Cex exchange london

22 comments

Texmo pumps price list in hyderabad andhra

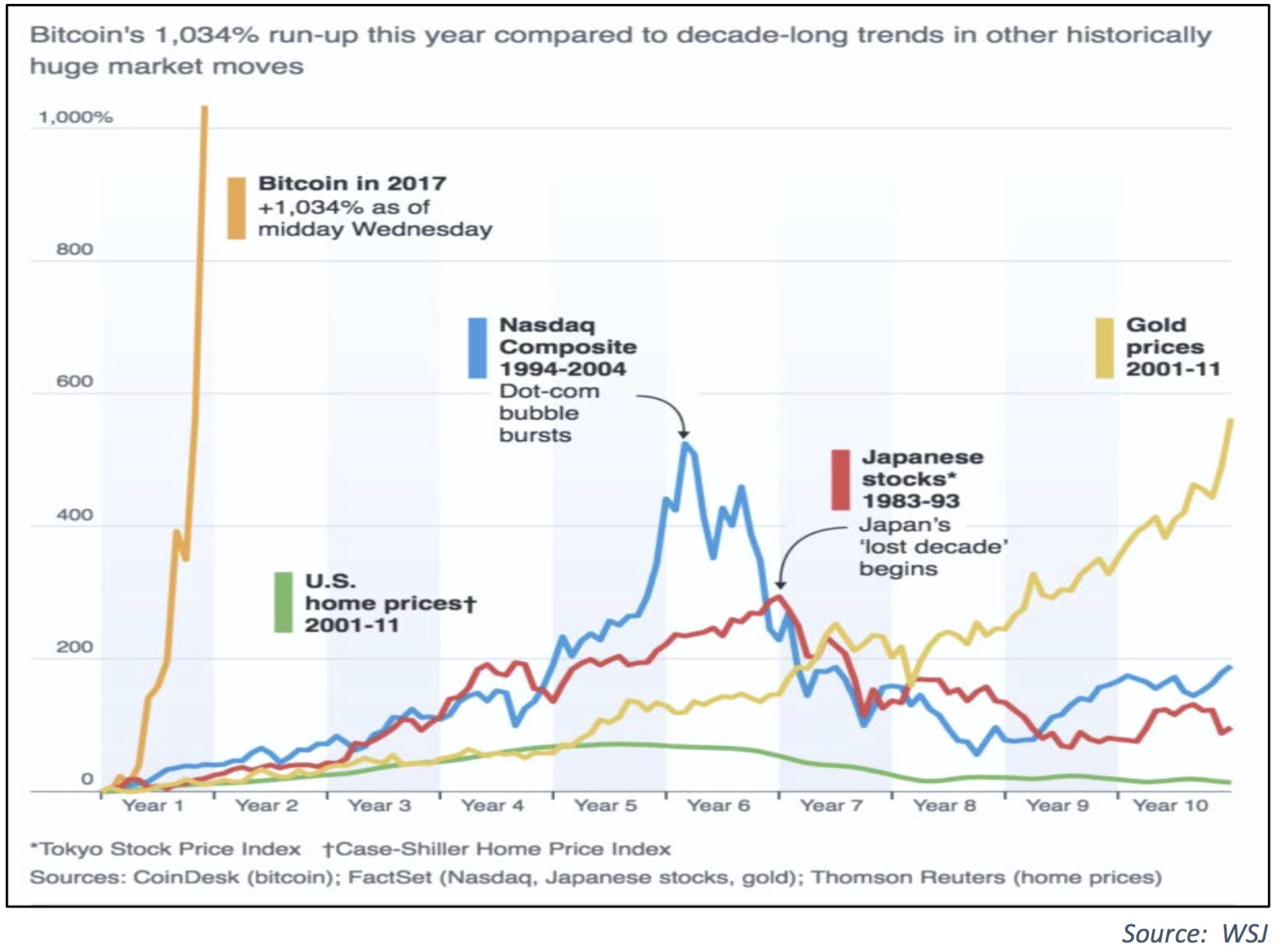

Digital Currencies have received a lot of attention this year on the back of explosive valuations. According to the website coinbase. My grasp of the technical features surrounding digital currencies may be limited, but I will opine that the magnitude of realized price variability diminishes their usefulness as a means of exchange.

Quartz recently published the below interview with economist Robert Shiller. In this interview, Dr. Robert Shiller wrote the book on bubbles. Yale economics professor Robert Shiller won the Nobel prize for his work on bubbles.

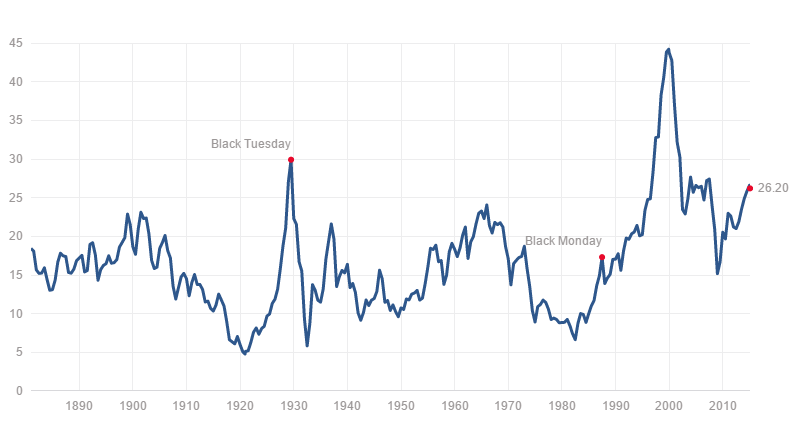

He wrote a seminal book on speculative manias, Irrational Exuberance, a deep analysis of the dramas over the centuries when otherwise sane people drove prices for tulips, stocks, and houses to inexplicable heights. Shiller developed some of the tools that are considered vital for taking a sober look at markets. He helped create indexes for measuring real estate prices and his stock market valuation indicator, the cyclically adjusted price-earnings ratio, or CAPE ratio, is seen as one of the best forecasting models for stock returns.

