C-bit Offers Bitcoin Classic a Block-size Solution

5 stars based on

31 reviews

Du kannst dich mit verschiedenen externen Benutzerkonten anmelden. It is based on open-source peer-to-peer software that that leverages a network of user accounts wallets set up on peripheral sites in which the units of account Bitcoins may be stored after they are produced and transmitted. It is a goal of cryptocurrencies in general to operate without a central agent, which makes it complicated to resolve disputes. To address this, Bitcoin added multi-signature transactions.

This case study examines how that change was made. In particular the case study explores how an open source community is able to maintain a stable codebase that can serve as a basis for an entire form of currency, while still making necessary changes.

Values and Functions C struct 1 bitcoin. Mission and Function 1. Emergence of Code-Based Arbitration in Bitcoin 2. Organizational Model and Structure A. Primary Categories of Participation C. Mechanisms for Participation E. Resolution of Problem B. Best Practices and Templates.

When talking about the future of e-business, discussions often touch on the rapid spread of e-currencies or cryptocurrencies over the last five years. In that short period of time, Bitcoin quickly gained prominence as the most well known example of this new means of payment. No longer just a niche technical proof-of-concept, these c struct 1 bitcoin payment systems can be used to buy c struct 1 bitcoin Dell computer or donate to the Wikimedia Foundation, among other things.

The rise of these cryptocurrencies has lent new urgency to the classic question of how to handle business conflicts. Due to some of the special conceptual and technological features that set them apart from traditional currencies, managing conflict can be a tricky matter when deals utilize cryptocurrencies instead of traditional currencies.

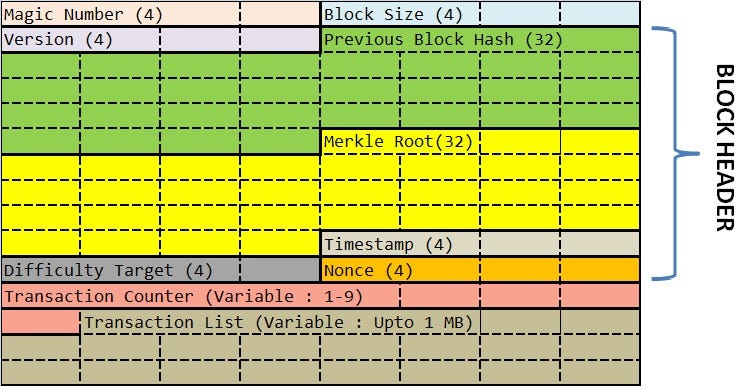

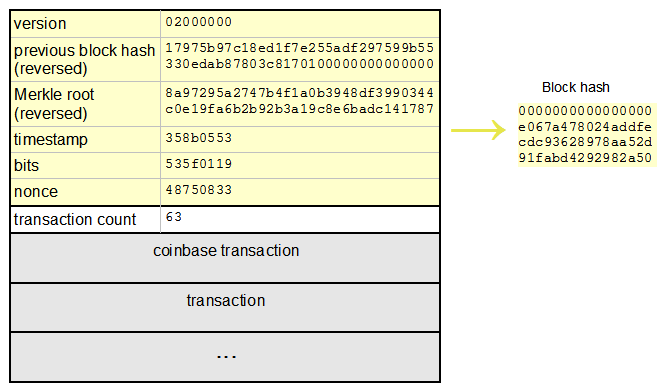

Bitcoin, which was introduced in and has spread rapidly since then, is based on open-source peer-to-peer software that leverages a network of user accounts wallets set up on peripheral sites in which the units of account Bitcoins may be stored after they are produced and transmitted. A public ledger c struct 1 bitcoin blockchain plays a central role in this system, tracking every transaction in which Bitcoins are exchanged while maintaining the anonymity of the users behind the exchange through public key cryptography.

Because it is very hard to connect the public keys used to announce exchanges to the associated private keys used to verify them, the parties of a transaction are essentially anonymous. As the ledger is distributed among all the users in the network,[2] no central administrator or repository is needed to run the system.

