Liquid handling robotic system components

27 comments

Bitcoin qt blockchain location of gardenscapes

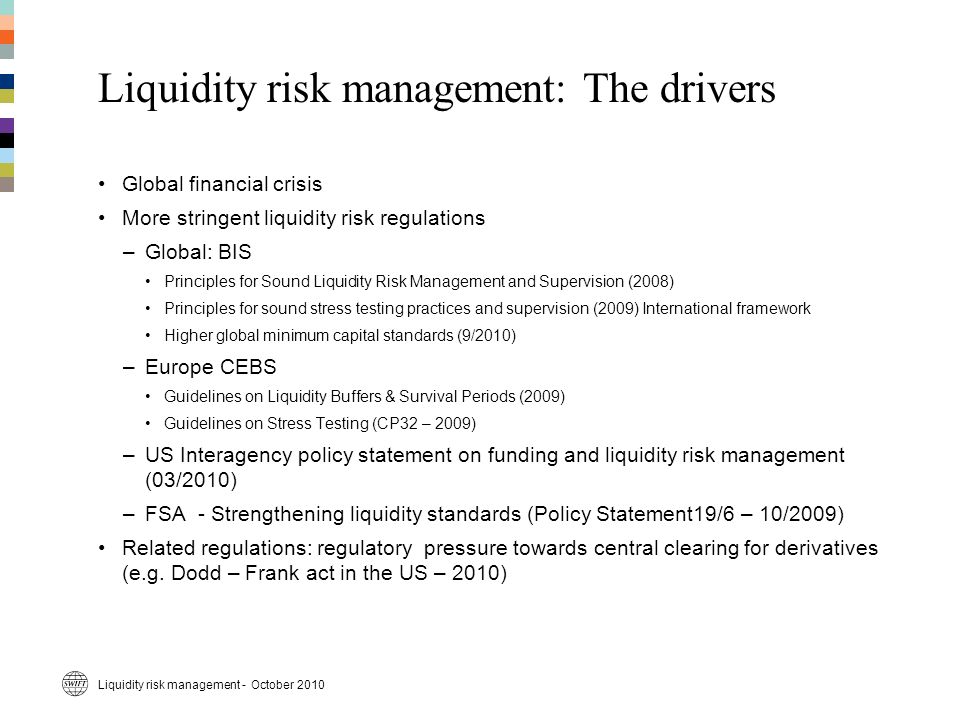

The BIS hosts nine international organisations engaged in standard setting and the pursuit of financial stability through the Basel Process. The Basel Committee on Banking Supervision, in consultation with the Committee on Payment and Settlement Systems, issued a final version of the document Monitoring tools for intraday liquidity management.

This document introduces a new reporting framework that will enable banking supervisors to monitor a bank's management of intraday liquidity risk and its ability to meet payment and settlement obligations on a timely basis. Over time, the tools will also provide supervisors with a better understanding of banks' payment and settlement behaviour. A number of important changes have been incorporated into the final version of the monitoring tools to reflect responses received to the consultation document issued in July In particular, the reporting burden on banks has been reduced by:.

Furthermore, the scope of application of the reporting regime has been narrowed to apply only to internationally active banks, with discretion available to national supervisors to apply the tools more widely as appropriate. The implementation date for the new regime has been set for 1 January to coincide with that of the Liquidity Coverage Ratio, but customer banks have been offered a concession to defer implementation until 1 January with the agreement of their local supervisor if they encounter data availability difficulties with their correspondent bank s.

The set of seven quantitative monitoring tools in the new framework will complement the qualitative guidance on intraday liquidity management set out in the Basel Committee's Principles for Sound Liquidity Risk Management and Supervision. This website requires javascript for proper use.

About BIS The BIS's mission is to serve central banks in their pursuit of monetary and financial stability, to foster international cooperation in those areas and to act as a bank for central banks. Read more about the BIS. Central bank hub The BIS facilitates dialogue, collaboration and information-sharing among central banks and other authorities that are responsible for promoting financial stability.

Read more about our central bank hub. Statistics BIS statistics on the international financial system shed light on issues related to global financial stability. Read more about our statistics.

Banking services The BIS offers a wide range of financial services to central banks and other official monetary authorities. Read more about our banking services. Visit the media centre.

Comments received on the consultative document "Monitoring indicators for intraday liquidity management" The Basel Committee on Banking Supervision, in consultation with the Committee on Payment and Settlement Systems, issued a final version of the document Monitoring tools for intraday liquidity management. In particular, the reporting burden on banks has been reduced by: Related information Consultative version: Consultative document, July Top Share this page.