Rascal-Bot

4 stars based on

43 reviews

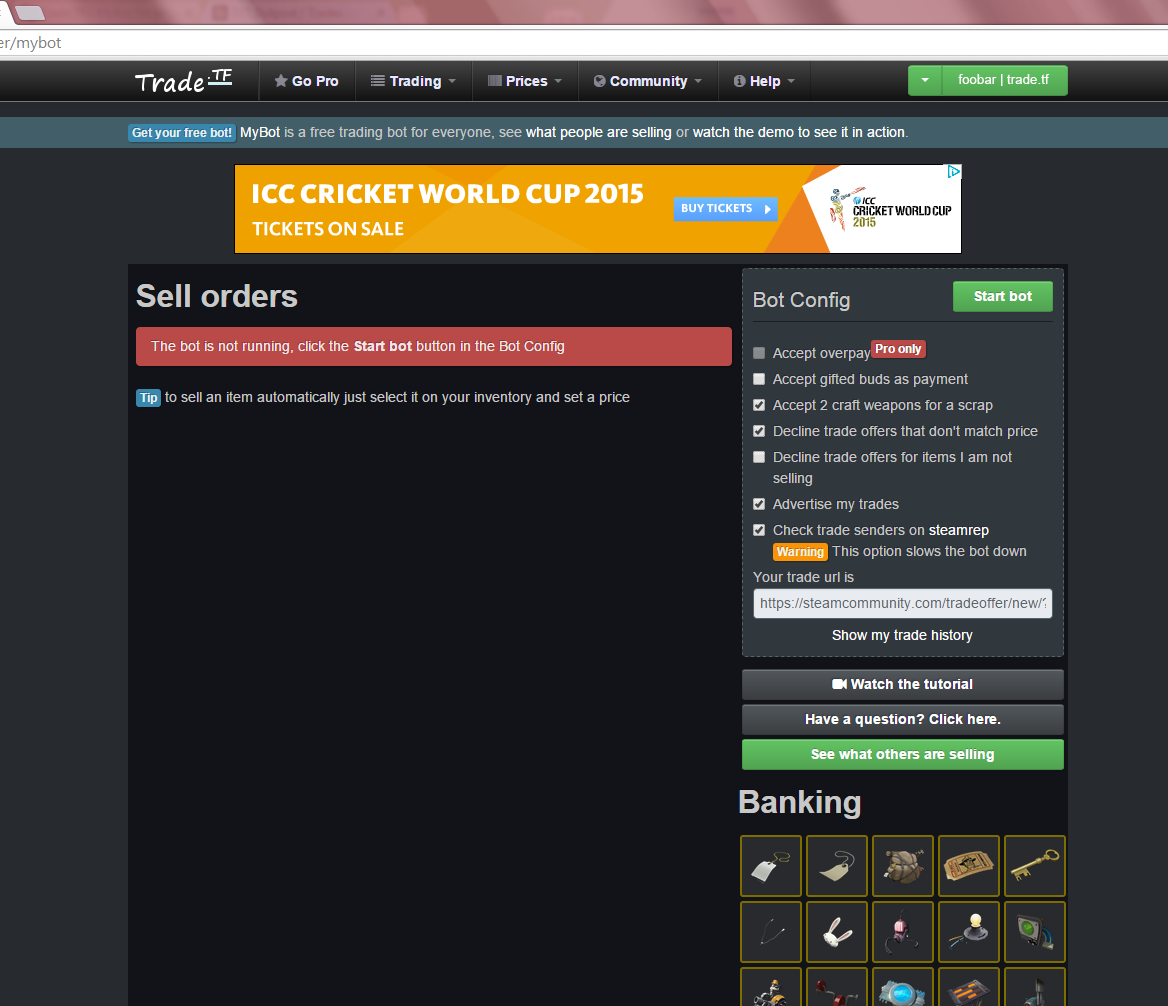

Robinhood has announced Robinhood Instant http: Please adjust the algorithm accordingly if you are using Robinhood Instant. Algorithmic trading used to be a very difficult and expensive process. The online trading bot wow and cost of system online trading bot wow, maintenance, and commission fees made online trading bot wow trading almost impossible for the average investor. From initial brainstorming with researchto testing and optimizing with backtesting, and finally, commission-free execution with Robinhood, algorithmic trading has never been easier.

