Perhaps vampires is a bit strong but letra y traduccion

23 comments

Bitproof blockchain technology

These new people are different. The only reason they are here is the money. When we consider that fresh, naive amateurs are and their money is flowing into the sector at a rate of millions of people per month, we should also understand that these amateurs are more susceptible to the animal spirits than their stoic, abrasive, less-socially-adept, battle-hardened forebears. They will be prone to cut and run. As such, a shock to the system, such as an exchange being taken down in a necessary and overdue enforcement action, could lead to a loss in confidence in the entire cryptocurrency ecosystem as a whole and a stampede for the exits the likes of which Bitcoin has not seen to date.

As Bitcoin qua decentralized bank is running a fractional reserve with a chronic shortage of dollars, a shock therefore has the potential to not just drive the price of Bitcoin down a little bit, but also lead to a major liquidity crunch and abject panic. In the current environment, there are a number of ways such a shock could arise. I had a hunch people were lending into the sector. Fortunately, I was reading CoinDesk this afternoon and their reporting from the Consensus: It would not only facilitate short positions but also provide working capital for trading desks to make markets, he said.

During his talk, Boonen of B2C2 acknowledged the irony of the situation given that bitcoin was born as a reaction to the credit crisis. There are two, not necessarily mutually exclusive ways people are responding to the Great Bubble of Cryptocurrency is, admittedly, much smaller than the subprime bubble, which was roughly 2 orders of magnitude larger than Bitcoin today.

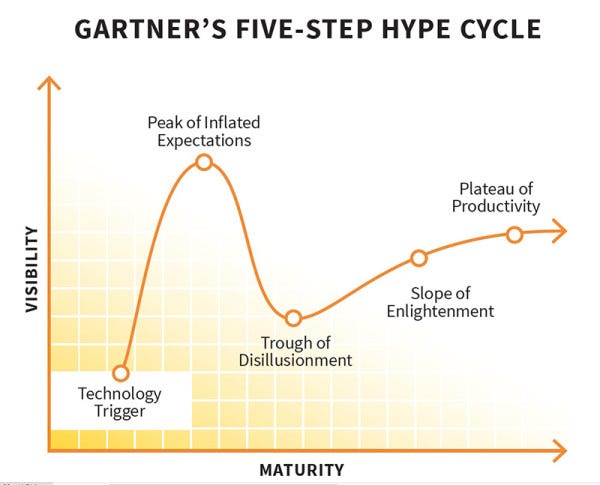

But Bitcoin has shown, on several occasions, a persistent ability to defy detractors like me to grow an order of magnitude in less than 12 months; if it does so again, it will be 3x larger than LTCM. LTCM on its own very nearly ruined the world in It is a matter of time before the punter on the street becomes as disillusioned as I, an irascible blockchain software entrepreneur, have become.

Put another way, this is a disaster waiting to happen. Fortunately for us, is not ancient history, and the fact that Bitcoin is a classic, manic bubble is so transparently obvious that it should be impossible for thinking people to deal with it otherwise. There are no excuses for not doing right by the societies and taxpayers who had to bail out the financial services industry last time around.

So, banks, shadow banks, and anyone else of systemic importance, I implore you: Hey Preston, some exchanges have lending markets which power margin trading, and others say they use their own liquidity. There may be institutions directly lending to the exchanges themselves but there are at lest some transparent mechanisms and institutions could in theory lend via the platform.

The exchanges take a cut of the interest. Creating un-backed Tether to lend would certainly be a cause for concern and is getting some attention but yet to be proven. Its more like a cult you just need to quietly worship the 25 year old who had magically created millions out of thin air.

Like Liked by 1 person. You decry the new uninformed investors in this market but you need some pretty deep levels of stupidity to borrow in a deflationary space.

I wonder if naysayers like Byrne and Dimon will put their money where their mouth is and sell short. Shorting a cryptocurrency is a great way to lose your shirt. So is being long for that matter. They reek of fear. This could get serious There are two, not necessarily mutually exclusive ways people are responding to the Great Bubble of Just say no So, banks, shadow banks, and anyone else of systemic importance, I implore you: Then keep running Like this: November 29, November 30, Categories: Great comment Jim, thank you!

Rohit Mittal Author November 30, at Author December 3, at 9: OnLine Author December 3, at 9: ChicagoBob Author December 3, at 3: Thank you for making it clear. ChicagoBob Author December 3, at 8: Try not to be Isaac Newton. Metascarcity and Bitcoins future - cryptoconverts.

Metascarcity and Bitcoins future Author December 4, at 8: Metascarcity and Bitcoins future - BitcoinMall.