Buy litecoin miner microsoft store

46 comments

Buy bitcoin in usa without verification

A statistically valid analysis of some pools and their payout methods: Bitcoin network and pool analysis. The following pools are known or strongly suspected to be mining on top of blocks before fully validating them with Bitcoin Core 0. The following pools are believed to be currently fully validating blocks with Bitcoin Core 0. Operator receives portion of payout on short rounds and returns it on longer rounds to normalize payments.

Similar to proportional, but instead of looking at the number of shares in the round, instead looks at the last N shares, regardless of round boundaries. Each submitted share is worth certain amount of BTC. It is risky for pool operators, hence the fee is highest. When block is found, the reward is distributed among all workers proportionally to how much shares each of them has found. Each submitted share is worth more in the function of time t since start of current round.

For each share score is updated by: This makes later shares worth much more than earlier shares, thus the miner's score quickly diminishes when they stop mining on the pool. Rewards are calculated proportionally to scores and not to shares. Like Pay Per Share, but never pays more than the pool earns.

Calculate a standard transaction fee within a certain period and distribute it to miners according to their hash power contributions in the pool. It will increase the miners' earnings by sharing some of the transaction fees.

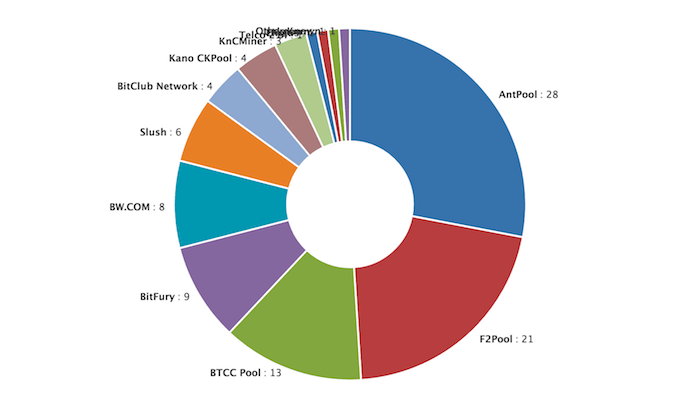

The pool's total hash rate is very dynamic on most pools. Over time, as the network grows, so does most pool's hash rates. The displayed values are the pool's relative sizes based on the network: Retrieved from " https: Navigation menu Personal tools Create account Log in.

Views Read View source View history. Sister projects Essays Source. This page was last edited on 27 March , at Content is available under Creative Commons Attribution 3. Privacy policy About Bitcoin Wiki Disclaimers. Jonny Bravo's Mining Emporium. Merged mining can be done on a "solo mining" basis [4].