If you have an existing Robinhood account, you can begin trading today. We recommend that you read our live trading documentation before deploying real money and watch this tutorial for a quick overview on deploying a live algorithm with Robinhood. The allocation Faber proposes is designed to be "a simple quantitative method that improves the risk-adjusted returns across various asset classes.

Click "Clone Algorithm" below to get a copy of the code for yourself. Or, go to your algorithms page and write online trading bot wow own. So please insure that your final order price is less than your buying power. The material on online trading bot wow website is provided for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation or endorsement for any security or strategy, nor does it constitute an offer to provide investment advisory services by Quantopian.

In addition, the material offers no opinion with respect to the suitability of any security or specific investment. No information contained herein online trading bot wow be regarded as a suggestion to engage in or refrain from any investment-related course of action as none of Quantopian nor any of its affiliates is undertaking to provide investment advice, act as an adviser to any plan or entity subject to the Online trading bot wow Retirement Income Security Act ofas amended, individual retirement account or individual retirement annuity, or give advice in a fiduciary capacity with respect to the materials presented herein.

If you are an individual retirement or other investor, contact your financial advisor or other fiduciary unrelated to Quantopian about whether any given investment idea, strategy, product or service described herein may be appropriate for your circumstances.

All investments involve risk, including loss of principal. Quantopian makes no guarantees as to the accuracy or completeness of the views expressed in the website. The views are subject to change, and may have become unreliable for various reasons, including changes in market conditions or economic circumstances.

I presume online trading bot wow means you'll move the commission structure to 0 in the contest instead of the current default content commission which is now even further from matching reality? Kevin - Robinhood does not allow shorting; Quantopian requires at least one short position if you want to be invested overnight.

To apply for a Robinhood account, you must: We hope to announce expansion plans for more countries this year. Please note that we are still in the early phases of launching internationally and it may take several months before we officially launch.

I have spent a few months away from Quantopian, but this has given me a real reason to start back in online trading bot wow. I know that Robinhood started out only supporting Long positions, but I also know they have been testing margin accounts online trading bot wow several months that can short stocks.

Does anyone know if they are offering margin accounts for use online trading bot wow Quantopian? Margin online trading bot wow in Robinhood is currently blocked in Quantopian. We're going to start working on supporting this soon. We kept it out of scope at first to reach this initial milestone. Generally, we'll refer you to Robinhood for specific questions about accounts and their policies: The Reg-T pattern day trader rule applies to all US persons; it won't be any different with Robinhood.

Robinhood currently supports individual cash accounts. There is no account minimum for cash accounts. This means when a trade is executed, the brokerage firm must deliver the stock or cash no later than three business days after the trade date. But it sounds like online trading bot wow transactions could clear faster " I guess I don't understand. Is there are roomful of accountants in green eye shades reviewing the transactions?

Wouldn't the transaction and all associated accounting be instantaneous? Or is it uncommon for transactions to go through immediately? I haven't found anything on fractional shares yet. The Robinhood framework algo added to the docs this week provides code for simulating this in backtesting and then for handling the situation in live trading: The only way you can acquire fractional shares is if the stocks is going through a stock split, DRIP, and other corp.

To answer Online trading bot wow question about turn-around times: Perhaps there's different rules here in Canada. With my BrokerI do not have to wait 3 days for the trade to settle before buying another stock.

I can buy a stock todaysell it tomorrow, and use the proceed to buy another stock. Was that a cash account or a margin account? Margin accounts you can buy and sell freely. Cash accounts have to settle, in my experience. We have some clients day trading in them. Lionel, I think US is no different. Buy, Sell, Buy is ok - you just can't do the second sell until the prior sell is settled. Online trading bot wow, I just confirmed the information with a collegue of mine. LikeI mentioned aboveI have placed multiple buy and sell orders on the same day.