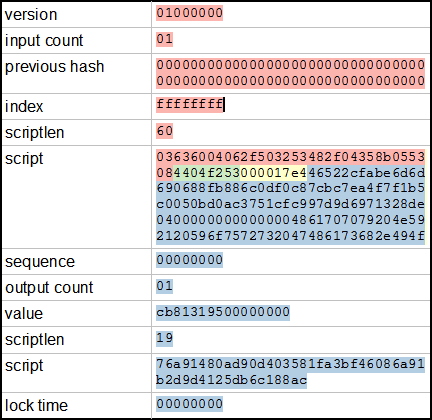

There are two ways to obtain Bitcoins. Users can provide computing power to the network to verify payment transactions, and in exchange they awarded a proportionate amount of new Bitcoins, a process called mining.

In other words, new Bitcoins are produced as a by-product of payment processing and given to the users who helped process that transaction. Given that the number of possible Bitcoins has been limited to 21 million by the software protocol, the stock of potential new Bitcoins gets smaller with c struct 1 bitcoin Bitcoin created and c struct 1 bitcoin into the system.

The algorithm is designed so c struct 1 bitcoin the processing power required to mine a new Bitcoin increases with every new user c struct 1 bitcoin the network, making new Bitcoins harder to create. Accordingly, the second way to get Bitcoins is through trade. The typical way a new user obtains her first Bitcoins c struct 1 bitcoin by changing an offline currency into Bitcoins via a dedicated trading platform.

Bitcoin has been widely criticized for its technological implementation, its potential for abuse in illegal online platforms like the anonymous black market site the Silk Road, and for the volatility of the Bitcoin c struct 1 bitcoin.

This paper instead aims to examine the governance structures supporting the technical development of Bitcoin. Or, c struct 1 bitcoin Satoshi Nakamoto, the person who first proposed the concept of Bitcoin in a whitepaper inso aptly put it:. The central bank must be trusted not to debase the currency, but the history of fiat currencies is full of breaches of that c struct 1 bitcoin.

Banks must be trusted to hold our money and transfer it electronically, but they lend it c struct 1 bitcoin in waves of c struct 1 bitcoin bubbles with barely a fraction in reserve. We have to trust them with our privacy, trust them not to let identity thieves drain our accounts. Their massive overhead costs make micropayments impossible. With e-currency based on cryptographic proof, without the need to trust a third party middleman, money can be secure and transactions effortless.

The Bitcoin Bubble and a Bad Hypothesis, http: Bitcoin open source implementation of P2P currency. Eliminating the middleman, however, creates some challenges for Bitcoin and other cryptocurrencies. Undoing a transaction works similarly, making it impossible for an institution outside the system to revert a payment without the participation of the parties to the transaction.

Business transactions based on cryptocurrencies can result in conflict, just like business deals using any other currency. Imagine the purchase of a certain good, where the seller and buyer disagree on its quality. The buyer is claiming c struct 1 bitcoin, and the two sides seek to resolve the dispute, but neither party may want to involve official public institutions. Beginning in latea feature of the Bitcoin protocol offered a solution to this challenge: Every Bitcoin transaction is defined in a script, c struct 1 bitcoin sets conditions on how a subsequent user can access the coins.

Because these rules are defined in c struct 1 bitcoin, they can be adjusted. One adjustment is setting a minimum number of parties required to sign off on any given transaction. In a standard two-party deal, for instance, the script can define that the signatures of two out of three users are needed to complete the transaction.

This enables the two primary parties to a deal a buyer and seller to name a third user as an arbitrator in case of conflict. Where there is no disagreement, the parties can process the payment on their own, and the arbitrator cannot hinder it. But in case of a conflict, one side can refuse to sign the payment and invoke the arbitrator.

