Dogecoin blockchain statistics problems

25 comments

7970 vs 7950 litecoin mining contractor

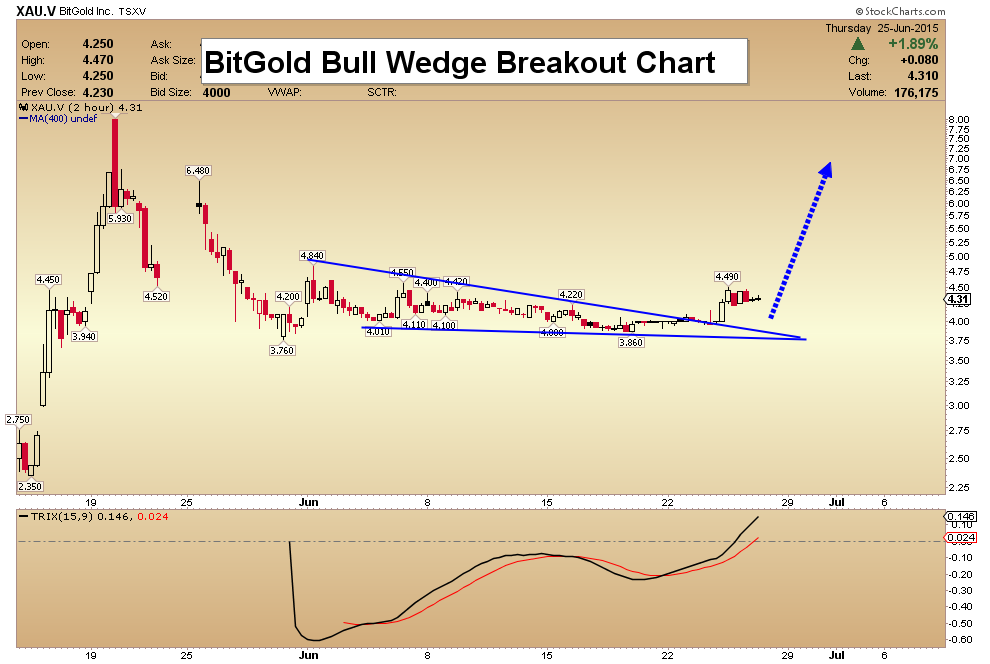

This section was produced by the editorial department. The client was not given the opportunity to put restrictions on the content or review it prior to publication. May 20, 5: Shares of BitGold Inc. It promptly tripled in its first day of trading, and it has barely slowed down since. BitGold is a pioneering financial services platform built around gold.

In addition to allowing users to buy and store gold, BitGold lets them pay for products and services online using gold as the currency. The idea came from co-founders Roy Sebag and Josh Crumb, who wanted to create a service that would allow people to buy a Tim Hortons coffee using gold. They got big-name investors such as billionaire George Soros and Sprott Inc. Sebag, 29, controls more than half the stock, according to a filing. The company has earned praise from onlookers, who think the idea has a lot of potential.

But people are already starting to raise red flags about the valuation. One of them is Peter Schiff, a well-known market commentator who owns a gold banking business through his firm Euro Pacific Bank Ltd. Euro Pacific offers a gold- and silver-backed debit card to clients, similar to what BitGold is planning. He also said that there are no significant barriers to entry, and it will be easy for other people to launch rival services if BitGold catches on.

Still, he praised BitGold for trying to make gold ownership more liquid so that people can spend it like a currency. BitGold only opened for business a couple of weeks ago, but it has already signed up thousands of users. In an interview last week, Sebag said the product is catching on with a broad audience, as gold bugs made up less than 10 per cent of the user base. But in the short term, Kaiser said the stock appears to be a plaything for some of the gold bug crowd.

BitGold Inc's soaring stock raises red flags for onlookers: Canadian NHL teams don't often win the Stanley Cup now, but their rabid fan base still makes them big winners.

Even a modest increase in interest rates in Toronto and Vancouver is a concern for most buyers. Find Financial Post on Facebook.