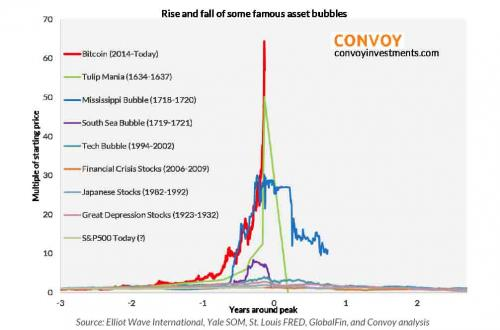

The conversation was edited and condensed for clarity. What are the best examples now of irrational exuberance or speculative bubbles? The best example right now is bitcoin. And I think that has to do with the motivating quality of the bitcoin story. You have to think like humanities people. What is this bitcoin story? It starts with Satoshi Nakamoto—remember him?

The mysterious figure who may or may not be real. That has a nice mystery quality to it. It kind of fits in with the angst of this time in history. Will I have anything? Somehow bitcoin fits into that and it gives a sense of empowerment: I can speculate and I can be rich from understanding this! That kind of is a solution to the fundamental angst. Big things happen if someone invents the right story and promulgates it.

But I have a sense that something is exciting to you. Another thing that is exciting to people now is Donald J. You may have heard of this guy. He too is related to this fundamental angst that we have about where are we in this digitized society — international and digitized. It was the printing press, Gutenberg in the s. It was then that we started seeing bubbles. There were celebrities and international stars, like Homer, who wrote the Iliad and the Odyssey.

He did that by traveling from town to town and reciting his books. And then around the s they invented the idea of weekly newspapers that told you what happened this week. The internet takes it to another dimension. Someone can promote their views widely without getting buy-in from editors or other gatekeepers? Maybe it will come back. You have news media that have developed their reputation for honesty and integrity. Those are the extreme, crazy forms of the narrative. This is another narrative.

These are the stories that drive the bubble. He also legitimizes wealth. You can be rich, too. The Trump story helps inflate all kinds of bubbles, not just bitcoin. I think there are aspects of a housing bubble, and a stock market bubble right now. I have another indicator you can find on my website that not many people pay attention to. I have something I call a valuation confidence index.

Maybe I should expand my size. In other words, people think the market is highly valued. Both individual and institutional investors.

We are in a time of mistrust of the market. The only time mistrust of the market was lower since was in So around , the peak of the dot-com bubble. It seems like the mindset is somewhat similar to the dot-com mindset. High-tech companies are probably more exciting, as they were in The year was kind of like That was the gold rush. It really created a viral explosion of men going out west in looking for gold.

You have to do it now! It was the same thing in or thereabouts, when stories of some internet companies were coming out and people said, you know, this is the future, these guys are going to take over.

And they got ahead of themselves with the dot-com bubble. Well volatility is very low, both actual and projected in the VIX. So, why is that? I tend to think of it as something that reflects the quality of the narrative, which is not encouraging a lot of trading activity now. One thing I emphasized in my book Irrational Exuberance is attention is capricious. We all focus our attention in the same way. But part of the story has to be what Donald J.

Trump said about it. Somehow the attention is elsewhere than day-to-day motions of the stock market. It could suddenly change. I remember in October That was the biggest one-day stock market drop ever. How did I hear about it?

I was teaching my lecture in the morning. I noticed that one or two students were listening to transistor radios. Monetary policy has entered a new regime. The only historical precedent for when interest rates were low for anything like this long was in the s, the Great Depression, and how did that end? It ended with World War II. Why are long-term interest rates so low? News media like to tie things in with already popular narratives. A token is worth one beer, but your bar will only ever serve a set number of beers.

People are raising hundreds of millions of dollars this way, with pretty thin business plans. Maybe this is a more viral story. Cambridge and Pacificus Capital Management are not affiliated.

Therefore, the information should be relied upon when coordinated with individual professional advice. These are the opinions of Justin Kobe and not necessarily those of Cambridge Investment Research, are for informational purposes only, and should not be construed or acted upon as individualized investment advice. Investing in the bond market is subject to risks, including market, interest rate, issuer credit, inflation risk, and liquidity risk.

The value of most bonds and bond strategies is impacted by changes in interest rates. Bonds and bond strategies with longer durations tend to be more sensitive and volatile than those with shorter durations; bond prices generally fall as interest rates rise, and the current low interest rate environment increases this risk.

Current reductions in bond counterparty capacity may contribute todecreased market liquidity and increased price volatility. Bond investments may be worth more or less than the original cost when redeemed.