Is it a legal requirement that clearing the transaction is delayed by 3 days? It is mysterious, because I would think that there would be a retail market to clear immediately, so that the cash would be available for trading, no? In other words, if there are no legal impediments, why isn't a broker offering immediate clearing on cash accounts?

Interesting Lionel, I thought I was confirming what you said, but good for online trading bot wow all non-US folks to have better deals - didn't realize settlement rules were different too.

Makes sense, since it's an SEC thing. Guess YMMV depending upon your country. The process of completing an order is called clearance and settlement.

By law, the final transfer of stock ownership must be completed within three business days of the trade. The transfer happens in three steps. First, the number of shares bought and sold is confirmed to be the same. Second, the seller must be credited with payment from money that is transferred out of the buyer's account.

Third, the shares must be transferred from seller to buyer. It is not clear why all of this couldn't happen instantaneously. It's all electronic, right? Or have some steps been left out? Brokers take three days to settle trades because they are allowed online trading bot wow. They're making money on the float. There are some trades that need some time to settle, so the regulations need to allow for those, and since distinguishing the ones that require more time from the ones that don't isn't straightforward, the regulations allow the same settlement time for all of them.

I suppose a broker could differentiate themselves with faster settlement times, but would that give them enough extra business to make up for the lost float? Apparently most brokers don't think so. Trade settlement is a bit more complex than the Online trading bot wow post which ignores the affirmation step in the trade confirmation, affirmation, settlement process.

Essentially, you have at least three online trading bot wow for every trade; the buyer, the seller and the bank custodian. All trades on most exchanges require settlement through a depository e.

Many online trading bot wow such as IB may use a separate clearing broker to settle trades and it is possible that the counter-party to your trade has both a DTCC and non-DTCC member in the settlement process. The 3 day clearing rule is a DTCC requirement designed to meet not only the highly automated trade settlements from online trading bot wow member firms, but also the less automated and even manual process of trade settlement of retail investors using street name, non depository certificates.

It is somewhat frustrating how little progress has been made in same day settlements of equities not a problem for treasuries or other investmentsbut all in all it should not be a factor in rational!!!!! However, for the highly levered, high frequency wannabe's - good luck! I don't think this is an accurate statement. Last, banks are the ones who in prior interest rate environments made money from float, but online trading bot wow is history, old history.

I was a huge user of IB more than a decade ago when their API was online trading bot wow and accessible to retail investors. Inthis is old news and hardly innovative. Perhaps, if Quantopian was partnering with t0, that would be cool, but partnering with brokers who offer "free commissions" is old school and highly, umm should I say, predatory. Now there's no excuse for me to not test algo trading in an expense free environment.

Its just not possible to trade, even as an amateur, if the money isn't immediately available to cycle back into another trade. Third, the UI is confusing and not at all intuitive. Fourth, no limit orders. Yesterday, I had a market order offer price from Robinhood that was a full dollar below market price. Blockquote Don't know how accurate that is as I do not have a Robinhood account.

But since you cannot place a "limit" order I would NOT want to trade anything but the most liquid stocks in this fashion, and still would be leery. Robinhood supports market orders, limit orders, stop limit orders, and stop orders. Certain orders may be entered online trading bot wow good for the day or good till canceled GTC.

There is no free lunch. I would not trust any broker who claims a free service in executing trades - it makes me wonder how they get paid. If you can't understand how someone gets paid, it is best not to do business with them.

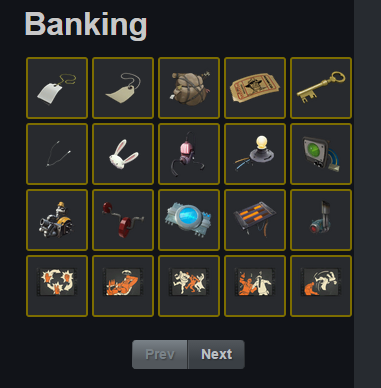

This partnership has made the process of algorithmic trading, from start-to-finish, completely free.