XE Currency Converter: XBT to USD

4 stars based on

47 reviews

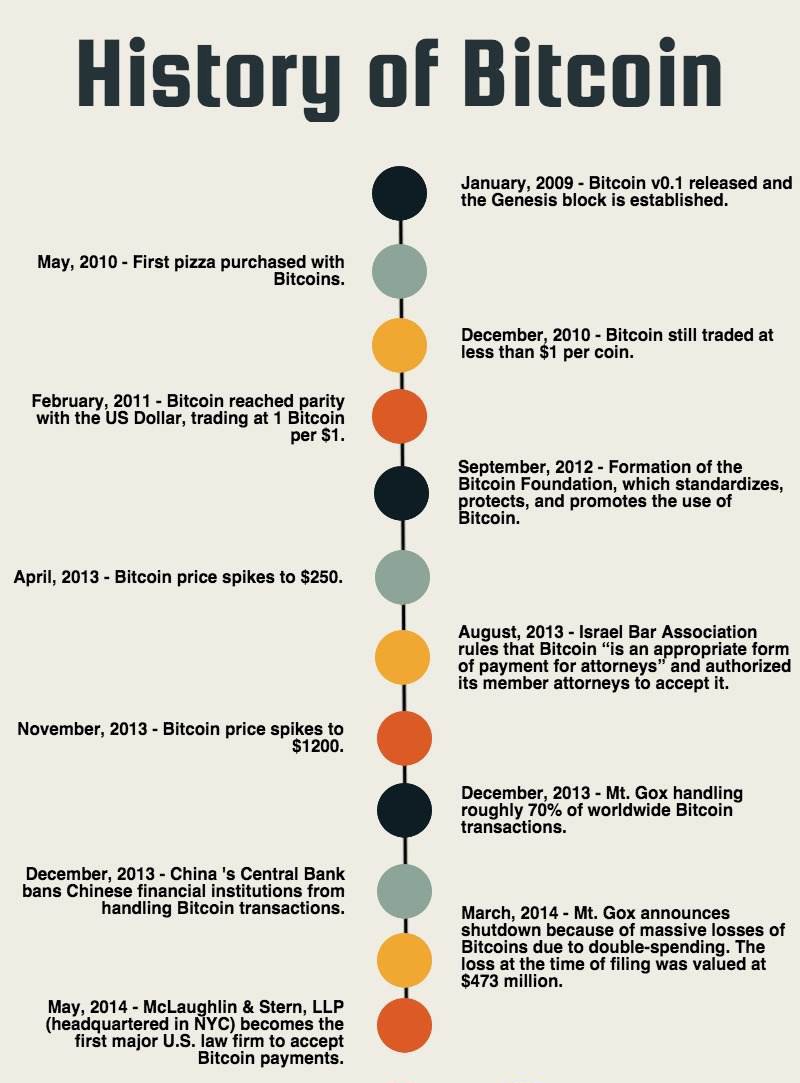

At the same time the Dollar was gaining strength among fiat currencies. Bitcoin dollar parity two stories together made a lot of people doubt the viability of Bitcoin as a safe investment as it seems that Bitcoin was bearish when both the Dollar and Gold are bullish. Now here starts the catch 22, how do we bitcoin dollar parity the dollar's strength? We compare it to the purchasing power of other fiat bitcoin dollar parity, while none of them are pegged bitcoin dollar parity real life.

