Bot bitcoin kaivos

17 comments

Accepterar bitcoin exchange rates

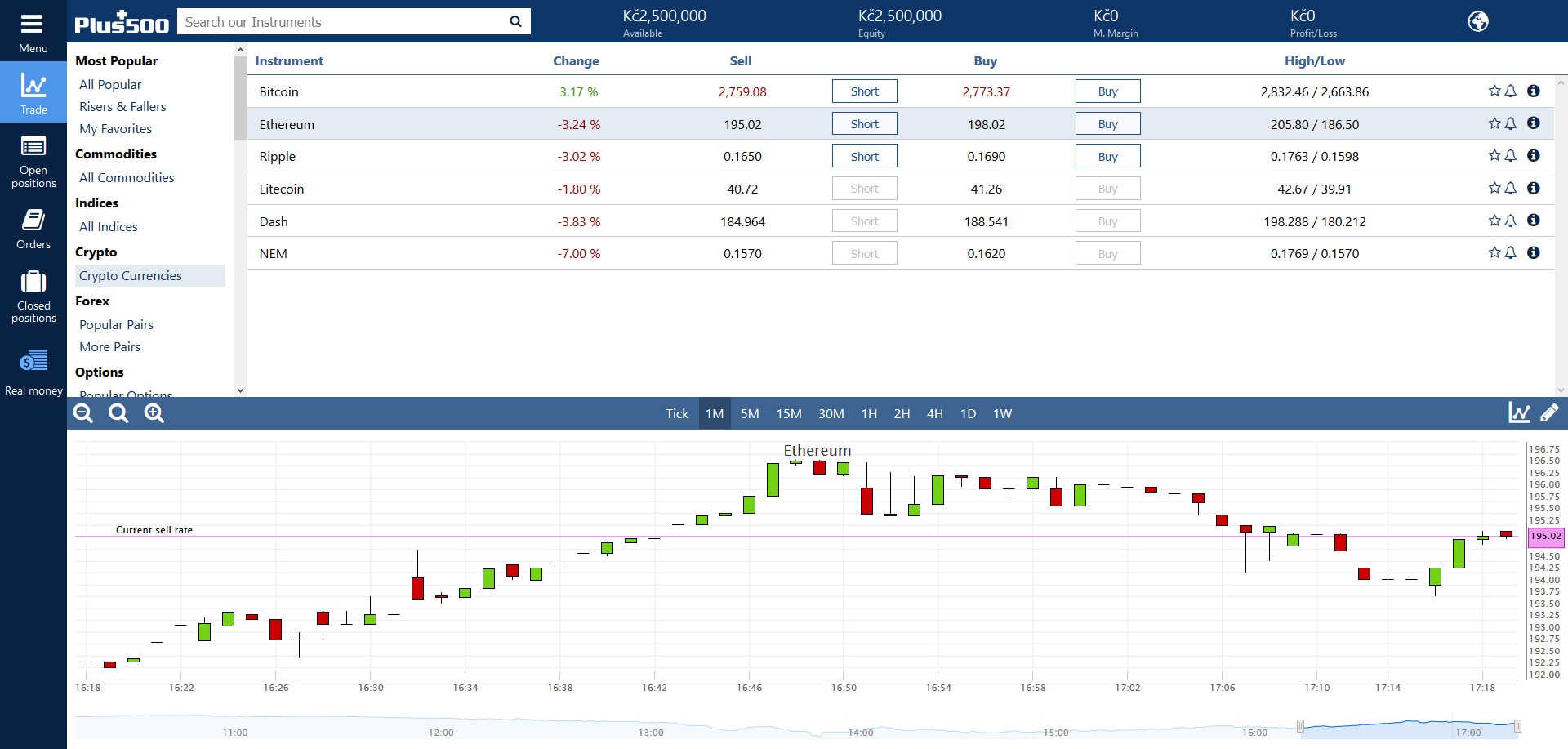

Generally there are two ways of doing this:. It does however have many hidden risks which you should be aware of, this guide will explain some of these. This guide will focus on risks, see this guide for a tutorial on using eToro.

