Litecoin mining bsd medical center

43 comments

Ethereum computerwhat is litecoin mining algorithm

It started off with Roger Ver, also known as Bitcoin Jesus in the Bitcoin community for his active promotions of the cryptocurrency, who is standing in his living room in Tokyo sending Bitcoins to the value of Euros into the living rooms of the Dutch. At the moment of writing, that same amount of Bitcoin has more than doubled to It is a powerful demonstration of how easy currency flows from one side of the planet to the other.

If he would have made the transaction through the traditional way, it would have taken several days and it could have cost him up to 30 Euros. Using Bitcoins, he could send the money practically costless, and almost instantly without the need of any intermediaries.

If I could point out my two most favorite scenes, it would be the beginning scene 0: The documentary however, also featured critics of the cryptocurrency — hence providing a balanced perspective of Bitcoins.

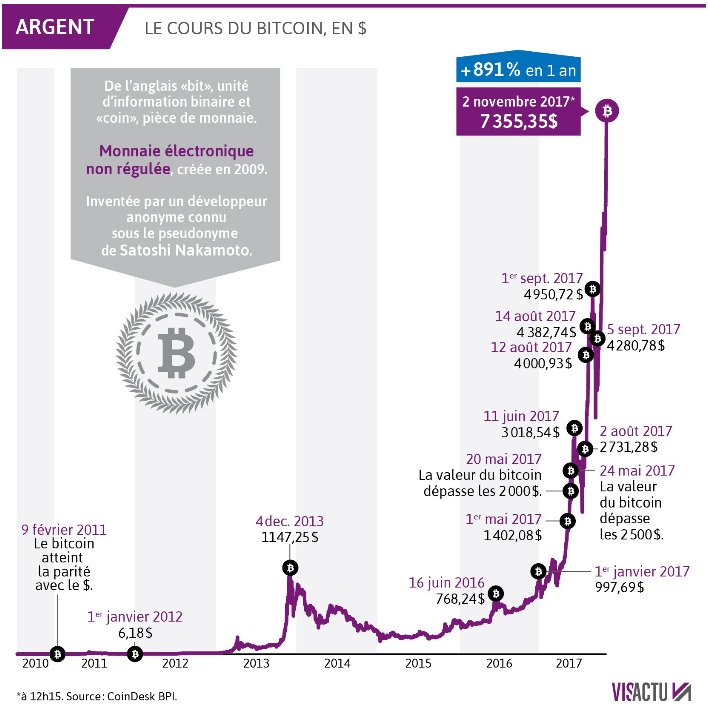

Its main critic was Izabella Kaminska, a financial blogger at the Financial Times. She has offered several interesting critiques to which I would like to respond in this article. Kaminska reminds the viewers of the turbulent swings in Bitcoin prices. Its volatility is due to its small market and the experimental phase it is still in. It effectively means that only a small amount of money flows into or out of the market can already have huge implications for its price movements. It is therefore only natural that its price is still volatile.

Volatility also offers prospects of possible gains, hence attracting more capital from investors. Total investments into Bitcoin related projects in is already more than double that for Coindesk, The more investments are made into Bitcoin related projects, the greater the chance that Bitcoin will be widely accepted so that eventually in the long run products and services can be denominated in Bitcoins. Hopefully, this will make Bitcoins gain the same relatively low-volatility attribute of many fiat currencies.

Bitcoins are like any other investments in that they are always subjected to uncertainties. No serious investor believes that he has a right to profits. The Bitcoin investor is like an entrepreneur — he knows that he can only make a profit if he anticipates future conditions correctly.

The notion that one should not hoard Bitcoins or cash or gold corresponds with the false notion that. Hoarding induces more hoarding as the economy sinks into a downward spiral. Those who are not hoarding are therefore actually benefitting from the decline in prices. In my view, it is only justified that those who have done the research into Bitcoins and who have taken the high risk to invest in new inventions also have a higher rate of return.

Similarly, those who were pioneers by investing in Facebook or Microsoft during their inception period also deserve potentially higher rates of return as these companies were running higher risk of failures. If the first adopters of Bitcoins would not have had the opportunity to make enormous amounts of money, they would not have had investment incentives, it would not have got this successful and this critique of Kaminska would not even have been possible.

She maintains that when she is paying for coffee she just wants the benefits of a working payment network and smooth transactions, not support for a certain political ideology. The idea that payment systems can be apolitical is an illusion.

Governments have always had vested interests in the moneys of its citizens as its existence is entirely dependent on taxation and money creation. It seems to me that she is holding an idealized view of our society if she believes that using USD does not support any political-economic system.

Her statement that the Bitcoin community is thrusting their political ideology on everyone else is highly arguable as well. The government is an institution that holds the unjust power to determine which currency can serve as legal tender and which goods — including currencies — can be traded or should be outlawed. Unlike governments, the Bitcoin community does not hold the power to initiate force upon the people.

It cannot thrust the adoption of the payment network on all citizens. Indeed, Bitcoin is a free market invention that allows, but not forces, anyone to join the payment network voluntarily. Kaminska is right, when one uses Bitcoins one is supporting the libertarian political ideology.

The really relevant question however is not whether you are supporting a political ideology. The question that should be asked is: The Case For Hoarding. Money jumps instantly from one pocket to another whenever it is used in a transaction. This could refer to the demand to hold money which is the inverse of the velocity of money.

We hold money for convenience, safety, and occasionally as a hedge against deflation. Second, decreased velocity means price deflation, other things being equal, and if a fall in velocity happens suddenly and unexpectedly, it can be a temporary boon to buyers and a detriment to sellers.

But the idea of a deflationary spiral feeding on itself is silly, if only because we all have to eat. Low prices are the cure for low prices, as bargain-hunters move in and prices stabilize. Real social income is not enhanced by faster spending. It is enhanced by greater productivity which depends on private saving, which in turn depends largely on property-friendly institutions. We cannot spend our way to prosperity. When outside money is deposited in a fractional-reserve bank where it becomes inside money, some is kept in reserve and some is loaned out.

There is nothing anti-social about holding outside money. Some of us see marginal benefits in holding outside money security, convenience that exceed the cost in foregone interest.

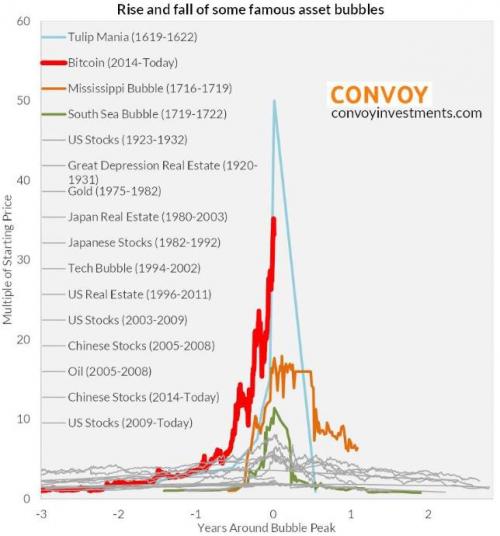

This is like an article touting tulips at the height of tulipmania. You are commenting using your WordPress. You are commenting using your Twitter account. You are commenting using your Facebook account. Notify me of new comments via email. Notify me of new posts via email. You can watch the full documentary here: But Dave, tulips were a bubble that was doomed to collapse. Exactly what bitcoin is. Have you irrefutable proof? Please keep it civil Cancel reply Enter your comment here Fill in your details below or click an icon to log in: Email required Address never made public.

Post was not sent - check your email addresses! Sorry, your blog cannot share posts by email.