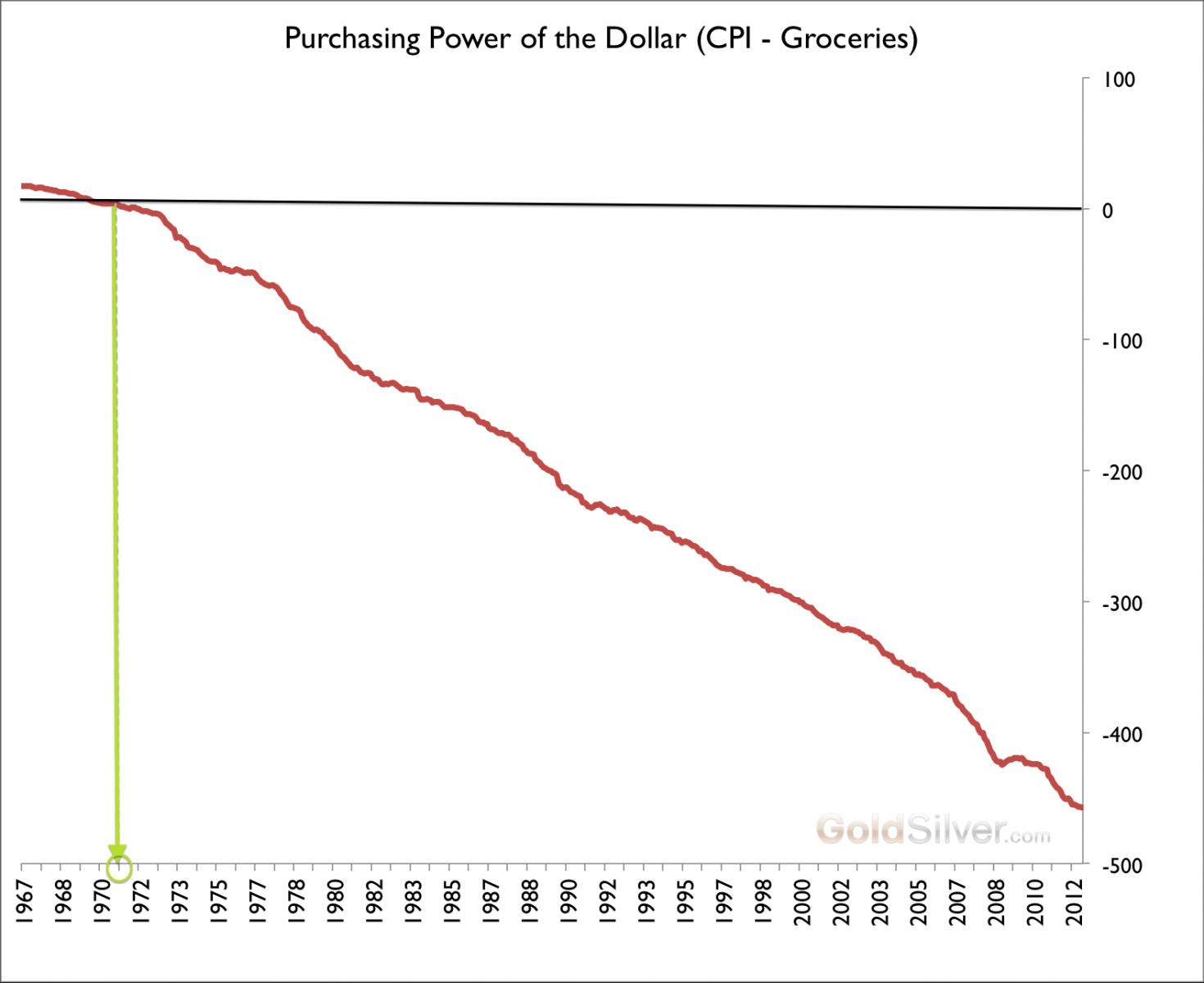

This scenario causes skewed interpretations as Bitcoin will appear bullish in one nation as opposed to bearish in another, depending on how the local fiat currency is doing. Another thing to recognize is that our current economy relies on steady and constant inflation. This effectively means that your dollar can purchase less over time as there is an influx of new banknotes, due to supply and demand.

This scenario also causes a steady but false bitcoin dollar parity in Bitcoins value, while its real life purchasing power remains the same. For simple proof of the concept above, ask any American how far they could get with 5, dollars before or study the following graph illustrating the purchasing power of the dollar since I will go into this data in more detail in my next post. As illustrated in the above scenarios, then our current measurement system for Bitcoins value is broken as it relies on fiat currencies to determine its relative purchasing power.

My reasoning for this, is that gold prices auto correct for fiat volatility almost instantly, as gold has a universal value. Gold prices constantly vary, however, I argue that this is due to the above phenomenon of inflation, causing the purchasing power of the dollar to decrease. This artificially drives up the price of gold while the purchasing power of gold has remained more or less constant.

This is of course difficult to prove as not a lot of merchants accept gold as a payment and there are no official reports of the purchasing power of gold. There is also the fact that only a few gold merchants at present accept Bitcoin, and thus to find the true gold purchasing power of Bitcoin, we usually have to convert the bitcoin back into your fiat currency of choice. However, if we did use gold purchasing bitcoin dollar parity as the standard for measuring the strength of Bitcoin.

Bitcoin dollar parity we would also have a universal indicator, which needs no conversion between borders, and shows the true strength of Bitcoin. This bitcoin dollar parity a great read - thanks! I was just reading about this article below and think it's fascinating.

What do you think the ultimate purchasing power of Bitcoin dollar parity will be as fiat currencies collapse? Will be interesting to see how this plays out.

Here's the article I was reading about this: Also, here's something I recently posted about this. I will delve more into this in our next piece. Authors get paid when people like you upvote their post. What are your thoughts on Bitcoinppi.