We encourage you to read this entire guide before trying eToro to understand the potential risks; but if after reading this you still want to try it out, here's a link we'll get some money if you sign up via this. When you first use an exchange, you'll find lots of guides and tutorials on how you should be storing your Bitcoin. The general consensus is that once you buy it, you shouldn't keep it on the exchange - it should be moved to a wallet.

The most common reason is that the exchange might run away with your money, but there's a second less dramatic one; that by moving your Bitcoin to a wallet, it makes it harder to sell it. This might seem counter-intuitive, but context is important here.

The user interface on eToro is much more user-friendly than most exchanges or CFD brokers, and there are many online reviews stating this causing beginner traders to see eToro as a good platform to try out. When these beginners first trade they're inevitably going to open positions that don't go well and lose them money. In cryptocurrencies they are not. For this to happen to a beginner, the fear of losing more money will often give them a very strong urge to sell.

On eToro it's possible to do this in just a few seconds, to close your position and walk away. But a beginner trader would then experience the fear of missing out, and so buy back in again - often at a higher price. This statement is highly speculative, but next time this happens, if you look at the eToro Bitcoin user feed, you'll see many people in this scenario. If you'd stored your Bitcoin on a wallet, the time between moving it back to the exchange would have given you a better time frame to make your decision off.

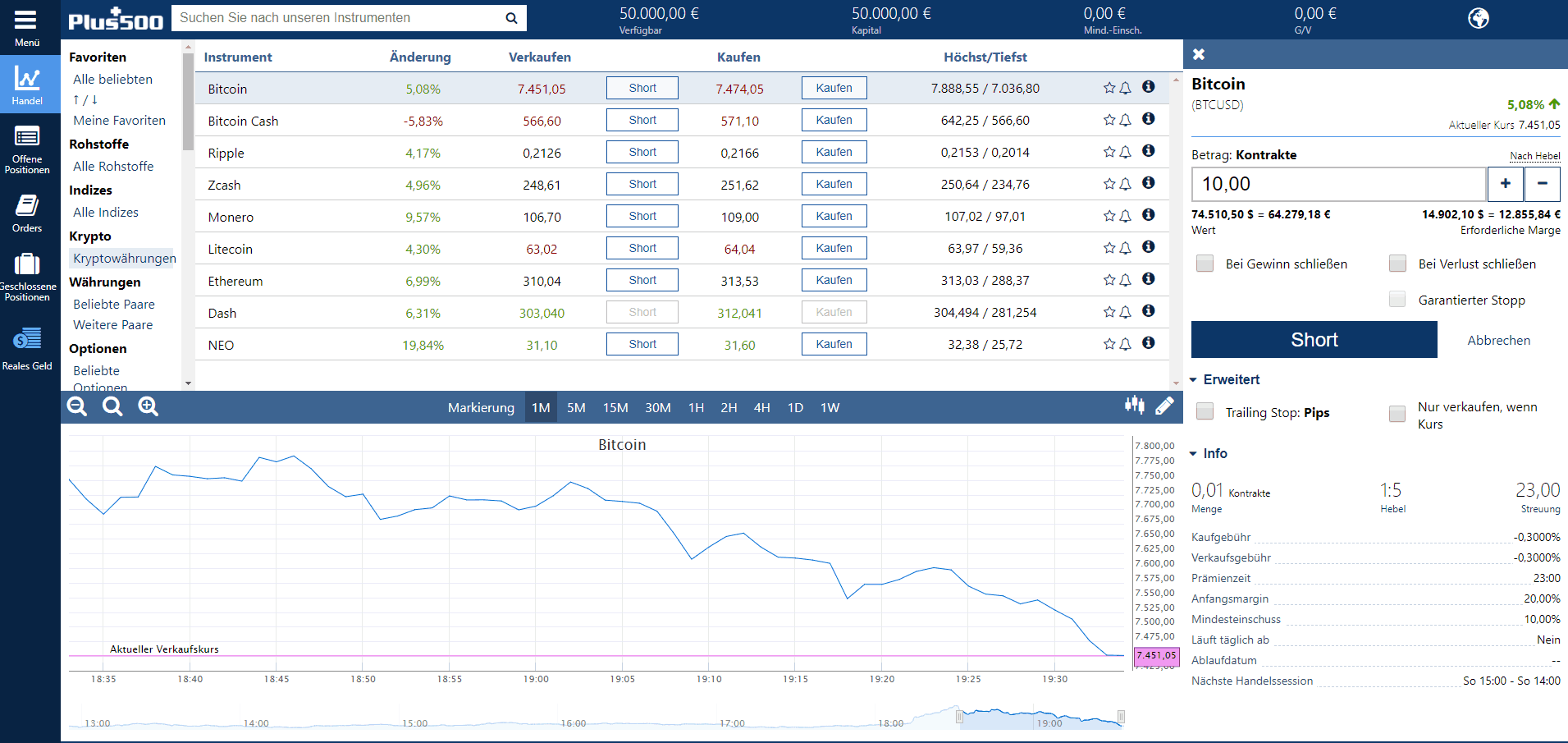

That said, if you're a more experienced trader you'll likely be aware of this scenario so it won't be an issue for you. If you were to go on an exchange right now to buy Bitcoin, the price would be determined by the person willing to sell their Bitcoin for the lowest amount. On this exchange you'd normally pay a fee of around 0.

On eToro you pay a fixed fee of 0. This is only 0. This problem by itself makes profitable trades harder, but given the extra functionality you get, some justify this as an acceptable cost. Where this isn't ok is how their system for opening orders works. We'll explain a situation we experienced ourselves. Regardless; the trade we just made should not have been possible.

Allowing a trade to be opened with a difference between the opening value and stop loss of such a low amount is an incredibly dangerous feature. But if you're dealing with small amounts of a few hundred dollars this will both eat away at your profits and encourage you to deposit and withdraw larger amounts of money to increase profit margins.

