Bitcoin ideology

Eighteenth century canals were new, on the scale that they were being built. Nineteenth century railways were new. Twentieth century cars and radios were new.

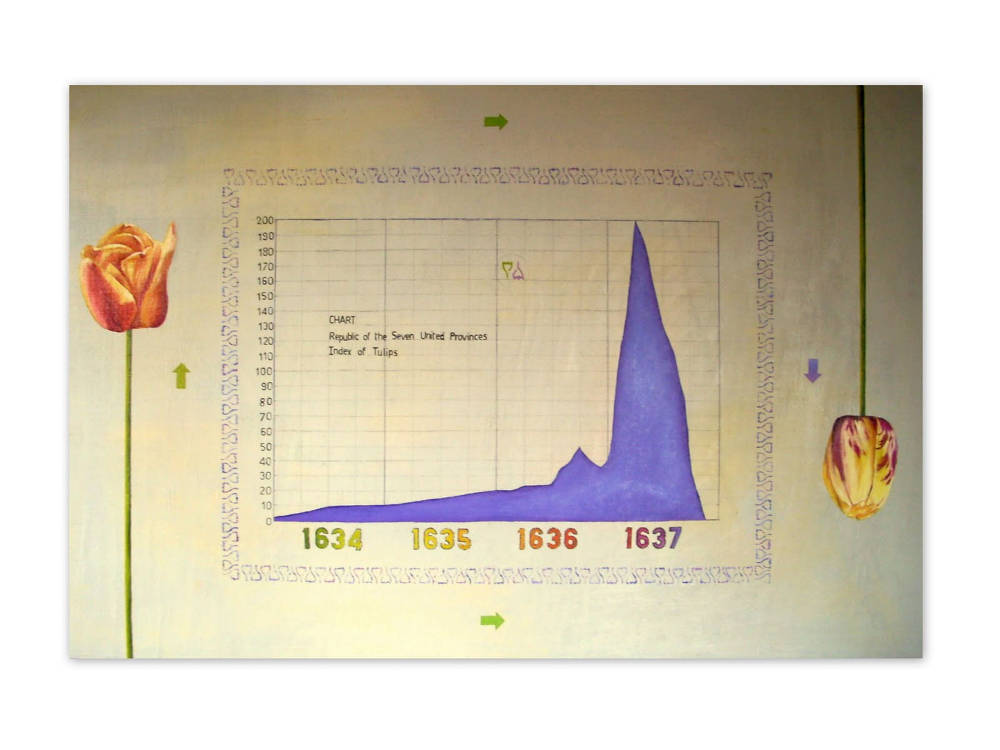

Turn of the century internet stocks were new. Cryptocurrencies today are new. Alternatively, it can be the financial innovation that is the novelty. Cash-settled futures contracts on Dutch tulip bulbs were new. Large scale joint stock companies in France and England in the early eighteen-century were new. Large scale leveraged buyouts in the s were new. Novelty matters to a bubble, because it makes valuing future fundamentals more difficult.

Novelty allows the dread phrase "this time it is different" to be spoken. If fundamental value is to be ignored, there has to be a reason investors forget the rational lessons of history. A bubble must promise real world returns at some distant date. If real world returns are expected quickly, the failure to realize those returns quickly will be obvious quickly.

It took time for tulip bulbs to become tulips. The Mississippi and South Sea bubbles of the early eighteenth century promised non-existent riches from trade. The non-existent riches were supposed to be earned in the future. The internet bubble promised that we would all be buying pet food online — not immediately, but in the new millennium. The gap between selling financial assets and achieving the real world returns lets irrationality build. The asset price continues to rise because "this time it is different" and bubble buyers believe that returns will come pouring in if only they wait long enough.

The final characteristic of a bubble is that a bubble bursts. The sudden drop in the asset price is the defining characteristic of a bubble. It is the bursting of a bubble that is of most interest to the economist. This conclusive signal comes too late for the bubble buyer, of course.

The bubble buyer must suffer the result. The immediate aftermath was a slump. But the flight of capital out of China was temporary. Everybody is feverishly bidding for all the action they missed out on. Meanwhile there are punters gaming the system as well as they would in any other market when they spot an opportunity. Between all of these, the prices have moved up. It is only a matter of time before prices come down. Does bitcoin as a currency have the muscle to withstand multiple onslaughts from various stakeholders in the ecosystem?

The larger question on the mind and one I am deeply conflicted about is whether bitcoin as a currency has the muscle to withstand multiple onslaughts from various stakeholders in the ecosystem—whether it be governments, private players, regulatory authorities, or those looking to make a fast buck.

