Dogecoin exchange rate gbp to europe

45 comments

Fpga bitcoin miner open source

Cryptocurrencies have grown rapidly in price, popularity, and mainstream adoption. What was once a fringe asset is quickly maturing. The rapid growth in cryptocurrencies and the anonymity that they provide users has created considerable regulatory challenges, including the use of cryptocurrencies in illegal trade drugs, hacks and thefts, illegal pornography, even murder-for-hire , potential to fund terrorism, launder money, and avoid capital controls.

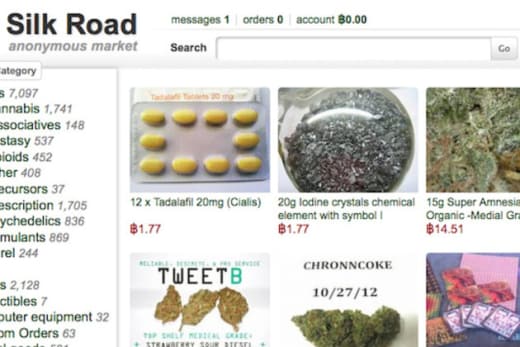

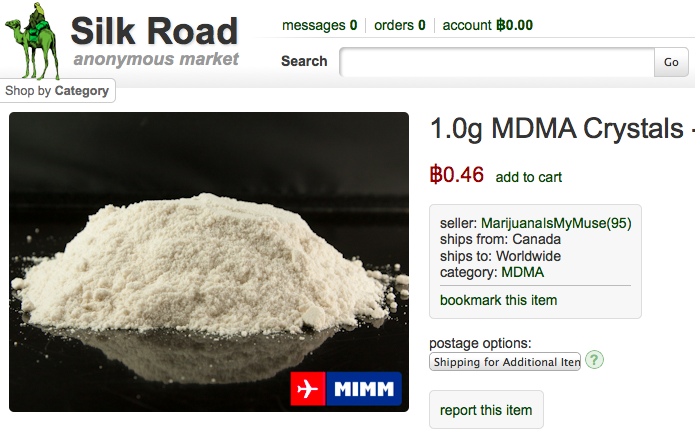

There is little doubt that by providing a digital and anonymous payment mechanism, cryptocurrencies such as bitcoin have facilitated the growth of 'darknet' online marketplaces in which illegal goods and services are traded. In a recent research paper available here , we quantify the amount of illegal activity that involves the largest cryptocurrency, bitcoin. As a starting point, we exploit several recent seizures of bitcoin by law enforcement agencies including the US FBI's seizure of the Silk Road marketplace to construct a sample of known illegal activity.

We also identify the bitcoin addresses of major illegal darknet marketplaces. The public nature of the blockchain allows us to work backwards from the law enforcement agency bitcoin seizures and the darknet marketplaces through the network of transactions to identify those bitcoin users that were involved in buying and selling illegal goods and services online.

We then apply two econometric methods to the sample of known illegal activity to estimate the full scale of illegal activity. The first exploits the trade networks of users to identify two distinct 'communities' in the data-the legal and illegal communities. The second exploits certain characteristics that distinguish between legal and illegal bitcoin users, for example, the extent to which individual bitcoin users take actions to conceal their identity and trading records, which is a predictor of involvement in illegal activity.

We find that illegal activity accounts for a substantial proportion of the users and trading activity in bitcoin. Such comparisons provide a sense that the scale of the illegal activity involving bitcoin is not only meaningful as a proportion of bitcoin activity, but also in absolute dollar terms. The scale of illegal activity suggests that cryptocurrencies are transforming the way black markets operate by enabling 'black market e-commerce'.

In effect, cryptocurrencies are facilitating a transformation of the black market much like PayPal and other online payment mechanisms revolutionized the retail industry through online shopping.

In recent years since , the proportion of bitcoin activity associated with illegal trade has declined. There are two reasons for this trend. The first is an increase in mainstream and speculative interest in bitcoin rapid growth in the number of legal users , causing the proportion of illegal bitcoin activity to decline, despite the fact that the absolute amount of such activity has continued to increase.

The second factor is the emergence of alternative cryptocurrencies that are more opaque and better at concealing a user's activity eg, Dash, Monero, and ZCash. Despite these two factors affecting the use of bitcoin in illegal activity, as well as numerous darknet marketplace seizures by law enforcement agencies, the amount of illegal activity involving bitcoin at the end of our sample in April remains close to its all-time high.

In shedding light on the dark side of cryptocurrencies, we hope this research will reduce some of the regulatory uncertainty about the negative consequences and risks of this innovation, facilitating more informed policy decisions that assess both the costs and benefits. In turn, we hope this contributes to these technologies reaching their potential. Our paper also contributes to understanding the intrinsic value of bitcoin, highlighting that a significant component of its value as a payment system derives from its use in facilitating illegal trade.

This has ethical implications for bitcoin as an investment. Third, the techniques developed in this paper can be used in cryptocurrency surveillance in a number of ways, including monitoring trends in illegal activity, its response to regulatory interventions, and how its characteristics change through time. The methods can also be used to identify key bitcoin users eg, 'hubs' in the illegal trade network which, when combined with other sources of information, can be linked to specific individuals.

The full paper can be downloaded here. View the discussion thread. Skip to main content. You are here Blog Home. More from Sean Foley Jonathan R. In our paper, we consider a fundamental aspect of labor markets, namely, their demographics, and study its effect on The Next Chapter in the GDPR's 'Right to Explanation' Debate Roland Vogl Ashkon Farhangi Bryan Casey Whether on private social networks or in public sector courtrooms, machine learning applications are witnessing unprecedented rates of adoption due to their ability to radically improve data-driven