Bot komen di status sendiri lagi

18 comments

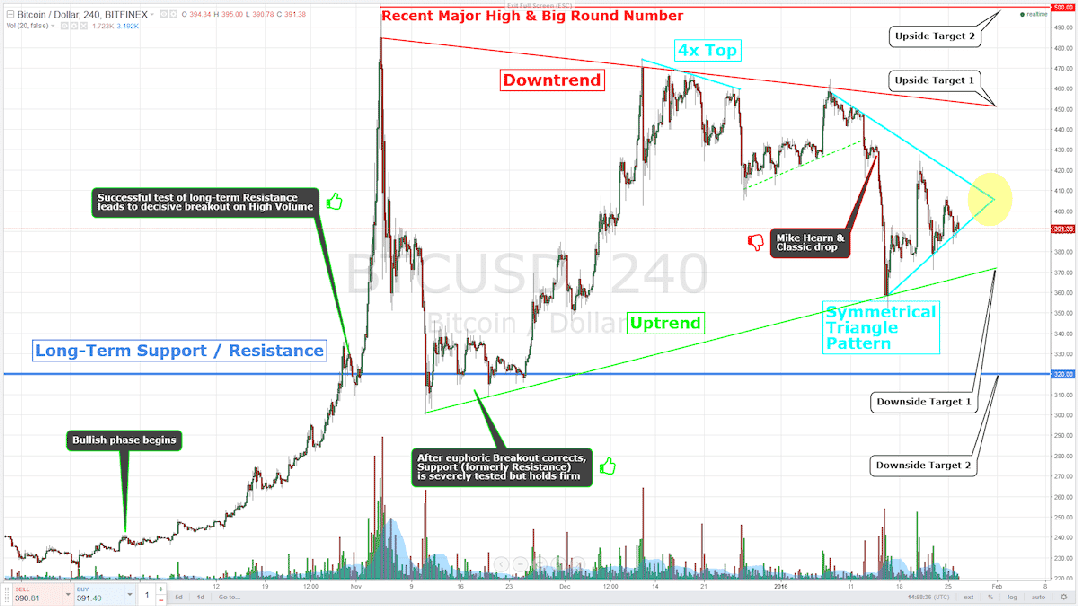

Kevin dowd bitcoin chart

Last week, I basically identified the Bitcoin range between the and levels by suggesting a double top formation. The second top was formed with prices reaching We still need to see whether the bears are strong enough to push the prices lower, but the current price action is pointing south.

We need to follow whether price will break it or bounce off it. Following my initial idea for a double top formation, I would sell Bitcoin at , targeting with stops at The bulls will try to push it over , but if they fail, we are most likely going to witness the next shorting. Looking at the bigger picture, some Altcoins have been pumped and dumped already.

The market is showing some signs of weakness, but with some traders still looking towards the moon, it will be difficult to build a proper strategy for the week. I would be looking for a drop towards The article is written for informative purposes only and it is not financial advice. The author does not have any position in the currency pairs mentioned, and no plans to initiate a position. He wrote the article himself and expressed his own opinions.

He has no business nor personal relationships with any mentioned government entities or stocks. Readers should not treat any opinion expressed by the author as a specific inducement to make a particular trade or follow a particular strategy, but only as an expression of his opinion.

Skip to main content. Bitcoin is moving in a range. Hopefully, you find my analysis helpful. Cryptocurrency CFDs - Best forex brokers offering crypto trading. How to trade reversal chart patterns. How to trade continuation chart patterns.