Incidentally, this is the subject of much debate between the writer on the theme and readers on the Wall Street Journal and perspectives of all kinds can be heard. What I do know is that basis what I have seen in the past, ideological battles in a marketplace can last so long as the money to back it lasts.

After that, it morphs into something else altogether. In the interim though, much good comes out as well. In the race to find the ideal cryptocurrency, blockchain as a technology is one outcome, and the experiments at TCS around it and how entities like Bajaj Electricals are deploying it to pay for material in real time are real time cases.

Who knows what else may emerge? And yes, I know that sounds terrible. Was this article useful? Sign up and we'll send you articles like this every week. Charles Assisi is an award-winning journalist with two decades of experience to back him. He is currently co-founder and director at Founding Fuel. He writes a weekly column as well under the slug Life Hacks in Mint , India's most influential business newspaper.

He is vocal in his views on journalism and what shape it ought to take in India. He speaks on the theme at various forums and is often invited by various organizations to teach their teams how to write. In his last assignment, he wore two hats: As part of the leadership team, his mandate was to create a distinctive business title in a market many thought was saturated. When Forbes India was finally launched after much brainstorming and thinking through, it broke through the ranks and got to be recognized as the most influential business magazine in the country.

He did much the same thing with ForbesLife India where he broke from convention and launched the title to critical acclaim. He was appointed Editor and given a free run to create what he wanted. During this stint, he worked and interacted with all of Vogel Burda's various newsrooms across Europe and Asia.

In his spare time, he reads voraciously across the board, but is biased towards psychology and the social sciences. He dabbles in various things that catch his fancy at various points. But as fancies go, many evaporate as often as they fall on him. Articles Columns Videos Podcasts. Home Articles Tulip mania versus bitcoin ideology Apparently, bitcoins are worth investing in. Charles Assisi Nov 19, 3: This is where the problem and the paradox lie 3. All this said, I think I must attempt to deconstruct each of my assertions here.

A history of contemporary money This is a theme that interests me deeply for various reasons. Humans are attracted to it But they were let off after paying some chump change in fine, are back in business, being wooed again and earning more money. What do we trust then? What if there exists a ledger where no bank is needed to maintain it?

What if there is no government needed to underwrite a promissory note? What if there exists a system of notes digitally issued from one person to another person minus any intermediary and authenticated at once by multiple third-party entities?

That it cuts costs and intermediation is one thing—but it is the ultimate political statement any libertarian can make If it could be accomplished, the global financial ecosystem could be dismantled and all intermediaries, including the government as we understand it now can be done away with. At a more micro level, to ensure the authenticity of these notes, what if the ledger books were to be open?

That means, at any given point in time, if I make a payment, that note will be visible to many people who can vouch whether it is an authentic note or not in the bitcoin ecosystem.

Between strong privacy and the evolving nature of encryption, it will ensure nobody can see who makes the payment, who receives it, or attempt to change the value of the promissory note. To that extent, it is a global currency. This facilitates free movement of trade and capital—again a libertarian ideal. Add to this the fact that this promissory note or currency will not exist on a single repository, but across multiple computers on a network spread across the world.

If you are connected to the internet, you can access this network. So, it cannot be regulated by any government. This is P2P technology It is a theme for the legislature to debate on and try to figure what kind of framework it must arrive at. And finally, much like we understand that the amount of money in a system must be controlled, Satoshi Nakamoto has created bitcoin as a finite resource.

It is not the prospect of buying from Overstock. People can use Bitcoin-powered apps even if they are not investors in the currency. For the investors, price is everything. If there were few Bitcoin investors, there would be no reason to make Bitcoin companies and it would be difficult to make Bitcoin payments because it would be so illiquid.

For the entrepreneurs, the latest gadget is always the most important. New features and new designs are what attract consumers. Not understanding the network effect, the entrepreneurs are easily fooled into thinking that altcoins, with their interesting new mining algorithms and other special features , are viable, whereas the investors know that Bitcoin is a classic and the rest are pretenders.

Even within Bitcoin itself, the entrepreneurs envision many more uses for the Bitcoin network. Currency is just its first app. The investors see currency overwhelmingly the most important use of the Bitcoin network. They will choose bitcoin because they can profit from it. I have said these ideologies are not logically related to politics, but actually politics intrudes into this ideological division in at least one way.

It was time for everyone to part ways from the idealism of Stallman to the pragmatism of Linus Torvalds without forgetting the best of what Stallman offered. As a person, Stallman was a pleasant and gentle creature to be around.

He had a quirky sense of humour that I thought endearing. Because when used in isolation, he thought of it a bastardisation of his philosophy. I thought I almost got my skin pulled out when I asked him about the future of the operating system. It was a faux pas on my part. Be that as it may, there is no taking away from his multiple contributions. The world and the computing prowess we now take for granted would not have been possible without his idealism. It needed to show its prowess as a pragmatic alternative to the monoliths in the business.

