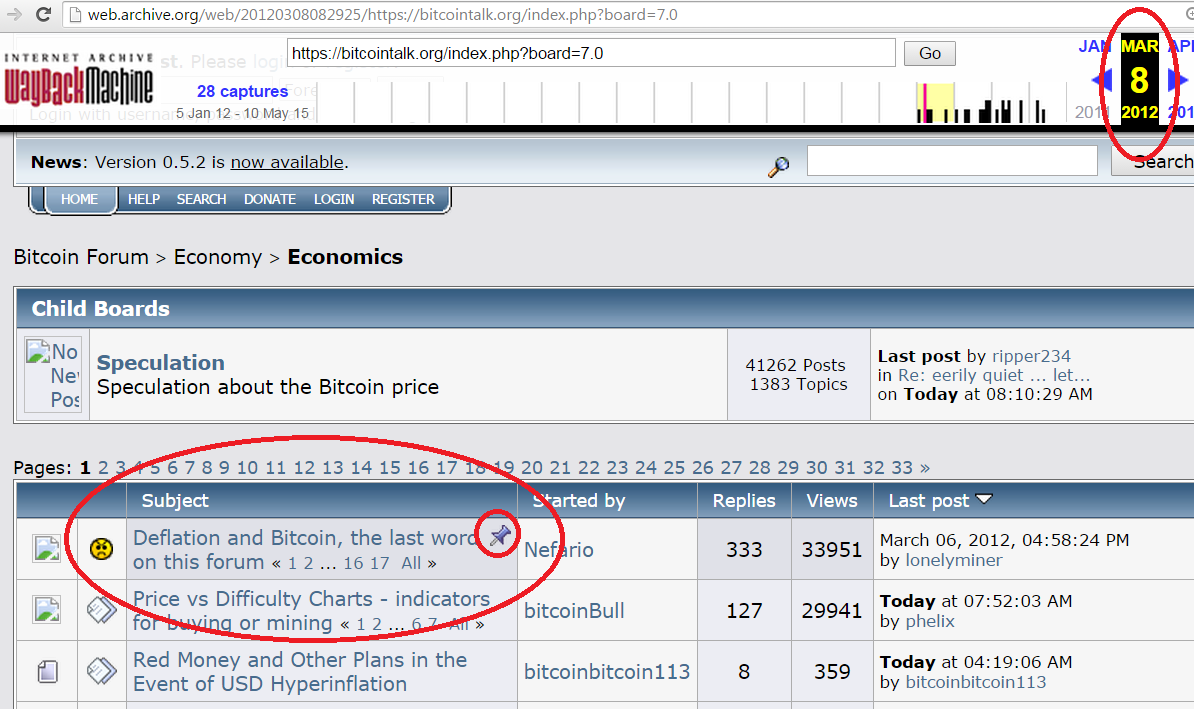

In fact, I posted bitcoin deflation bad along these lines on LinkedIn recently: He has a point. Wonder what your thoughts are on this? The whole concept of fractional cash system blows my mind. These banks are creating loans out of thin air! But also, what is it that is putting demand on that debt? The market would adjust. Less borrowing is going to definitely reduce economic activity. So before we hit this crisis, which will happen in the next century due to birth rates declining Japan and Italy are going to be an interesting to watch for this reasonwe need to better way to measure progress.

And so by changing the equation of what is progress, we change the inputs. It is an interesting point you raise, given countries control the cash rate which impacts lending and inflation, as well as being the local store of value. Right now, the greenback is the reserve currency off the world and economic statistics are quoted in USD not to bitcoin deflation bad directly impact some dollarised countries. If they became quoted in BTC, that would certainly change the perception of where the numbers are.

On the assumption BTC becomes the global store of value, this is a shift in dynamic on the global economy that will turn everything on its head. Case in point is internet commerce: So pricing with be evident there. Enter your email address to subscribe to this blog and receive notifications of new posts by email. I've been blessed with not just one but two unpronounceable names: I pronounce them as E-lee-uh s bi-ZAH-nis.

Need to write a bio about me? Use the one here. Powered by WordPress bitcoin deflation bad K2. Entries Feed and Comments Feed. Why Bitcoin or another deflationary currency will lead to an economic revolution Published on October 15, in cryptocurrency. Meaning, inflation is evil, but in a good kind of way so we encourage it if we can control it. But not with Bitcoin. Itai October 16, at 4: Elias October 18, at Whit October bitcoin deflation bad, at 6: Elias October 20, at Subscribe via Email Enter your email address to subscribe to this blog and receive notifications of new posts by email.

Recent Posts Why Bitcoin or another deflationary currency will lead to an economic revolution Gay marriage is asking a deeper question about humanity Bitcoin as Store of Value Is this the f—g button?