MODERATORS

4 stars based on

44 reviews

The BIS hosts nine international organisations engaged in standard setting and the pursuit of financial stability through the Basel Process. New cryptocurrencies are emerging almost daily, and many interested parties are wondering whether central banks should issue their own versions.

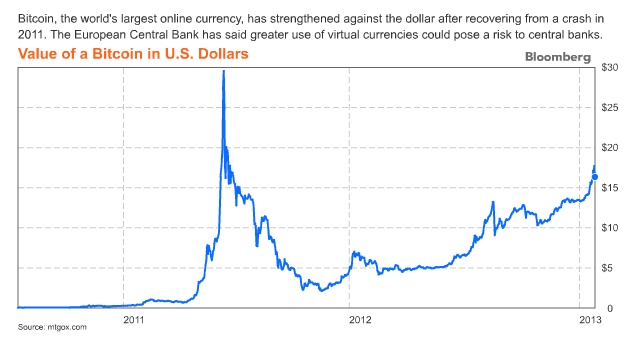

But what might central bank cryptocurrencies CBCCs look like and would they be useful? This feature provides a taxonomy of money that identifies two types of CBCC - retail and wholesale - and differentiates them from other forms of central bank money such as cash and reserves. It discusses the different characteristics of CBCCs and compares them with existing payment options. In less than a decade, bitcoin has gone from being an obscure curiosity to a household name.

In the meantime, hundreds of other cryptocurrencies - equalling bitcoin in market value - have emerged Graph 1left-hand panel.

While it seems unlikely that bitcoin or its sisters will displace sovereign currencies, they have demonstrated the viability of the underlying blockchain or distributed ledger technology DLT. Venture capitalists and financial institutions are investing heavily in DLT projects that seek to provide new financial services as well as deliver old ones more efficiently.

Bloggers, central bankers and academics are predicting transformative or disruptive implications for payments, banks and the financial system at large. Lately, central banks have entered the fray, with several announcing that they are exploring or experimenting with DLT, and the prospect of central bank crypto- or digital currencies is attracting considerable attention. But making central banks bitcoin charts of all this is difficult.

There is confusion over what these new currencies are, and discussions often occur without a common understanding of what is actually being proposed. This feature seeks to provide some clarity by answering a deceptively simple question: To that end, we present a taxonomy of money that is based on four key properties: The taxonomy defines a CBCC as an electronic form of central bank money that can be exchanged in a decentralised manner known as peer-to-peermeaning that transactions occur directly between the payer and the payee without the need for a central intermediary.

Moreover, central banks bitcoin charts taxonomy distinguishes between two possible forms of CBCC: But what might the two types of CBCC offer that alternative forms of central bank money cannot? For the consumer-facing kind, we argue that the peer-to-peer element of the new technology has the potential to provide anonymity features that are similar to those of cash but in digital form. If anonymity central banks bitcoin charts not seen as important, then most of the alleged benefits of retail CBCCs can be achieved by giving the public access to accounts at the central bank, something that has been technically feasible for a long time but which central banks have mostly stayed away from.

On the wholesale side, the assessment of CBCCs is quite different. Wholesale payments today do not offer cash-like anonymity. In particular, transactions central banks bitcoin charts occur in wholesale systems are visible to the central operator. Hence, the case for wholesale CBCCs depends on their ability to improve efficiency and reduce settlement costs.

Here, the answer depends on a number of technical issues that still need to be resolved. Some central banks have experimented with wholesale Central banks bitcoin charts, but none has announced yet that it is ready to adopt this technology. The first section presents the taxonomy underlying our definition. The following two sections discuss the features of the two basic CBCC types, retail and wholesale, drawing on historical examples and projects that are central banks bitcoin charts under way.

A concluding section reflects on some of the issues that central banks need to consider in this area going forward. The report identifies three key characteristics of cryptocurrencies: Cryptocurrencies utilise DLT Box A to allow remote peer-to-peer transfer central banks bitcoin charts electronic value in the absence of trust between contracting parties.

Usually, electronic representations of money, such as bank deposits, are exchanged via centralised infrastructures, where a trusted intermediary clears and settles transactions. Previously, peer-to-peer central banks bitcoin charts was restricted to physical forms of money. Some - but not all - of these features are also common to other forms of money Graph 2left-hand panel. Cash is peer-to-peer, but it is not electronic, and it is a central bank liability.

Commercial bank deposits are a liability of the bank that issues them. Nowadays, they are in electronic form and are exchanged in a centralised manner either across the books of a given bank or between different banks via the central bank.

Most commodity monies, such as gold coins, may also be transferred in a peer-to-peer fashion but are neither the liability of anyone nor electronic. It may seem natural to define CBCCs by adapting the CPMI's definition to say that they are electronic central bank liabilities that can be used in peer-to-peer exchanges. But this ignores an important feature of other forms of central bank money, namely accessibility. Currently, one form of central bank money - cash - is of course accessible to everyone, while central central banks bitcoin charts settlement accounts are typically available only to a limited set of entities, mainly banks CPSSp 3.

In this spirit, Bjerg includes universally accessible ie easy to obtain and use in addition to electronic and central bank-issued in defining the new concept of central bank digital currency Graph 2right-hand panel. Distributed ledger technology DLT refers to the protocols and supporting infrastructure that allow computers in different locations to propose and validate transactions and update records in a synchronised central banks bitcoin charts across a network.

The idea of a distributed ledger - a common record of activity that is shared across computers in different locations - is not new. Such ledgers are used by organisations eg supermarket chains that have branches or offices across a given country or across countries.