It did and much of it was possible because of evangelists like Stallman. That brings me back to bitcoin. This is not just a battle about technology. This is about world views. The debate among bitcoin miners on bitcoin cash versus bitcoin gold and the confusion in the ranks, for instance, are pointers in that direction.

The revolution he ignited would have been the perfect one. I liked the sound of it too—much like I love the sound of bitcoins displacing the current financial dispensation. But it sounds unlikely. I feel compelled to state that because historical evidence on bubbles of all kinds—including the most famous of them all, the tulip mania—points to just that. It is only pertinent then you ask why should the excitement around bitcoin be a bubble? For that matter, what is to suggest that there is a bubble?

It can be the underlying asset that is new. Dutch tulips were new and exotic. Eighteenth century canals were new, on the scale that they were being built. Nineteenth century railways were new. Twentieth century cars and radios were new.

Turn of the century internet stocks were new. Cryptocurrencies today are new. Alternatively, it can be the financial innovation that is the novelty. Cash-settled futures contracts on Dutch tulip bulbs were new. Large scale joint stock companies in France and England in the early eighteen-century were new. Large scale leveraged buyouts in the s were new.

Novelty matters to a bubble, because it makes valuing future fundamentals more difficult. Novelty allows the dread phrase "this time it is different" to be spoken.

If fundamental value is to be ignored, there has to be a reason investors forget the rational lessons of history. A bubble must promise real world returns at some distant date. If real world returns are expected quickly, the failure to realize those returns quickly will be obvious quickly.

It took time for tulip bulbs to become tulips. The Mississippi and South Sea bubbles of the early eighteenth century promised non-existent riches from trade. The non-existent riches were supposed to be earned in the future. The internet bubble promised that we would all be buying pet food online — not immediately, but in the new millennium. The gap between selling financial assets and achieving the real world returns lets irrationality build.

The asset price continues to rise because "this time it is different" and bubble buyers believe that returns will come pouring in if only they wait long enough. The final characteristic of a bubble is that a bubble bursts. The sudden drop in the asset price is the defining characteristic of a bubble.

It is the bursting of a bubble that is of most interest to the economist. This conclusive signal comes too late for the bubble buyer, of course. The bubble buyer must suffer the result. The immediate aftermath was a slump. But the flight of capital out of China was temporary. Everybody is feverishly bidding for all the action they missed out on. Meanwhile there are punters gaming the system as well as they would in any other market when they spot an opportunity.

Between all of these, the prices have moved up. It is only a matter of time before prices come down. Does bitcoin as a currency have the muscle to withstand multiple onslaughts from various stakeholders in the ecosystem?

The larger question on the mind and one I am deeply conflicted about is whether bitcoin as a currency has the muscle to withstand multiple onslaughts from various stakeholders in the ecosystem—whether it be governments, private players, regulatory authorities, or those looking to make a fast buck. Incidentally, this is the subject of much debate between the writer on the theme and readers on the Wall Street Journal and perspectives of all kinds can be heard.

What I do know is that basis what I have seen in the past, ideological battles in a marketplace can last so long as the money to back it lasts.

After that, it morphs into something else altogether. In the interim though, much good comes out as well. In the race to find the ideal cryptocurrency, blockchain as a technology is one outcome, and the experiments at TCS around it and how entities like Bajaj Electricals are deploying it to pay for material in real time are real time cases. Who knows what else may emerge? And yes, I know that sounds terrible. Was this article useful? Sign up and we'll send you articles like this every week.

Charles Assisi is an award-winning journalist with two decades of experience to back him. He is currently co-founder and director at Founding Fuel. He writes a weekly column as well under the slug Life Hacks in Mint , India's most influential business newspaper. He is vocal in his views on journalism and what shape it ought to take in India. He speaks on the theme at various forums and is often invited by various organizations to teach their teams how to write.

In his last assignment, he wore two hats: As part of the leadership team, his mandate was to create a distinctive business title in a market many thought was saturated. When Forbes India was finally launched after much brainstorming and thinking through, it broke through the ranks and got to be recognized as the most influential business magazine in the country.

He did much the same thing with ForbesLife India where he broke from convention and launched the title to critical acclaim. He was appointed Editor and given a free run to create what he wanted. During this stint, he worked and interacted with all of Vogel Burda's various newsrooms across Europe and Asia. In his spare time, he reads voraciously across the board, but is biased towards psychology and the social sciences.

He dabbles in various things that catch his fancy at various points. But as fancies go, many evaporate as often as they fall on him. Articles Columns Videos Podcasts. Home Articles Tulip mania versus bitcoin ideology Apparently, bitcoins are worth investing in.