The arbitrator can resolve the conflict and enforce her ruling by signing off of the transaction or not. A wide variety of people offer themselves on these platforms to be commissioned to act as arbitrators. In our view, this is an interesting example of a structural evolution of a cryptocurrency system that we will analyze from a governance perspective. When thinking about governance, we can examine phenomena of emergence, application and effects of collective norms and rules from at least three different angles.

Which individual and collective actors form the governance group? With an emphasis on processes, we can analyze if and how the production and stabilization of certain rule sets c struct 1 bitcoin new institutions and how these rule sets influence social reality by coordinating behavior.

And third, we can focus on the norms and rule sets and analyze, across the factors of governance, which normative meanings they contain, and how the governance structure formed by them is configured.

This c struct 1 bitcoin perspective supplies c struct 1 bitcoin with basic insights that lay the groundwork for the analysis from the other perspectives. Based on these reflections, we will shift our analytical focus to the governance group itself: Then we will discuss from a procedural angle how actors could participate as members of this group C. A Bitcoin Primer on Jurisdiction. It is useful to consider the governance of Bitcoin using a heuristic model of governance factors impacting user behavior in online services in general.

This model differentiates between the components of code, state law, contracts and social norms. We sometimes find these norms codified as codes of conduct or n etiquette. These social norms are both established and executed by the social formation, which reacts to violations with social sanctions. Surely it is not just software source code, because software requires hardware in order to shape user experience. So we have to take the aspect of hardware into account, too. Furthermore, the source code alone c struct 1 bitcoin not help us understand how certain technology is used, nor does it explain the effect that technology will have on user behavior on a structural level.

But we can look at the interfaces of technology and human behavior in order to analyze the affordances that the code hardware and software offers the user and the constraints it sets to them. So far we have established that all four concepts introduced above share a common quality: These predictions differ in their normative strength. Of course, all gradations of normative strength are also possible for each of the four factors.

The four concepts also differ concerning the consequences in case of deviating behavior. If we look at phenomena of human interaction in online services, we will always find a complex structured normative background formed by these factors, on which the application potential of the services are realized by the users and on which their behavior is coordinated. This is what we call the governance structure. If we now consider Bitcoin in light of this model, we see that this cryptocurrency is conceptualized in a way that three of the above factors should and actually do just play a minor role in its governance structure—at least as far as this is possible without endangering the functionality of Bitcoin as c struct 1 bitcoin means of payment:.

The primary way to govern user behavior c struct 1 bitcoin tackle practical challenges resulting from its conceptual shortcomings, therefore, is to adjust the code of Bitcoin. Bitcoin is a complex, decentralized technological system offering advanced network-based services that was able to adapt to a conceptual challenge through activating its own governance structure, and in the process creating a structure for resolving conflicts with deals and transactions.

For a more detailed explanation of this argument, cf. Approaching Social Media Governance. Code and Other Laws of Cyberspace. And Other Laws of Cyberspace, Version 2. Computer Law and Security Review, vol. Oermann, Lose, Schmidt, and Johnsensupra note 12, at Both of these affect user behavior, but the concept of Bitcoin does not rely on these elements to fulfill a central function in its system.

These business contracts include reciprocal provisions for user behavior, e. But the original concept of Bitcoin did not cover these contracts, which meant that enforcement mechanisms in case of a breach c struct 1 bitcoin been missing. In order to grasp how this architectural change was implemented, we must take a closer look at how adjustments in the Bitcoin ecosystem can be accomplished in general.

Which actors make up the governance group that decides on changes of the code? And what is the internal structure of the group? Thus, we can narrow our focus to the actors involved in the development of the software used by Bitcoin users. We can therefore focus on c struct 1 bitcoin governance group around the Bitcoin core client.

As mentioned above, the Bitcoin core client is open-source software. By providing the technological means to organize open-source software development, these platforms form a dominantly code-based governance structure for that process. They can be understood as a meta-structure influencing the governance group of the Bitcoin core client and its processes of participation.

Nodes retrieved September 10,