This is something that we find very concerning as this encourages new traders to invest larger amounts of money than they should given the associated risks of trading cryptocurrencies. With all the above said, you might think that we don't like eToro, that you should avoid it. But this isn't the case. Being aware of all the above issues, we're able to avoid the issues caused by them; we tend to avoid Bitcoin Cash trades for example!

Cryptocurrency trading is still very new to platforms which previously only dealt with CFDs, so quirks like this are expected. Our hope is that over time eToro will decrease their spreads for cryptocurrencies and add functionality to avoid the pitfalls we've described above. If you want to try out eToro and help us out, here's a link we'll get some money if you sign up via this. This site cannot substitute for professional investment or financial advice, or independent factual verification.

This guide is provided for general informational purposes only. The group of individuals writing these guides are cryptocurrency enthusiasts and investors, not financial advisors. Trading or mining any form of cryptocurrency is very high risk, so never invest money you can't afford to lose - you should be prepared to sustain a total loss of all invested money. This website is monetised through affiliate links. Where used, we will disclose this and make no attempt to hide it.

We don't endorse any affiliate services we use - and will not be liable for any damage, expense or other loss you may suffer from using any of these. Don't rush into anything, do your own research.

As we write new content, we will update this disclaimer to encompass it. We first discovered Bitcoin in late , and wanted to get everyone around us involved.

But no one seemed to know what it was! We made this website to try and fix this, to get everyone up-to-speed! Click here for more information on these. All information on this website is for general informational purposes only, it is not intended to provide legal or financial advice.

The Risks of Trading Bitcoin on eToro. Generally there are two ways of doing this: Cryptocurrency exchanges allow you to buy and sell real coins e. See this guide for some examples. Most brokers don't allow you to buy Bitcoin directly.

Instead they allow you to invest in it via CFD Contract for Difference , which means you're not buying the coin itself - the exchange buys it on your behalf, and you have to pay a daily fee to hold it. Some brokers like eToro and IQ Option are starting to take the middle ground, where you can invest in Bitcoin and not pay a daily holding fee.

Conclusion With all the above said, you might think that we don't like eToro, that you should avoid it. April 24th, Best Coinbase Alternative? Written by the Anything Crypto team We first discovered Bitcoin in late , and wanted to get everyone around us involved. Never invest money you can't afford to lose.