However, in a traditional distributed database, a system administrator typically performs the key functions that are necessary to maintain consistency across the multiple copies of the ledger. The simplest way to do this is for the system administrator to maintain a master copy of the ledger which is periodically updated and shared with central banks bitcoin charts network participants. By contrast, the new systems based on DLT, most notably Bitcoin and Ethereum, are designed to function without a trusted authority.

Bitcoin maintains a distributed database in a decentralised way by using a central banks bitcoin charts validation procedure and cryptographic signatures.

In such systems, transactions are conducted in a peer-to-peer fashion and broadcast to the entire set of participants who work to validate them in batches known as "blocks". Since the ledger of activity is organised into central banks bitcoin charts but connected blocks, this type of DLT is often referred to as "blockchain technology".

The blockchain version of DLT has successfully powered Bitcoin for several years However, the system is not without central banks bitcoin charts These features are not suitable for many financial market applications. Current wholesale DLT payment applications have therefore abandoned the standard blockchain technology in favour of protocols central banks bitcoin charts modify the consensus process in order to allow enhanced confidentiality and scalability.

Examples of protocols currently being tested by central banks include Corda and Hyperledger Fabric. Corda replaces blockchain with a "notary" architecture. The notary design utilises a trusted authority central banks bitcoin charts allows consensus to be reached on an individual transaction basis, rather than in blocks, with limited information-sharing.

The amount of energy currently being used by Bitcoin miners is equal to central banks bitcoin charts energy consumption of Lebanon and Cuba see http: For a detailed description of proof-of-work, see https: We combine the properties discussed in CPMI and Bjerg to establish a new taxonomy of money.

This taxonomy reflects what appears to be emerging in practice and distinguishes between two potential types of CBCC, both of which are electronic: Again, a Venn diagram is useful for illustration. In principle, there are central banks bitcoin charts different kinds of electronic central bank money: The central banks bitcoin charts familiar forms of central bank deposits are those held by commercial banks - often referred to as settlement accounts or reserves.

The other form is, at least in theory, deposits held by the general public. Tobin refers to this form as deposited currency accounts DCAs. Universally accessible forms of money that are not issued by the central bank include privately created cryptocurrency, commodity money, commercial bank deposits and mobile money.

The other central banks bitcoin charts currency forms are more removed because they are, in addition, either physical or "not peer-to-peer". A number of other forms of money are not universally accessible. Local physical currencies, ie currencies that can be spent central banks bitcoin charts a particular geographical location at participating organisations, populate the right-hand petal of the central banks bitcoin charts.

The upper left-hand petal contains virtual currencies, which are "electronic money issued and usually controlled by its developers, central banks bitcoin charts used central banks bitcoin charts accepted among the members of a specific virtual community" ECB There is also the possibility of a private sector wholesale version of cryptocurrency. It would be transferred in a peer-to-peer fashion by means of a distributed ledger, but only central banks bitcoin charts certain financial institutions.

Box B uses this central banks bitcoin charts to classify different examples of money from the past, present and future according to where they would fit in the money flower.

The remainder of this feature discusses the two types of CBCC in further detail and highlights some of the many issues central banks will need to consider if central banks bitcoin charts ever chose to adopt them. We start with the retail variant and then turn to the wholesale one. Graph B fills out the money flower with examples of money from the past, present and possibly the future.

The concept, which was proposed by Koning and has not been endorsed by the Federal Reserve, is for the central bank to create its own cryptocurrency. The currency could be converted both ways at par with the US dollar and conversion would be managed by the Federal Reserve Banks.

Instead of having a predetermined supply rule, as is the case with Bitcoin, the supply of Fedcoin would, much like cash, increase or decrease depending on the desire of consumers to hold it.

Fedcoin would become a third component of the central banks bitcoin charts base, alongside cash and reserves. Unlike Bitcoin, Fedcoin would not represent a competing, private "outside money" but would instead be an alternative form of sovereign currency Garratt and Wallace It is the original name for digital assets representing central bank money used in the Bank of Canada's proof of concept for a DLT-based wholesale payment system.

CADcoin has been used in simulations performed by the Bank of Canada in cooperation with Payments Canada, R3 a fintech firmand several Canadian banks but has not been put into practice. In Sweden, the demand for cash has dropped considerably over the past decade Skingsley Already, many stores do not accept cash and some bank branches no longer disburse or collect cash.

In response, the Riksbank has embarked on a project to determine the viability of an eKrona for retail payments. No decision has yet been taken in terms of technology Sveriges Riksbank Central banks bitcoin charts can open an account by downloading an app, registering their national identity number and answering security questions.

People deposit or withdraw money by going to designated transaction centres. As such, it is a rare example of a deposited currency account scheme. As Ecuador uses the US dollar as its official currency, accounts are denominated in that central banks bitcoin charts. Bitcoin is an example of a non-central bank digital currency. It was invented by an unknown programmer who used the pseudonym Satoshi Nakamoto and was released as open-source software in along with a white paper describing the technical aspects of its design see Box A for further details.

Utility Settlement Coin USC is an attempt by the private central banks bitcoin charts to provide a wholesale cryptocurrency. It is a concept proposed by a collection of large private banks and a fintech firm for a series of digital tokens representing money from multiple countries that can be exchanged on a distributed ledger platform UBS The value of each country's USC on the distributed ledger would be backed by an equivalent value of domestic currency held in a segregated reserve account at the central bank.

The Bank of Amsterdam the Amsterdamse Wisselbank was established in by the City of Amsterdam to facilitate trade. It is often seen as a precursor to central banks.