Bitcoin and the Deflationary Spiral – a Double Edged Sword

4 stars based on

60 reviews

Among the mainstream financial media and economic pundits there is a great deal of skepticism about Bitcoin. Critics have come up with all kinds of reasons why they believe Bitcoin fail. Now there deflationary spiral bitcoin mining two forms of the deflationary spiral argument: A more deflationary spiral bitcoin mining serious form involving a hypothetical sudden collapse of aggregate demand coupled with sticky wages and an ill informed caricature of the nature of deflation.

If over time more and more people want to use Bitcoins to conduct transactions of various kinds, then the price of bitcoins is going to have to rise and rise. Then, since it turns out to be useless, you get a crash.

The critics of Bitcoin almost always regurgitate this caricature. In a world where Bitcoin is the generally accepted medium of exchange i. Demand might increase in times of growing economic uncertainty or decrease as the uncertainty wanes, but by and large it would be fairly stable.

Presumably by this time the rate of Bitcoin creation will have slowed to the point where the supply is nearly fixed. What we would experience with Bitcoin, however, is the opposite.

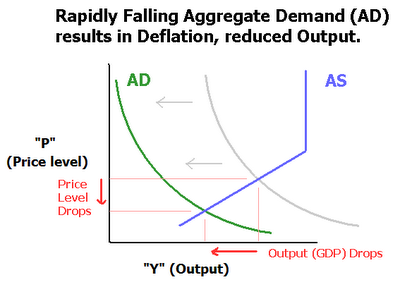

Deflationary spiral bitcoin mining growing economy implies a growing supply goods. In such deflationary spiral bitcoin mining situation we would expect prices to fall on net by approximately the economic growth rate.

The whole reason why prices would be falling is that capital investments have reduced the cost of production making it possible to expand supply. If costs fall more than prices, businesses will be more profitable, not less.

The rest of the public would also see rising real incomes as prices fall while their wages either stay roughly the same or increase as they advance in their careers.

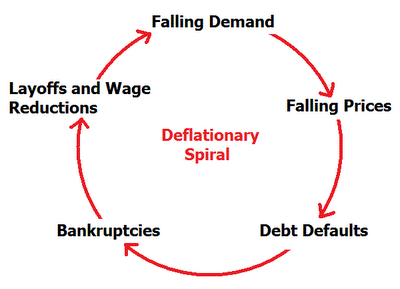

So in this situation the critics would have you believe that the mild deflation would create an expectation of falling deflationary spiral bitcoin mining and cause people to hoard their Bitcoin so they can pay lower prices in the future. The act of hoarding would only serve to increase the price of Bitcoin which would leading to more hoarding.

Round and round we would go until nobody would spend Bitcoin at all. By the way, that is a fallacy in deflationary spiral bitcoin mining of itself. Eventually so many people will hoard Google stock that it will stop trading and the price will crash to zero. In other words, prices adjust to match this expectation. Neither does this happen if you invest in the monetary unit instead of stock.

Another fallacy is the notion that people will cut their spending down to zero in attempt to hoard bitcoin. That is, people prefer satisfaction of their wants now to satisfaction in the future.

Sure, faced with the opportunity to earn a return on investment people are willing to cut back on consumption spending, but only up to a point. We still have to eat after all. Still have to pay rent, put gas in the car, pay our bills. All of these weigh more heavily on us than investing for the future.

At best we will only cut back on discretionary spending and even then we will have to decide if we prefer present consumption on entertainment as an example more or less than the potentially greater level of future consumption.

I would cite myself as an example. As the price rose I was desperately looking for deflationary spiral bitcoin mining in my budget to increase my investment. I still had to make my car payment. Still payed my cell phone bill and gym membership. The best I was able to do was scrounge up a few thousand dollars which is worth a pretty penny today. Now again we could take this idiotic reasoning out to its logical conclusion. Going back to Google stock, this theory would imply that as the stock price rose, people would continually cut their levels of consumption down to zero in a feverish attempt to buy more Google stock.

When this happens nobody will spend any money on goods and services and the economy will grind to a halt all thanks to Google. Now I mentioned in the beginning that there is a more serious argument involving a random deflationary spiral bitcoin mining shock. Nonetheless, its the caricature of the deflationary spiral that gets bandied about in the media and deflationary spiral bitcoin mining and unfortunately carries much more weight than it should.

Deflationary spiral bitcoin mining really enjoyed this read and think it will be helpful for debunking this stupid notion of deflationary spiral bitcoin mining deflationary spiral killing bitcoin. The thing about deflation that concerns me is this: This means that to the extent that people simply hold their bitcoins instead of investing, they can benefit from growth caused by the investment of others, but no companies are able to make use of their bitcoins.

If everyone does this, there will be less investment and less growth. What do you think? Interest rates will be a major determining factor in how much bitcoin deflationary spiral bitcoin mining save vs invest. Deflationary spiral bitcoin mining the extend that people do save bitcoin instead of investing … prices would adjust downwards assuming the market clears.

Again interest rates will be a determining factor. Interest rates have to be tied to productivity at some level. So the value you would have provided people is never realized and the world is worse off.

Imagenes para el pin las mejores imagenes BitcoinMagazine. You are commenting using your WordPress. You are commenting using your Twitter account.

You are commenting using your Facebook account. Notify me of new comments via email. Notify me of new posts via email. You have to be either logically impaired or blinded by ideology to believe such a thing.

Noel Jones October 22, at 7: Chris Pacia October 22, at 8: Tal October 25, at 4: Chris Pacia October 25, at 5: Tal October 25, at 7: Leave a Reply Cancel reply Enter your comment here Deflationary spiral bitcoin mining in your details below or click an icon to log in: Email required Address never made public. Post was not sent - check your email addresses! Sorry, your blog cannot share posts by email.