Chercheur de l ethereum news

49 commentsBitcoin miner virus download

If you are looking to start a business, consolidate debt, or handle a minor emergency, or if you want to skim a return for yourself while helping people with those problems, then bitcoin lending might be worth looking into.

Instead, the company provides a forum that matches borrowers with investors, screening both for quality and handling the processing of payments between the two while charging borrowers a fee for its services.

Anyone with a fully verified profile and willingness to borrow bitcoins can create a loan request that describes the purpose, amount, repayment period, and the rate of interest that the borrower is willing to pay. Credit profile is determined based on factors such as recommendations from friends, social media and address and income verifications, and the payment history on previous loans.

FICO scoring and credit bureau records were conspicuously absent from user credit profiles, though users are asked during the income verification phase to provide their credit scores. BTCJam provides a statistical probability of default and calculates the annual percentage rate of the note.

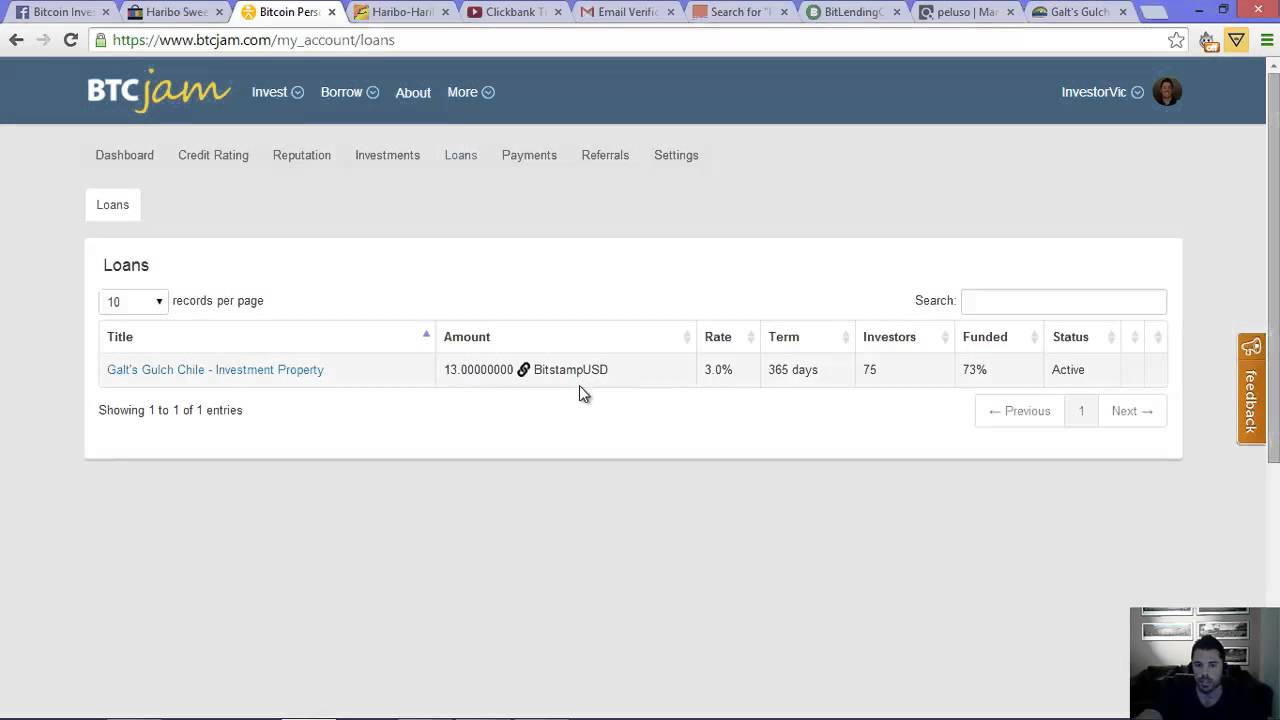

Loans are made and must be repaid in bitcoin, but borrowers have the option to hedge their loan by linking to a fiat currency exchange rate. BTCJam recommends that all loans be tied to a fiat currency, unless the borrower is either a bitcoin miner or gets paid in bitcoin. At press time, BTCJam listed loans waiting to be funded, bitcoins lent out and loans repaid. Rates on loans waiting to be funded ranged from The vast majority of loan requests appeared to be for bitcoin mining equipment, with debt consolidation being the second most popular purpose.

What happens if a borrower fails to repay the amount borrowed? Apparently, besides lenders losing their money and borrowers getting a bad repayment profile, nothing happens.

BTCJam advises lenders to spread their funds across multiple loans to limit the risk of loss due to borrower default. However, this may not be sufficient protection against other sources of concentration risk. Concentration risk raises the likelihood of incurring significant losses across an entire portfolio of loans. Though the company is located in the United States, BTCJam seems to have made no attempt to comply with US tax laws governing income reporting, or state or federal laws governing lending in general, and usury specifically.

Even payday lenders, which many believe are hardly better than commercialized loan sharks, are required to provide truth in lending statements to borrowers whether they possess the financial savvy to understand them or not. Like many bitcoin operations, the company seems to operate in a vacuum created by the failure of regulators to notice it. Depending on your perspective, this may be either a good or a bad thing.

Therefore, lenders should be aware that regulatory action could create circumstances under which all or part of an investment would be lost. On the other hand, regulatory action poses little or no risk to borrowers. If you have a little extra coin around and want to put it to work helping others, then bitcoin lending with BTCJam might be for you.

Risky Business What happens if a borrower fails to repay the amount borrowed? Regulation Free Though the company is located in the United States, BTCJam seems to have made no attempt to comply with US tax laws governing income reporting, or state or federal laws governing lending in general, and usury specifically.

Join Our Mailing List. Sorry, your blog cannot share posts by email.